Marcellus | Haynesville Shale | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Chesapeake Shares Dive Nearly 10% by Midday Following Quarterly Results

Chesapeake Energy Corp. saw its share price collapse on Wednesday after announcing it had shuttered more natural gas production in Appalachia, sharply reduced the total rig count and is prowling for buyers or partners to cope.

CEO Doug Lawler, who helmed a one-hour conference call Wednesday to discuss second quarter results, also said he doesn’t see any significant recovery in oil and gas prices over the medium-term. He had attempted to assuage concerned investors, who questioned high debt levels and locked-in gas transportation contracts.

However, when the market closed, Chesapeake’s share price had fallen to about $7.03/share, down 12%-plus on the day, with more than 53.9 million shares trading hands.

The Oklahoma City producer revealed a $4.02 billion loss (minus $6.27/share) in 2Q2015, versus profits a year ago of $145 million (22 cents). Excluding the one-time charges regarding the value of its onshore portfolio, losses totaled $126 million (minus 11 cents/share), versus year-ago profits of $235 million (36 cents). Revenue fell 41% year/year to $3.03 billion. Operating cash flow was $606 million, versus $1.269 billion a year ago.

Lawler acknowledged that investors were questioning how the company is coping, considering its high debt levels and, for instance, high transportation costs, which were locked in place before the commodity crash.

“We understand that our debt structure and gathering commitments add to the challenges in the commodity price environment,” he said, “and there are several questions out in the market, such as ‘can Chesapeake generate sufficient cash flow to weather this storm? Can the portfolio strengths overcome these significant obstacles?’

“The answer is definitely ‘yes.’ We have tremendous flexibility and optionality given the breadth of our portfolio,” said the CEO. “I came to Chesapeake two years ago because I considered it to be the biggest challenge and thus the biggest opportunity in the industry. We’ve made significant improvements on capital efficiency, cost structure and the balance sheet, and I’m as determined and confident today as then that we will become a top performing E&P company.”

The operator’s portfolio, spread across most of the key U.S. oil and gas basins, “offers several strategic options to enhance our cash flow and liquidity through potential asset sales, joint venture agreements and/or participation agreements, some of which we expect to execute in 2015,” he said. “Discussions have already begun with several parties and we’re confident in our ability to maximize the value of our resources, both in the short-term and for the long-term.”

Once the sales/partnership agreements are completed, the plan is to accelerate activity in 2016 “or use any potential proceeds to enhance our capital structure.” Last month the company eliminated its dividend (see Shale Daily, July 21).

Lawler demurred on what pieces of the portfolio could be sold, but he made it clear that nothing is off the table.

“The improvements in our capital efficiency over the last two years have served to increase the unrecognized value of our assets,” he said. “Further, I believe the strength and optionality of our portfolio provides meaningful opportunities to increase our liquidity and future cash flow. As a result, we are reviewing opportunities in multiple operating areas to create additional value through strategic asset sales, joint venture agreements and participation, or farmout agreements…We are not finished with the transformation of Chesapeake into a top-tier E&P company…”

Chesapeake’s realized price for natural gas was 75 cents/Mcf, while natural gas liquids sold for $1.90/bbl. Oil sold for $51.21/bbl. The oil equivalent realized price overall was $12.13/boe. Efficiencies, however, proved their mettle, with quarterly production expenses dropping 31% year/year to $4.32/boe.

CFO Nick Del’Osso said realized gas prices were lower from a year ago not only on lower New York Mercantile Exchange prices but also sequentially because of the seasonal increase in Northeast basis differentials.

“As for our basis costs, which include our gathering, treating, transportation, compression and fuel charges and marketing fees, these costs have been fairly flat over the past few quarters and are actually improved when compared to last year,” said the CFO. “When we take a preliminary look toward 2016, we see our total differentials…being flat to 2015. With the strong results from our Haynesville area and the majority of our Utica gas receiving better Gulf Coast pricing, we anticipate our basis differentials will improve in 2016…

“As for our realized NGL prices, we have seen much lower propane and butane pricing since the end of March due to very high storage levels. On top of that, approximately 40% of our NGL production is from the Utica, where there is a natural seasonality between summer and winter pricing due to heating demand. As a result, we do not see improvements in the pricing of ethane, propane or butane until the fourth quarter. So, we expect our third quarter NGL pricing to be below even these levels.”

Poor gas differentials in the Northeast are hampered by firm transportation contracts in place that don’t allow for much pricing relief for more than a year. Voluntary curtailments, all in the Marcellus and Utica, today total 50,000 boe/d net.

Chesapeake now is projecting both basis and non-basis differentials “to be relatively flat for the next 18 months,” said Lawler. The company is working on “several initiatives…to improve these costs. Positive discussions with Williams, our primary gas gathering provider, are continuing and we are confident in finding mutually agreeable solutions that will benefit both companies.”

Williams CEO Alan Armstrong indicated during his company’s 2Q2015 conference call last week that discussions with Chesapeake were ongoing. “I will just tell you we continue to enjoy a very good relationship with Chesapeake,” he said. “We’re very impressed with their responsiveness to the situation that they are in. I can tell you that they continue to work hard…they continue to look for opportunities, and we will continue to be constructive and work with them where we can on that…

“In terms of restructuring, certainly, they take the lead on that and we try to provide support and find win-win ways where they can add volumes that help offset some of those obligations. And that is the kind of things that we are looking at…I’m not going to get ahead of them on that, but I will just tell you that we are very excited about some of the new opportunities that we can help with where they can bring on new volumes up against existing obligations.”

Chesapeake’s Utica operations in eastern Ohio delivered 124,000 boe/d net during the quarter, a 13% sequential increase. In July, Chesapeake voluntarily curtailed about 100 MMcf/d gross and as of Wednesday, it was shutting in about 275,000 MMcf/d gross because of weak in-basin gas prices and deteriorating propane prices.

The company expects to maintain the curtailments until a regional pipeline is placed in-service in November, which would allow it to move about 350 MMcf/d gross out of the basin at a competitive basin transportation rate with access to the Gulf Coast market, said northern division chief Chris Doyle. The company also is using ethane rejection to maximize its gas price realizations.

However, the Utica shut-ins “effectively eliminates our in-basin sales,” Doyle said. “The current differential that we see between in basin and out basin is about $1.30, representing about half the gas price.”

In the Marcellus, output averaged around 820 MMcf/d net in the quarter, down 1% from 1Q2015. Chesapeake began voluntarily curtailing 300 MMcf/d gross of Marcellus output during the first quarter and increased it to 500 MMcf/d gross in the second quarter, also because of weak pricing and pipeline constraints.

“The company anticipates maintaining Marcellus curtailments for the remainder of the year,” Doyle said.

Gas prices are much better in the Haynesville Shale, where Chesapeake is nearly doubling its rig count to seven. Output averaged 669 MMcf/d in 2Q2015, 32% higher year/year and 9% sequentially. Fifteen wells were turned in line and “minimal base decline” was seen in wells turned to sales in 1Q2015.

Gains in the Haynesville, combined with gas production growth from the Barnett Shale in Texas, have allowed the company to lower the midpoint of the estimated total midstream volume commitment shortfall payments this year by $20 million, said southern division chief Jason Pigott.

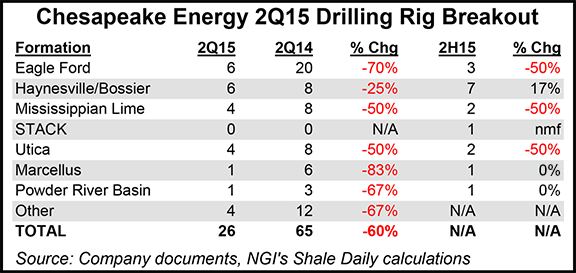

The operated rig count in the Haynesville averaged six rigs in 2Q2015, down from eight a year ago, but the company anticipates increasing to seven operated rigs in the second half of this year.

The rig count has fallen to 26, less than half the number running in the first quarter and part of a planned drawdown (see Shale Daily,May 6). A year ago Chesapeake was running 67 rigs in the U.S. onshore.

Despite the voluntary curtailments, Chesapeake’s quarterly output jumped 13% to 703,000 boe/d, up 2% sequentially when adjusted for asset sales.Wells took less time and cost less money. Output guidance for 2015 is expected to be 4% higher than in 2014 to average 667,000-677,000 boe/d.

Although investors overall seemed disappointed in the results, energy analysts were more positive, pointing to higher volume guidance and an acknowledgement by Lawler that cost cutting has to continue.

Sanford Bernstein’s Bob Brackett called the report a mixed bag. For the bulls, he said, volume guidance was raised almost 4%, and the company turned it on in the Haynesville, a nod to being able to ramp up when needed.

The bears found plenty to love, however, as “quarterly revenue was abysmal,” said Brackett, driven by a “staggering” $1.90/bbl natural gas liquids realization, about $55.00/bbl below West Texas Intermediate in the quarter.

“We continue to see upside…primarily due to our bullish commodity deck,” Brackett said in a note. “The call…while including some negative news, continued to give us confidence that management is open to asset sales, joint ventures and other potentially required moves to get through what we believe is the price trough. The engine of production growth is there — just awaiting fuel (capex), and the focus on cost control is evident.”

Wells Fargo’s team also said the takeaway was positive, particularly on the production side, with cash flow results beating Wall Street expectations. “While results and forward guidance should provide upward bias for shares, we fundamentally still look at any potential individual…transaction as either not enough standalone and/or dilutive. With short interest 33% of float, shares should remain volatile, but don’t believe enough is in the release to get shorts off their longer-term short thesis.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |