E&P | Eagle Ford Shale | NGI All News Access

Swift Considering Finance Alternatives

Houston’s Swift Energy Co. said Tuesday it has retained Lazard Freres & Co. LLC to advise management and the board of directors regarding “capital structure, financing alternatives and related strategic opportunities.”

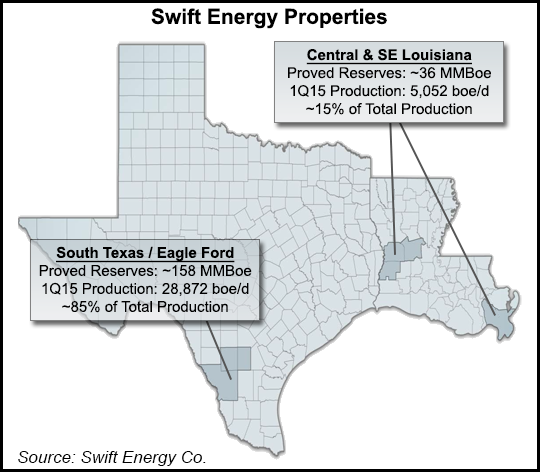

Swift, founded in 1979, develops oil and gas properties in onshore Texas and Louisiana, and in Louisiana’s inland waters. Swift’s share price was 74 cents/share when the market opened Wednesday; it has traded as high as $12.49/share in the past year. Lazard advises global clients on mergers, acquisitions, restructuring, capital structure and strategy.

“We believe the underlying assets that Swift Energy has developed have meaningful value, much of which can be realized even in today’s challenging environment,” said CEO Terry Swift. “Consequently, we have retained Lazard to explore alternatives with respect to realigning our balance sheet including our senior notes, which trade at levels significantly below face value, addressing certain maturities and enhancing our liquidity profile. We believe this will better position the company to execute our forward drilling program, which will benefit all constituencies.”

During the first three months of this year, the independent produced 3.06 million boe, 4% more than in the year-ago period and 2% higher than in 4Q2014. Eagle Ford Shale output was 19% higher from a year ago.

In the first quarter, Swift reported an adjusted net loss of $36.5 million (minus 83 cents/share), excluding a $502.6 million writedown on its properties. Total revenues in the period decreased 53% year/year to $68.3 million, primarily because of lower commodity prices and lower oil production, partially offset by higher natural gas production.

The board is in the process of evaluating a “strategic and financial review” but “no assurance can be given as to its outcome or timing.” No further announcements are expected until disclosures are “necessary or appropriate.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |