E&P | NGI All News Access | NGI The Weekly Gas Market Report

Seven Gas Rigs Leave, But It’s Still Summer of Surplus

In these supply glut times, it would be nice if there were more gas-fired power plants burning more natural gas, but don’t blame power generators for the oversupply. Look to producers and the rig count.

“While the number of natural gas power plants operating in the U.S. exceeded the most optimistic forecasts, the fuel requirements from these new plants did not introduce a structural shift in seasonality,” wrote BNP Paribas’ Teri Viswanath, director of natural gas commodity strategy, in a note Friday on the summer of too much gas.

All that new gas-fired generation demand was more than met by all the rigs that went to work in the shale patch, Viswanath wrote, giving “…rise to unrestrained growth of domestic supply, offsetting the increase in peaking demand over the past several summers.”

Viswanath wrote that even in 2012 when storage ballooned on a mild winter, producers didn’t cut back. “…[T]he industry was unable or unwilling to exercise production restraint in the summertime,” she wrote. “Likewise, we do not anticipate proactive supply cuts later this season as a means to re-balance the market and avert the potential further deterioration in prices.”

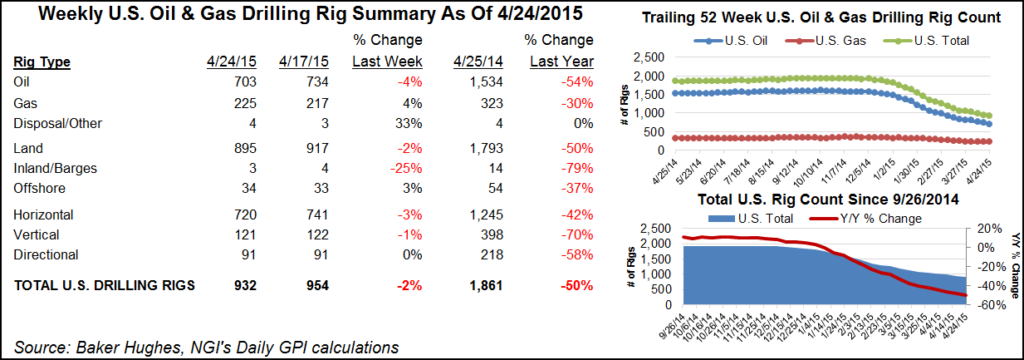

According to the latest tally from Baker Hughes Inc., five U.S. rigs joined the hunt for oil, but seven left the natural gas game. That’s a bit of a flip from the previous week when seven oil-directed rigs were lost and one gas-directed rig was added (see Daily GPI, July 17).

In a bit of a twist from recent weekly rig count reports from Baker Hughes Inc., the latest tally shows that three U.S. rigs returned to the offshore while six left activity on land. Overall, the total U.S. count fell by two in the report issued Friday (July 31). However, Canada added 15 rigs for a net North America gain of 13.

Across producing states, changes from the previous week were modest. Kansas lost the most rigs (four), followed by Utah, which lost three. New Mexico gained three rigs, the largest statewide increase. Louisiana gained two rigs net of land and offshore changes.

According to Baker Hughes data, Texas only gained one rig statewide, but Railroad Commission of Texas Districts 1 and 2 in the San Antonio region saw more dramatic changes. District 1 lost five rigs while District 2 to the southeast gained seven. The other districts either held steady or only gained/lost one or two rigs.

According to NGI‘s examination of other basins, the Tuscaloosa Marine Shale and the Uinta Basin were the big losers in the latest count, each dropping by three rigs.

In Canada, Alberta and Saskatchewan each added five rigs; British Columbia added four, and Manitoba gained one. Only one natural gas-directed rig was added in Canada, but 14 more oil-directed rigs came online.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |