Markets | NGI All News Access | NGI Data

Physical NatGas Flat, But August Futures Drops 8 Cents on EIA Data

Traders elected to get their deals done ahead of the Energy Information Administration’s (EIA) storage report Thursday and may have dodged a bullet or two in the process.

Overall, gas for Friday delivery ended the day unchanged at $2.60, but futures skidded close to a dime. Double-digit average losses in New England were prompted by weak next-day power pricing as well as weather forecasts calling for moderating temperatures.

Futures traders were initially caught off guard by a revision in the weekly storage figures that showed 7 Bcf reclassified from working gas to base gas. Futures shot higher, and the seemingly bullish 61 Bcf storage build was quickly refactored. At the close, August was down 8.1 cents to $2.816 and September had fallen 9.1 cents to $2.817. September crude oil continued lower falling losing 74 cents to $48.45/bbl.

Figures show that whether its due to the steady build of gas moving westward out of the Marcellus or simply a mild summer, supplies within the Midcontinent have been increasing due to lower demand and increased production. In a report industry consultant Genscape said, “To balance, the region has had to reduce imports while restructuring exports. While total Midcontinent exports are flat at 9.7 Bcf/d summer to date compared to the three years average of 9.7 Bcf/d, exports to the Midwest are at record lows.”

The firm’s figures show that summer to date exports have dropped from a three-year average of 6.8 Bcf/d to 6.5 Bcf/d. “The largest contributors to this drop in exports has been ANR and NGPL. This summer to date ANR has averaged 0.60 Bcf/d compared to the three year average of 0.62 Bcf/d. NGPL exports have dropped 0.3 Bcf/d from the three year summer to date average of 2.9 Bcf/d to 2.6 Bcf/d.”

Not only have exports from the Midcontinent declined, but at the same time Midcontinent production continues to grow. “Midcontinent production is averaging 8.9 Bcf/d summer to date, about 0.2 Bcf/d greater than the three-year average of 8.7 Bcf/d. Decreased Midcontinent demand has exacerbated the region’s supply build. Midcontinent demand this summer to date has averaged 2.0 Bcf/d, down about 0.3 Bcf/d from the three-year average of 2.3 Bcf/d,” Genscape said.

Gas for delivery Friday to the NGPL Midcontinent Pool was unchanged at $2.85, and parcels on Northern Natural Ventura fell a penny to $2.87. Gas on Panhandle Eastern rose a penny to $2.77 and gas on OGT changed hands at $2.73, up a penny.

Northeastern points proved to be the day’s biggest movers, and although about half the points registered gains, a few big losses skewed the region to an average loss of over a dime. AccuWeather.com reported that Boston’s high Thursday of 82 degrees would slide to 78 Friday and 72 by Saturday. The normal high in Boston is 82. New York City’s Thursday high of 86 was forecast to hold through Saturday, two degrees above normal.

Gas in the Northeast showed its uncanny ability to trade as an extension of the Marcellus in times of low demand. Gas for Friday delivery to the Algonquin Citygate fell 40 cents to $1.34, and deliveries to Iroquois Waddington fell 60 cents to $2.25. Gas on Tennessee Zone 6 200 L was quoted 30 cents lower at $1.43.

Gas for Friday on Transco Leidy was up 4 cents to $1.22 and Dominion South rose 3 cents to $1.22.

Next-day power prices were mostly lower in the region as well. Intercontinental Exchange reported that on-peak power deliverable Friday to the New York ISO’s West Zone (Zone A) fell $25.00 to $27.00/MWh and on-peak power at the ISO New England’s Massachusetts Hub shed $1.18 to $24.22/MWh. On-peak Friday power at the PJM West Hub added $4.22 to $39.47/MWh.

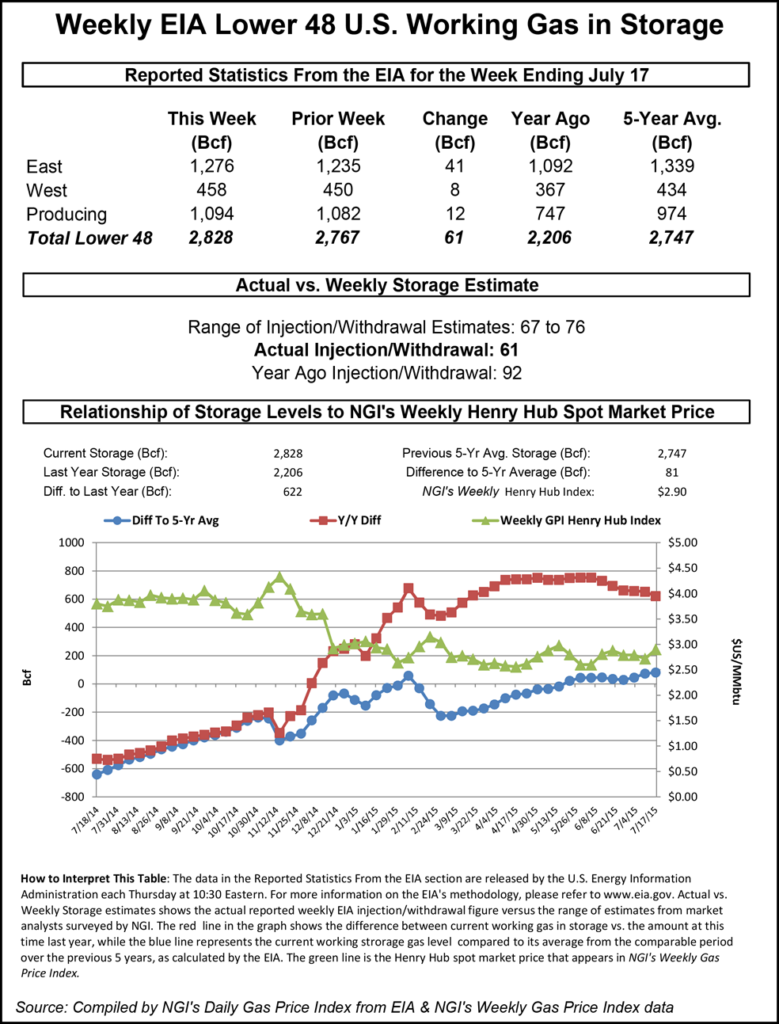

Futures bulls noted that the two previous storage reports had a decidedly bearish luster to them, but August futures now sit higher by double digits prior to those reports. A run of three straight was a bit too much to ask, and for the week ended July 17 the EIA reported an injection of 61 Bcf in its 10:30 a.m. EDT release that included a reclassification of 7 Bcf from working gas to base gas in the Eastern Region. August futures rose to a high of $2.951 after the number was released but quickly adjusted. By 10:45 a.m. August was trading at $2.861, down 3.6 cents from Wednesday’s settlement.

Prior to the release of the data analysts were looking for an increase in the upper 60 Bcf range. Bentek Energy’s flow model estimated 67 Bcf, and IAF Advisors was counting on a 67 Bcf increase as well. A Reuters poll of 25 traders and analysts showed an average 70 Bcf with a range of 64 Bcf to a 79 Bcf injection.

The 7 Bcf re-classification caught some traders by surprise. “It didn’t make any sense. We were looking for a build in the high 60s, 67 to 70, but the 61 Bcf was a bit of a surprise,” said a New York floor trader. “We are looking at a $2.85 to $2.95 trading range, and support below at $2.75 and resistance at $3.”

Tim Evans of Citi Futures Perspective saw a positive tone to the figure. “The DOE reported 61 Bcf in net injections for last week, but noted that it had moved 7 Bcf in gas in the Eastern Region total from working gas into the base gas category. So the flow for the week was more like 68 Bcf, even though the total increased by just 61 Bcf. Either way, we consider this a constructive report, with even the 68-Bcf figure still a robust drop from the 99 Bcf level of the prior week and closer to the 54-Bcf five-year average result than it might have been.”

Inventories now stand at 2,828 Bcf and are 622 Bcf greater than last year and 89 Bcf more than the 5-year average. In the East Region 41 Bcf was injected and the West Region saw inventories increase by 8 Bcf. Stocks in the Producing Region rose by 12 Bcf.

Overnight weather models had turned slightly warmer. According to Commodity Weather Group’s Thursday morning report, increased energy demand is likely due to “warmer to hotter weather next week ahead of a cold front that the models are struggling to define. We saw that issue on the models last week, too, and they eventually firmed it up over the weekend leading into this week. As a result of this struggle, we lowered confidence a bit on the overall six-10 day, but it still looks like the East Coast could see a spike of stronger warming around the middle of next week (Wednesday-Thursday) with possible middle 90s for the Middle Atlantic.

“Otherwise, the outlook is slightly warmer Midwest to South for the six-10 day and trending hotter for California later next week. The 11-15 day shows very similar themes to yesterday, but it is slightly warmer on the East Coast (near normal). The outlook is still not as cool as the American ensemble for the Midwest, but the Western heat ridge upstream offers that risk of cooler results in the East,” said Matt Rogers, president of the firm.

Increased heat and higher expected cooling loads this week may be just the recipe to bring storage builds to within long-term averages.

The National Weather Service forecasts that for the week ended July 25, major population centers will experience greater than normal cooling requirements. New England is expected to toast under 70 cooling degree days (CDD), or 25 more than normal, and New York, New Jersey and Pennsylvania should see 75 CDDs, or 16 more than normal. The greater Midwest from Ohio to Wisconsin is forecast to swelter under 74 CDD, which is 16 more than normal.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |