Markets | Infrastructure | NGI All News Access

Coal Short Term to Exceed NatGas-Fired Power, EIA Says

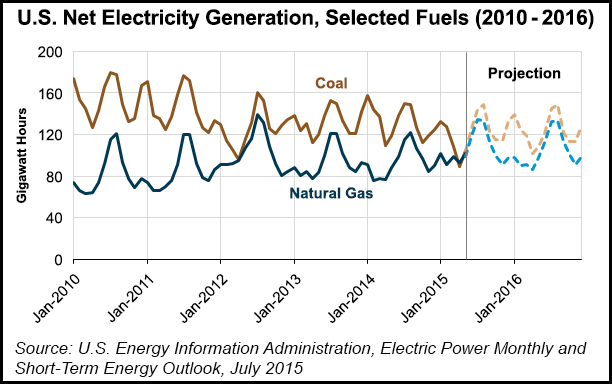

Slowly increasing natural gas prices and other factors are likely to allow coal to add to its position as the primary fuel for electricity generation, although in April the gas proportion exceeded coal, an analyst with the U.S. Energy Information Agency (EIA) told NGI on Tuesday. Gas is expected to pass coal for good some time before 2020.

Coal will have a slight increase in its proportion to 35.9% next year, while gas will drop back to about 30%, said EIA’s Tyler Hodge, an electric fuel analyst.

Longer term, natural gas is expected to be the dominant source of fuel for electricity, but it likely will take another two or three years, Hodge told NGI.

“The latest outlook has coal increasing slightly relative to gas-fired generation through the forecast horizon, which is through 2016, mainly due to the slowly rising gas prices,” Hodge said.

Noting that coal’s portion of the power burn is “actually quite a bit lower than it was last year,” Hodge said the projection is for coal to finish this year averaging 35.6% of the electricity market, compared with 38.7% last year.

Corresponding gas percentages are going up and down. Last year it was 27.4%, and this year the estimate is for the average gas share of the power burn to jump nearly 4% to 31.2%, but then slip back to 30% next year, Hodge said.

While gas prices are forecast to be the primary driver for the fuel’s percentage dropping, there also will be an increase in power from renewable sources. “That will probably take away some of the natural gas share also,” Hodge said.

Half of the 0.3% boost in coal-fired power and 1.2% decrease in gas-fired generation next year is attributable to expected higher gas prices, and the other half due to a bump up by renewables, EIA’s analysis showed.

“Right now in our short-term outlook, we don’t see gas and coal crossing over again as they did in April this year; the general trend is for less coal, but probably not for at least two or three years,” Hodge said. Pending Clean Power Plan and mercury emission requirements for generation plants eventually may have an impact on lessening coal-fired power.

“Right now, all of our short-term forecasts do not specifically model the Clean Power Plans just yet, so once that starts coming into play, we’ll likely see a lot of more volatility in coal’s share,” Hodge said. “And it also depends on natural gas production picking up and lowering gas prices. That should bring more rapid acceleration toward gas.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |