Markets | NGI All News Access | NGI Data

Bulls Circling Wagons Following Plump Storage Report

Natural gas futures fell following the release of government inventory figures showing an increase in working gas storage well above what the market was expecting.

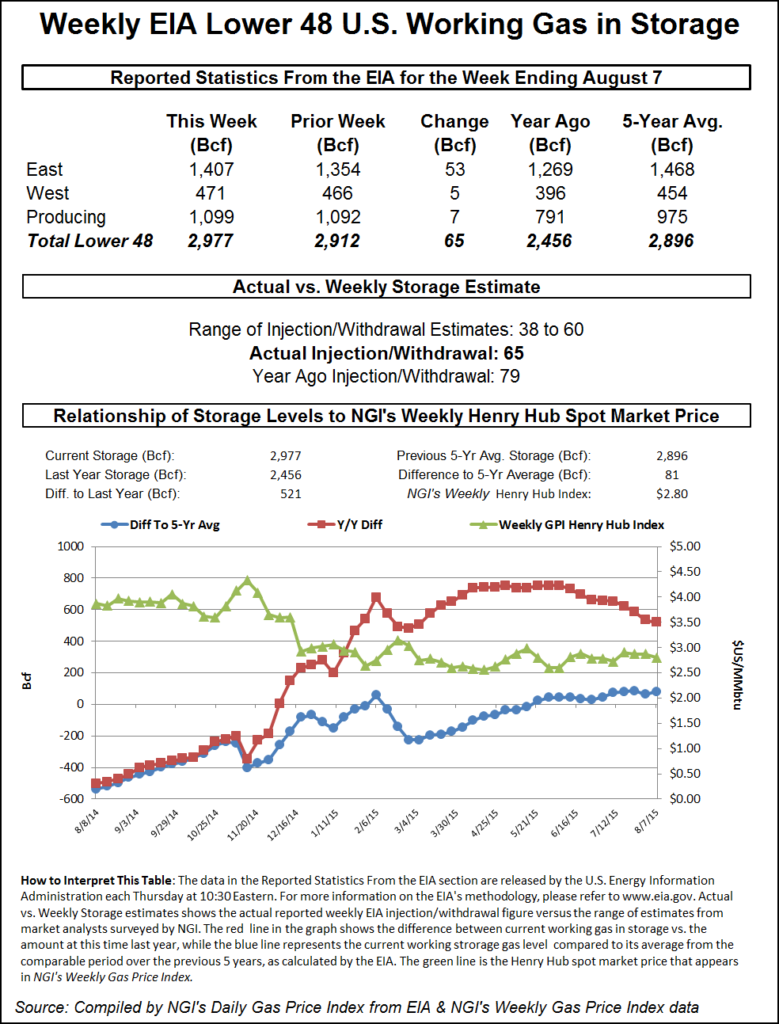

For the week ended Aug. 7, the Energy Information Administration (EIA) reported an injection of 65 Bcf in its 10:30 a.m. EDT release. September futures fell to a low of $2.838 after the number was released, and by 10:45 a.m. September was trading at $2.848, down 8.3 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase in the 55 Bcf area. ICAP Energy estimated 56 Bcf, and Citi Futures Perspective had calculated a 48 Bcf increase. A Reuters poll of 27 traders and analysts showed an average 55 Bcf with a range of 38 Bcf to a 60 Bcf injection.

“There’s nothing fundamental to move the market higher,” said a New York floor trader. “If the market can build a base in the $2.85 to $2.86 area, then it can confront $3. A close over $2.86 could give traders an incentive.”

Tim Evans of Citi Futures Perspective said the number was a “bearish surprise just a week following a significant bullish surprise, suggesting there may have also been some timing issues between the two reporting periods. The data will be a test for the market after the recent rally.”

Inventories now stand at 2,977 Bcf and are 521 Bcf greater than last year and 81 Bcf more than the five-year average. In the East Region, 53 Bcf was injected, and the West Region saw inventories increase by 5 Bcf. Stocks in the Producing Region rose by 7 Bcf.

The Producing Region salt cavern storage figure was down 1 Bcf at 291 Bcf, while the non-salt cavern figure increased 8 Bcf to 808 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |