E&P | NGI All News Access | NGI The Weekly Gas Market Report

Bill Barrett Finds Sweet Spot in DJ Basin

The Denver-Julesburg (DJ) Basin has become the sweet spot for Bill Barrett Corp. as the operator tries to negotiate low-price-driven cutbacks, CEO Scot Woodall told analysts last Friday.

Even in reporting a sea of red ink, Bill Barrett’s net production for 2Q2015 was 1.6 million boe, a 23% increase in volumes over the same period last year. While its long-term output elsewhere in the Uinta Basin was down, the company’s results from the DJ were up 8% sequentially and 76% compared with 2Q2014.

Woodall and CFO Bob Howard attributed the continuing production growth in the DJ to the deployment of its XRL extended reach lateral drilling program and increasingly efficient completion techniques.

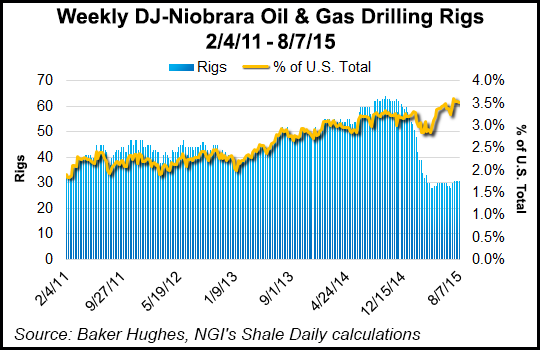

Management in June had said it would increase its capital expenditures for the second half of 2015, deploying a second drilling rig to the DJ as it expanded its stable of wells drilled with longer laterals (see Shale Daily, June 6).

“We continued to demonstrate that our XRL program and the DJ Basin are top tier assets,” Woodall said. “We have maintained a sharp focus on production, and it exceeded our guidance by 9%.”

Bill Barrett recently increased its 2015 production guidance for the third time this year to 6.1-6.5 million boe. Oil volumes are expected to jump up by 25%, said Woodall, noting that the company is no longer a natural gas-dominated producer.

While noting that the exploration and production company’s lease operating expenses (LOE) are dropping rapidly, Woodall said the XRL drilling approach uses 55 laterals, rather than 40, and tightly controls water and gas flowback in the horizontal drilling of the DJ.

“It is still too early, but we now have several months more data on these wells,” he said. “The results continue to validate our views about the play and its longer term potential.”

Woodall said management is counting on the DJ to help successfully reposition the company to a combination oil/gas and natural gas liquids (NGL) producer.

Only oil production picked up in 2Q2015; natural gas and NGL production were down sharply. Gas production was 1.8 Bcf, compared with 6.6 Bcf in 2Q2014.

Year-over-year prices for all the commodities fell, led by oil, which averaged $48.68/bbl in 2Q2015, compared with $86.64/bbl. Average natural gas prices were $2.33/Mcf, versus $4.74 a year ago, while NGL prices averaged $12.76/bbl from $31.64/bbl.

“Although these are currently challenging times for our sector, we are mainly focused on the items we can control — operational performance of execution,” Woodall said. Return rates on XRL wells in the DJ are outperforming the company’s other wells, producing returns averaging about 30%, even in a $44/bbl oil price market.

Woodall said in the second quarter about 1,000 boe/d of production was shuttered in the Uinta Basin, but DJ increases exceeded the loss in output. This provided an associated LOE drop in costs as a result, he said.

“Financially, we remain solid, with $101 million in cash and a hedge book worth $168 million today with 80% of our 2015 volumes hedged,” said Woodall. The company had discretionary cash flow in the second quarter of $51.4 million, or $1.06 per share, down from $67.3 million, or $1.40 per share, in 2Q2014. In 2015 discretionary cash flow in the was impacted by lower revenues due to a 38% decline in production volumes as a result of asset sales.

The company reported a $44.5 million net loss (minus 92 cent/share) for 2Q2015, compared with a loss of $26.5 million (minus 55 cents) for the same period last year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |