Markets | NGI All News Access | NGI Data

Cash NatGas Mostly Steady, But Futures Dive Following Storage Stats

Physical natural gas moved little as traders hunkered down and got deals done before the release of the 10:30 a.m. EDT Energy Information Administration (EIA) inventory report.

If you were selling gas, you made out well as futures were hit with a double-digit loss once the number came out. Most points traded within a few pennies of unchanged and the NGI National Spot Gas Average fell a penny to $2.72.

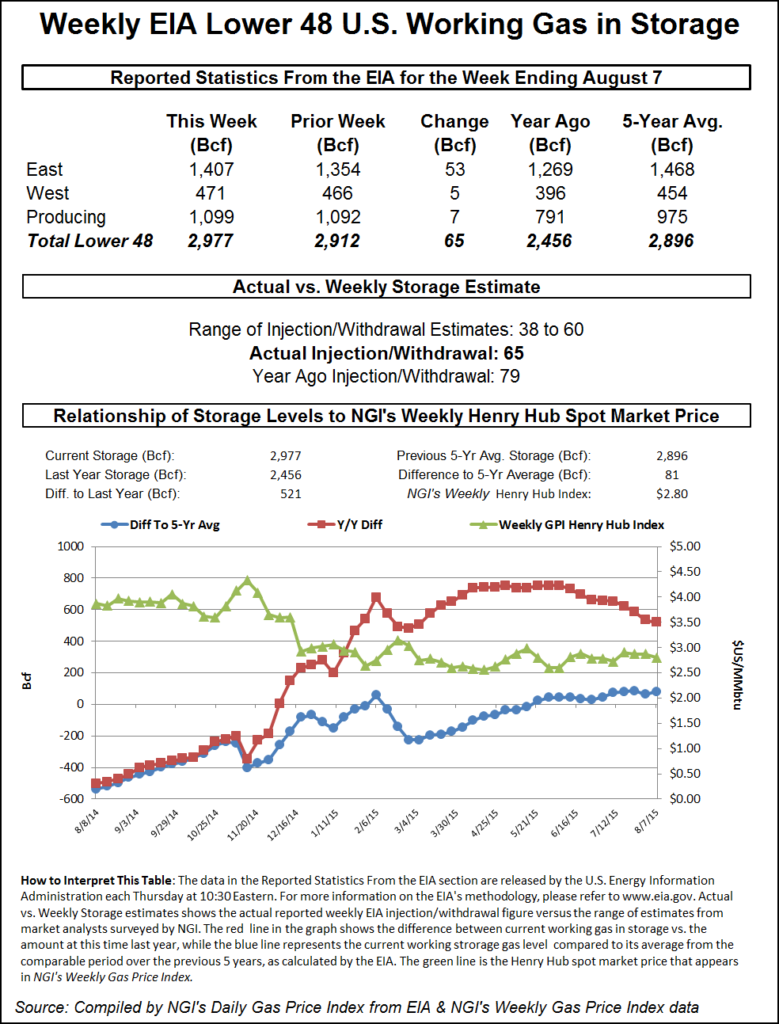

The EIA inventory report caught a number of traders by surprise. The reported 65 Bcf build was about 10 Bcf greater than industry estimates. Prices tanked, and at the close September had given up 14.4 cents to $2.787 and October was down 13.6 cents to $2.820. September crude oil tumbled $1.07 to $42.23/bbl.

Trading resumed at the Alliance Delivery point as the mainline pipeline system has been restarted and commercial operations have resumed. The company reported that flaring operations at its block valve near Arcola and the Alameda compressor station in southeastern Saskatchewan have concluded. The company began receiving operational linepack from shippers on Wednesday, enabling it to begin a controlled restart of the mainline. The force majeure was lifted earlier Thursday (see related story).

Market impact in the Midwest has been relatively light. A Michigan marketer reported no impact on its operations.

Gas for next-day delivery on Alliance traded up 3 cents at $3.04.

Eastern points were mixed, and Marcellus locations took a double-digit hit. Gas for delivery Friday on Texas Eastern M-3, Delivery fell 2 cents to $1.65, and gas on Transco Zone 6 NY added three pennies to $2.77.

Gas on Millennium retreated 12 cents to $1.32, and gas on Transco-Leidy Line was quoted 8 cents lower at $1.20. Parcels on Tennessee Zn 4 Marcellus skidded 15 cents to $1.13, and gas on Dominion South fell 2 cents to $1.54.

Other major trading centers were flat to higher. Gas at the Chicago Citygates added 3 cents to $3.01, and parcels on El Paso Permian were unchanged at $2.88. Gas at the Henry Hub was up a penny at $2.92, and deliveries to SoCal Citygate rose 3 cents to $3.21.

When the EIA reported an injection of 65 Bcf, September futures fell hard. September reached a low of $2.838 after the number was released, and by 10:45 a.m. September was trading at $2.848, down 8.3 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase in the 55 Bcf range. ICAP Energy estimated 56 Bcf, and Citi Futures Perspective had calculated a 48 Bcf increase. A Reuters poll of 27 traders and analysts showed an average 55 Bcf with a range of 38 to 60 Bcf.

“There’s nothing fundamental to move the market higher,” said a New York floor trader. “If the market can build a base in the $2.85 to $2.86 area then it can confront $3. A close over $2.86 could give traders an incentive.”

Tim Evans of Citi Futures Perspective said the number was a “bearish surprise just a week following a significant bullish surprise, suggesting there may have also been some timing issues between the two reporting periods. The data will be a test for the market after the recent rally.”

Inventories now stand at 2,977 Bcf and are 521 Bcf greater than last year and 81 Bcf more than the five-year average. In the East Region 53 Bcf was injected, and the West Region saw inventories increase by 5 Bcf. Stocks in the Producing Region rose by 7 Bcf.

At one point, analysts were singing a tune of ending inventories surpassing the 4 Tcf mark, but that seems to be something of a stretch at this point as ongoing hot weather and hefty power burns limit builds. Inventories currently stand at 2,977 Bcf and to reach 4 Tcf would require weekly increases in excess of 77 Bcf by the traditional Oct. 31 end of the injection season.

Natgasweather.com was looking for a little higher figure, about 59 Bcf, and said in a Thursday morning report that “if today’s reported build is lighter than estimates, it will clearly add to already established bullish weather sentiment. However, if it comes in a few Bcf higher, such as our calculations suggests, prices could drop several cents on the number only to find buyers step in as they could potentially view forthcoming hotter weather patterns as more important bigger picture than a couple Bcf miss. If the number is strongly bearish above +61 Bcf, then stronger selling may be warranted.” Amen.

According to Natgasweather.com meteorologist Rhett Milne, “The most important weather factor going forward is how long hot, high pressure that’s soon to become established over the eastern states lasts. We expect temperatures will be getting quite toasty by the end of next week as upper 80s to lower 90s gain ground over the Ohio Valley and Mid-Atlantic regions, including across major Northeast cities.”

Wednesday’s 9-cent gain had traders talking $3. “The rise favors a test of the $3 area. It looks like traders are inching closer to that and we could see it,” said a New York floor trader. “I think from a technical point, traders just might get it through this time.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |