Marcellus | Bakken Shale | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

NatGas and Oil Production From Big Seven Basins Stumbling, Says EIA

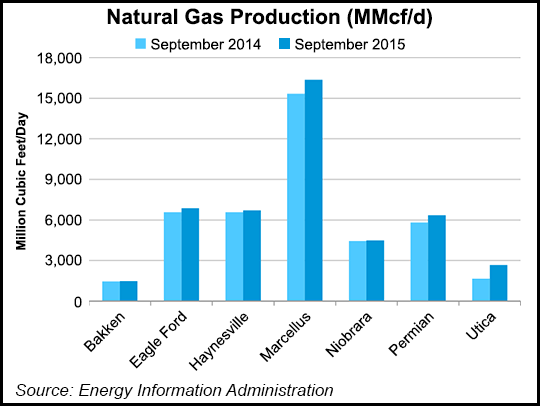

Natural gas and oil production from seven of the nation’s largest unconventional plays will decline slightly in September compared with August, according to the Energy Information Administration (EIA).

Total natural gas production from the plays will be an estimated 44.90 Bcf/d in September, a 261 MMcf/d decline from 45.16 Bcf/d in August, EIA said in its latest Drilling Productivity Report (DPR).

Minor decreases are expected in all of the basins analyzed in the DPR: the Bakken will produce an estimated 16.37 Bcf/d, compared with 16.43 Bcf/d in August; the Eagle Ford 6.86 Bcf/d, down from 6.98 Bcf/d; the Haynesville will be down marginally at 6.72 Bcf/d; the Permian 6.34 Bcf/d, down from 6.35 Bcf/d; the Niobrara 4.48 Bcf/d, down from 4.53 Bcf/d; the Utica down marginally at 2.66 Bcf/d; and the Bakken 1.47 Bcf/d, down from 1.49 Bcf/d.

EIA also expects slight declines in oil production, with the seven-basin total for September estimated at 5.27 million b/d, compared with 5.36 million b/d in August. Oil production will be lower in three basins — the Bakken (1.16 million b/d, compared with 1.18 million b/d in August), Eagle Ford (1.48 million b/d, compared with 1.54 million b/d) and Niobrara (399,000 b/d, compared with 417,000 b/d) — and will be nearly unchanged in the others, according to the DPR.

EIA released the first DPR in October 2013 (see Shale Daily, Oct. 22, 2013) but didn’t forecast month-to-month declines until five months ago (see Shale Daily, April 13).

The productivity of new wells in the plays, which had been a bright spot of recent DPRs, is expected to remain virtually unchanged in September, EIA said. On a rig-weighted average, new-well gas production per rig in the plays will be a combined 2.43 MMcf/d in September, compared with 2.44 MMcf/d this month, and new-well oil production per rig will be 434 b/d, compared with 433 b/d this month.

Even with fewer rigs in operation in the U.S. onshore, efficiency gains have proven to be the primary driver of more output, which should keep prices stagnant possibly for years, according to analyst firms and credit ratings agencies (see Shale Daily, Aug. 10).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |