Markets | NGI All News Access | NGI Data

NatGas Futures Bulls Scratching Heads Following EIA Report; Cash, Futures Slide

Physical natural gas for Friday delivery fell in Thursday’s trading. A few eastern points gained ground, but the overall market fell 8 cents to $2.65.

Typically, traders will try and get their deals done before the 10:30 a.m. EDT release of storage data by the Energy Information Administration (EIA), but in this case the physical market didn’t need any help from futures prices, which lost close to a dime on their own.

Eastern points led the charge lower, dropping close to 20 cents. This happened as next-day power prices took double-digit hits, even though near-term temperature forecasts in eastern population centers still called for above-normal temperatures. Futures made a counter-intuitive move lower as a government inventory report showed a lesser increase in inventories than anticipated. At the close September had shed 9.6 cents to $2.768, and October was lower by 9.1 cents to $2.797. September crude oil fell 27 cents to $48.52/bbl.

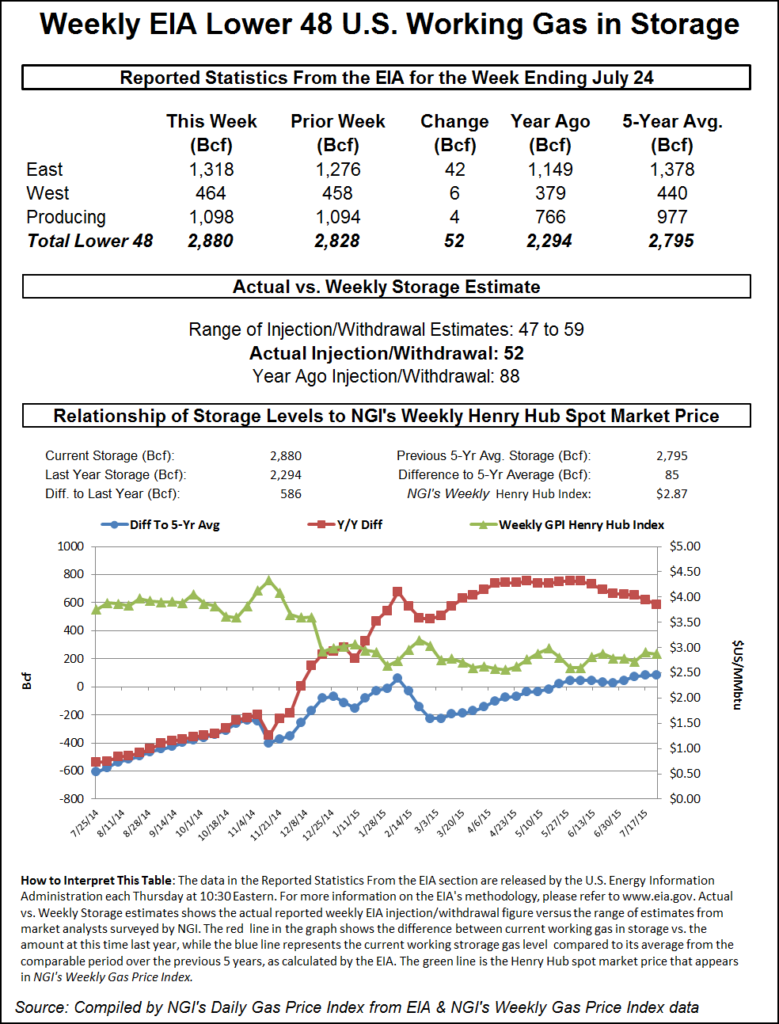

For the week ended July 24, EIA reported an injection of 52 Bcf. September futures rose to a high of $2.847 after the number was released, but by 10:45 a.m. September was trading at $2.796, down 6.8 cents from Wednesday’s settlement. Market analysts versed in technical analysis were dismissive of the report and focused on recent price action.

“That’s one reason we don’t follow fundamentals. The $2.90 to $2.915 area was a very important area that we needed to get through,” Brian LaRose, technical analyst at United ICAP told NGI. “Clearly, the market failed miserably, and now we have our eyes on the $2.67 level. If we take that level out, I think there is a chance we make a run at $2.55 and even $2.44 in the very short term.”

LaRose, however, remains positive on the market and said he thinks there is a good chance for a second-half rally. “That’s all dependent if the bulls can get their act together, and so far they have failed miserably at every turn. My line in the sand is $2.67. Take that out, and I move to the sidelines. Take out $2.44, and we are looking at $1.60.”

Prior to the release of the data, analysts were looking for an increase in the mid-50 Bcf area. Bentek Energy’s flow model estimated 55 Bcf, and IAF Advisors was counting on a 53 Bcf increase. A Reuters poll of 24 traders and analysts showed an average 54 Bcf with a range of 47 to 59 Bcf.

Tim Evans of Citi Futures Perspective thought the number “should be seen as constructive if not mildly supportive. There were no reclassification issues this week, and so this is a relatively clean report in that respect. We think it tends to reinforce the idea that we’ve seen enough air-conditioning demand to keep the market in a relatively close balance on a seasonally adjusted basis. This isn’t necessarily supportive, although we think it may qualify as stronger than expected, less than satisfying for those holding short positions.”

Natgasweather.com’s Andrea Paltrinieri was looking for a build of 54 Bcf and said her figure was revised lower because of lower production data last week, otherwise the figure would have been in the high 50s. “In regards to supply-demand, I see 54 Bcf as a bearish number for the overall balance, weather adjusted, and I see EOS at 4 Tcf with normal weather patterns. For supply-demand, I have as a neutral number 48 Bcf, in line with the five-year average. Any number below 47 would be bullish and above 50 bearish! However, since the market is incorporating 53-54 Bcf…we could have some brief upside [Thursday] with any number below estimates. But we need to disentangle market reaction from supply-demand balance.

For the moment it looks like those holding short positions are having the last laugh. “It just looks like there’s a lot of bearishness out there. We were at the lows of the day after the number came out,” said a New York floor trader.

Next-day gas in the East responded to double digit losses in on-peak Friday power. Intercontinental Exchange reported that Friday on-peak power at the ISO New England’s Massachusetts Hub tumbled $19.42 to $39.46/MWh, and peak power at the PJM West Hub skidded $25.58 to $44.23/MWh.

Gas at the Algonquin Citygate dropped $1.15 to $2.19, and deliveries to Iroquois, Waddington fell 9 cents to $3.02. Gas on Tenn Zone 6 200L lost $1.05 to $2.14.

Gas at Marcellus points couldn’t quite match the freefall of New England. Transco-Leidy Line was seen down two cents at $1.32. Gas on Tennessee Zn 4 Marcellus changed hands flat at $1.24, and gas on Dominion South was quoted 4 cents lower at $1.33.

The fall at New England points came in spite of near-term weather forecasts calling for above-normal temperatures. Forecaster Wunderground.com said Thursday’s high in Boston of 90 degrees would ease to 89 Friday and 87 Saturday. The normal high in Boston is 82. Providence, RI’s high Thursday of 88 was predicted to rise to 89 Friday and fall to 87 Saturday. The normal high in Providence is 83.

In bidweek trading, quotes at major market points improved over July. NGI‘s Bidweek Alert showed Columbia Gulf Mainline at $2.75-2.76, ahead of July Bidweek at $2.71. Chicago Citygate was seen at $2.85-2.92, as much as a dime higher than July Bidweek at $2.82.

Near-term weather outlooks suggest a cooling farther west and the chance at higher builds next week. “A cold front will stretch from the eastern Great Lakes to the lower Mississippi Valley on Thursday, while stormy weather develops across the Southwest,” said Wunderground.com’s Kari Strenfel.

“A cold frontal boundary will extend south-southwestward over the eastern Great Lakes, the interior Mid-Atlantic, the Tennessee Valley and the lower Mississippi Valley. This frontal boundary will interact with warm, humid air from the Gulf of Mexico, which will initiate a line of rain and thunderstorms across the Eastern Seaboard and the eastern half of the Gulf Coast. The heaviest rain will likely develop along the eastern Gulf Coast due to moisture pooling from the Gulf of Mexico.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |