NGI Archives | NGI All News Access

Natural Gas Forwards Following Futures; Bearish Storage Build Steals Bulls’ Thunder

Natural gas forward points tracked by NGI took their cue over the last week from the rising screen as heat in population centers across the country teamed to put upward pressure on prices.

Between Friday (Aug. 7) and Wednesday (Aug. 12) trading, NGI‘s Forward Look points averaged a gain in terms of fixed price of 14.9 cents. This gain was mostly due to a rising Henry Hub futures contract, which gained 13.3 cents over the same timeframe.

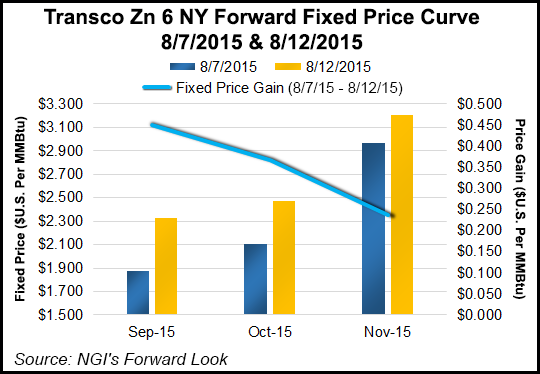

While most points followed the futures contract there were two points that went racing ahead. The Transco Zone 6 NY September fixed forward price leapt more than 45 cents from $1.875 in Friday trading to $2.327 during Wednesday’s trading session. Similarly, Algonquin Citygates September fixed forward price rose 28.3 cents from $1.904 to $2.187 during the same time period.

“Whatever the new information the market was pricing into Algonquin and Transco Zone 6 New York, it seems to be localized mostly to the September and October contracts at these two points,” said NGI Markets Analyst Nathan Harrison. “While Algonquin and New York jumped 28.3 and 45.2 cents respectively, in the prompt month, October and November gains at these points were more muted. The October fixed price at Algonquin rose only 21.8 cents and November gained a mere 15.7 cents.”

Harrison noted that Transco Zone 6 New York behaved similarly, gaining 36.9 cents for October and only 23.8 cents for November. “Regardless of the market’s intent, these gains appear to make the often drastic jump between summer and winter pricing in the Northeast slightly more gradual,” he said.

Storage in the East region still lags 61 Bcf behind its five-year average level with Energy Information Administration (EIA) figures for the week-ending Aug. 7 showing the region at 1,407 Bcf.

“With eastern storage well on track to surpass the five-year average before the end of the injection season, winter pricing in the Northeast may be less volatile than in recent years,” Harrison said. “However, with so few weeks of injections left, the market likely has a good bead on where storage levels will be by winter. With the size of this injection season mostly a known quantity, traders will be left looking to long-range weather projections and other factors in search of trading impetus.”

When the EIA reported an injection of 65 Bcf Thursday for the week ending Aug. 7, September natural gas futures fell hard. The contract reached a low of $2.838 after the number was released, and by 10:45 a.m. eastern, September was trading at $2.848. The prompt-month contract went on to close Thursday at $2.787, down 14.4 cents from Wednesday’s finish.

“The market’s relatively strong reaction hints at the possibility that traders might be rethinking the upcoming shoulder season weakness,” said Teri Viswanath, director of commodity strategy for natural gas at BNP Paribas. “Clearly the moderation in temperatures on the East Coast last week, that only marginally lowered the national cooling-degree days, had an amplified effect on restocking. This suggests that, as long as the southern states record normal or above-normal temperatures, the ‘swing’ factor for electric power demand growth will be centered in the Northeast. According to the updated weather guidance, the Middle-Atlantic states will likely record the hottest temperatures of the summer next week. Consequently, the return of very warm weather in this region implies a restrained build in storage for the balance of the month.”

Prior to the release of the data, analysts were looking for an increase in the 55 Bcf range. ICAP Energy estimated 56 Bcf, and Citi Futures Perspective had calculated a 48 Bcf increase. A Reuters poll of 27 traders and analysts showed an average 55 Bcf with a range of 38 to 60 Bcf.

“There’s nothing fundamental to move the market higher,” said a New York floor trader. “If the market can build a base in the $2.85 to $2.86 area then it can confront $3. A close over $2.86 could give traders an incentive.”

Tim Evans of Citi Futures Perspective said the number was a “bearish surprise just a week following a significant bullish surprise, suggesting there may have also been some timing issues between the two reporting periods. The data will be a test for the market after the recent rally.”

Inventories now stand at 2,977 Bcf and are 521 Bcf greater than last year and 81 Bcf more than the five-year average. In the East Region 53 Bcf was injected, and the West Region saw inventories increase by 5 Bcf. Stocks in the Producing Region rose by 7 Bcf.

At one point, analysts were singing a tune of ending inventories surpassing the 4 Tcf mark, but that seems to be something of a stretch at this point as ongoing hot weather and hefty power burns limit builds. Inventories currently stand at 2,977 Bcf and to reach 4 Tcf would require weekly increases in excess of 77 Bcf by the traditional Oct. 31 end of the injection season.

Natgasweather.com was looking for a little higher figure, about 59 Bcf, and said in a Thursday morning report that “if today’s reported build is lighter than estimates, it will clearly add to already established bullish weather sentiment. However, if it comes in a few Bcf higher, such as our calculations suggests, prices could drop several cents on the number only to find buyers step in as they could potentially view forthcoming hotter weather patterns as more important bigger picture than a couple Bcf miss. If the number is strongly bearish above +61 Bcf, then stronger selling may be warranted.” Amen.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |