NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

ExxonMobil Profits Down by Half, Chevron’s Tumble 90% in Grim Quarterlies

ExxonMobil Corp. and Chevron Corp., the largest natural gas and oil producers in the United States, posted their worst quarterly performances in years following the extended decline in commodity prices, signaling what is looking like a prolonged downturn across the sector.

ExxonMobil is scaling back its share buybacks, while Chevron has lowered its internal long-term price for crude oil. Both operators indicated that final investment decisions on major projects are being reconfigured, with some deferred and others possibly canceled. Both companies’ share prices slumped by as much as 5% in midday trading on Friday.

For the No. 1 U.S. natural gas producer, ExxonMobil’s upstream profits were dismal, falling overall by 74% from a year ago, and the U.S. arm failed to turn a profit for the second quarter in a row. Second quarter profits fell 52% year/year to $4.19 billion ($1.00/share) from $8.78 billion ($2.05). By comparison, using the average number of shares outstanding during each period, profits in 2Q2013 totaled $6.86 billion ($1.55/share), while in the second quarter of 2012, ExxonMobil earned $15.91 billion ($3.41). Earnings in 2Q2011 hit $10.68 billion ($2.19/share).

ExxonMobil’s capital expenditures (capex) fell sharply from a year ago, down 16% to $8.26 billion. Net cash year/year declined to $8.8 billion from $10.2 billion, and operational cash flow slumped to $9.4 billion from $12.8 billion.

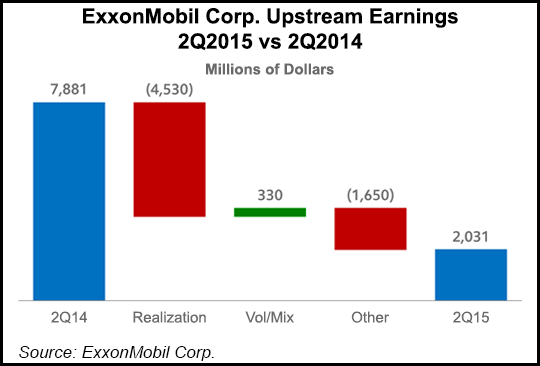

Upstream earnings tumbled sharply to $2 billion from $5.9 billion, as lower oil and gas price realizations decreased profits by $4.5 billion. In the U.S. upstream arm, which makes up about 25% of total output, the company reported a $47 million loss, down $1.2 billion from 2Q2014. The U.S. upstream unit recorded a $99 million loss in 1Q2015.

“Our quarterly results reflect the disparate impacts of the current commodity price environment, but also demonstrate the strength of our sound operations, superior project execution capabilities, as well as continued discipline in capital and expense management,” ExxonMobil CEO Rex Tillerson said.

Average price realizations for domestic natural gas averaged $2.31/Mcf from $4.426 a year ago, while average U.S. oil prices fell to $54.06/bbl from $98.55.

Production rose 3.6% worldwide to 5 million boe/d, with liquids volumes rising almost 12% to 2.3 million b/d, benefiting from new developments in the United States, Canada and overseas. However, natural gas output from 2Q2014 fell by 5.8% to 10.1 Bcf/d, down 622 MMcf/d, which the operator blamed on regulatory restrictions in the Netherlands.

Natural gas available for sale in the United States declined to 3.153 Bcf/d from 3.421 Bcf/d in 2Q2014. Canada/South America gas sales also fell to 262 MMcf/d from 316 MMcf/d. U.S. crude oil/liquids production increased to 468,000 b/d from year-ago output of 458,000 b/d, while production in Canada/South America was higher at 364,000 b/d versus 282,000 b/d.

For Chevron, it was a bloodbath, with second quarter profits plummeting to $571 million (30 cents/share), versus $5.7 billion ($2.98) in 2Q2014. Included in the latest report were impairments totaling $1.96 billion and other charges of $670 million relating to project suspensions and adverse tax effects. Part of the charges, said CFO Pat Yarrington during a Friday conference call, stem from a downward revision to the longer-term crude price outlook. She declined to tell investors what the revised price outlook is.

Chevron’s sales and other operating revenues in the latest period fell to $37 billion from $56 billion a year ago. The upstream unit posted a $2.22 billion loss, versus year-ago earnings of $5.264 billion. The downstream again proved to be the positive, posting quarterly profits of $2.96 billion from year-ago earnings of $721 million.

U.S. upstream operations incurred a $1.04 billion loss in the quarter, versus year-ago profits of $1.05 billion. The average sales price for crude/liquids was $50/bbl, versus $92 a year ago. The average sales price for natural gas was $1.92/Mcf, compared with $4.09 in 2Q2014.

“Second quarter financial results were weak, reflecting a crude price decline of nearly 50% from a year ago,” said CEO John Watson. “Our upstream businesses were particularly hard hit, as lower prices reduced revenues and triggered impairments and other charges. Downstream operations continued to deliver strong financial performance, reflecting both high reliability and improved margins.”

He said “multiple efforts” are ongoing to improve future earnings and cash flows.

“We’re getting our cost structure down through renegotiations across the supply chain and by sizing our contractor and employee workforce to reflect lower activity levels going forward. We’re actively managing to a smaller capital program, as projects currently under construction come online and as potential new projects are paced and re-bid. In addition, our four-year divestment program is ahead of pace.”

Top priorities are completing the Gorgon and Wheatstone liquefied natural gas export projects in Australia. “Incremental production and cash generation from these projects and others, along with a curtailed capital program, should provide support for continuing competitive shareholder distributions.”

Worldwide production was 2.60 million boe/d net in 2Q2015, slightly more than 2.55 million boe/d in 2Q2014.

Despite the impairments from price realizations, U.S. production was 9% higher than a year ago at 730,000 boe/d following project ramp-ups in the Gulf of Mexico, the Permian Basin and the Marcellus Shale, partially offset by normal field declines.The net liquids component production increased 11% to 511,000 b/d, while net natural gas production increased 5% to 1.31 Bcf/d.

In the U.S. onshore, the operator is on track to drill 325 wells (gross) this year, including “multiple horizontal well development programs” in the Permian’s Midland and Delaware subbasins, said upstream chief Jay Johnson.

Analysts were not impressed.

“Second quarter earnings were lower than expected for both companies, a disappointment for Exxon and a disaster for Chevron,” said Oppenheimer & Co. analyst Fadel Gheit. “A rising tide lifts all ships, but when the tide goes out, all ships go down.”

Wolfe Research LLC analyst Paul Sankey said the reports by the Big Oil companies to date indicates “this is the beginning, not the end, of the writedown process.” The biggest concern is weaker oil and gas demand through the rest of this year. The writedowns “will get worse” for the industry because the “market still looks very oversupplied with oil, and we’re in peak demand season globally.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |