Markets | NGI All News Access | NGI Data

Gulf, Midwest, California Strength Largely Subdue East Weakness; Futures Gain

Physical gas for delivery Thursday worked lower with wide differences between regions. Overall, the market shed 2 cents to $2.70, but losses in the East and Northeast averaging about 20 cents were almost completely offset by broad, but smaller gains in the Gulf, Midcontinent, Midwest, Rockies and California.

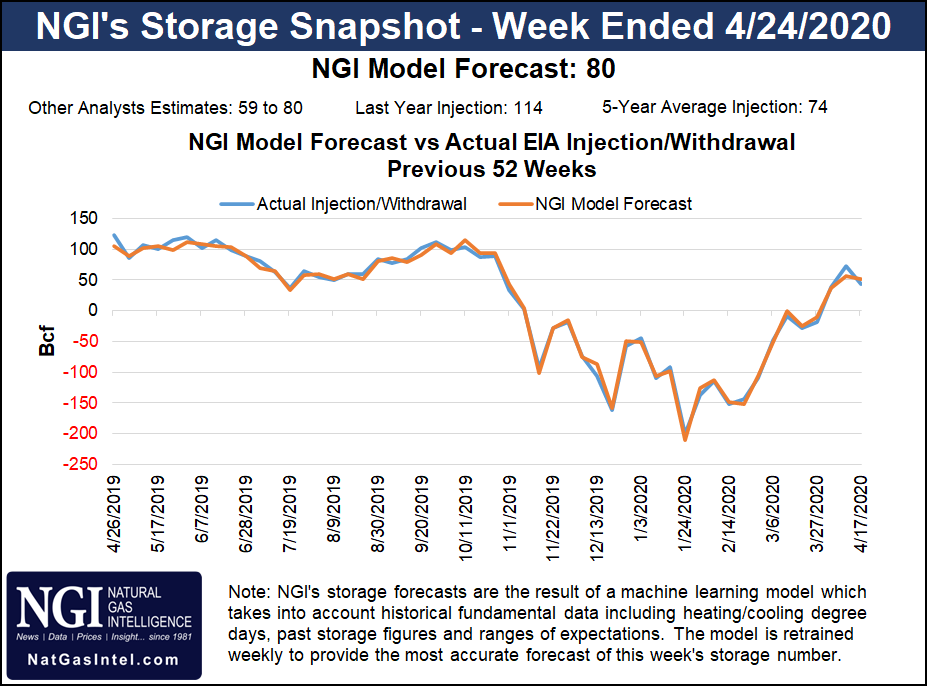

Most major hubs were higher by a penny or two. Futures inched higher ahead of Thursday’s Department of Energy (DOE) Energy Information Administration (EIA) storage report as increases are expected to lag last year’s levels.

At the close, August had advanced 1.5 cents to $2.897, and September was higher by 1.8 cents to $2.908. Crude oil breached the psychologically important $50 level with now spot September falling $1.67 to $49.19/bbl.

Gas for Thursday delivery at Dominion South settled at $1.19, down 8 cents, and gas at the Henry Hub rose a penny to $2.89.

No doubt the construction of major pipelines can have an extreme impact on basis differentials, but it takes time. One recent analog is the build-out of the Rockies Express (REX) pipeline conveying gas from Opal WY as far east as Ohio.

“REX was built in stages,” said NGI’s Director of Strategy and Research Pat Rau. “They basically acquired a pipeline that connected Opal to the Cheyenne Hub in 2006 to serve as the base. The REX-West portion (the first part of the mainline pipeline) was commissioned in late 2007, and reached full linepack in early 2008. The entire 1.8 Bcf/d pipeline reached its terminus at Clarington, OH in Nov 2009.

“Because the pipeline kept moving east in stages, its incremental impact on the Opal-Dominion basis was choppy. However, by the time the pipe was finished in November 2009, the Opal-Dominion basis spread fell from nearly $7/MMBtu to less than a dollar.”

In Wednesday’s trading stout losses were seen at Northeast points as next-day peak power provided little incentive to make incremental purchases. Intercontinental Exchange reported that on-peak power at the ISO New England’s Massachusetts Hub fell $8.46 to $25.40/MWh, and next-day on-peak power at the PJM West Hub fell $1.02 to $35.25/MWh.

Gas at the Algonquin Citygate fell 71 cents to $1.74, and deliveries to Iroquois Waddington skidded 17 cents to $2.85. Gas on Tennessee Zone 6 200 L tumbled 70 cents to $1.73.

Gas on Millennium added 7 cents to $1.27, and deliveries on Transco Leidy were seen 7 cents lower at $1.18. Gas on Tennessee Zone 4 Marcellus added 3 cents to $1.15.

Next-day gas at major hubs added about a penny. Deliveries to the Chicago Citygate changed hands flat at $2.93, and gas at the Henry Hub was up a penny at $2.89. Gas on El Paso Permian was also a penny higher at $2.86, and packages at the SoCal Citygate rose 3 cents to $3.21.

“Expectations for Thursday’s DOE storage report for the week ending July 17 may have firmed somewhat with the addition of more recent estimates somewhat below the early consensus for a 70 Bcf net injection,” said Tim Evans of Citi Futures Perspective in closing comments Tuesday.

Evans’ calculations show a 76 Bcf build, “which suggests some risk of a bearish storage surprise, although we wonder if it didn’t make too large an adjustment for the larger-than-expected 99 Bcf build for the week ended July 10. For now, we’ll stick with the model’s estimate, with today’s change in the forward outlook based on a slightly more moderate temperature forecast.”

His figures show the current year-on-five-year surplus of 73 Bcf increasing to 122 Bcf by Aug. 7. “This growing surplus confirms the market is becoming better supplied on a seasonally adjusted basis, which we view as a downward fundamental pressure on prices. Despite this moderate headwind, we continue to see some intermediate-term potential for a short-covering rally back above the $3.00 level, an upward correction to what we see as an overly conservative valuation.”

Last year 92 Bcf was injected and the five-year pace stands at 53 Bcf. Analysts at IAF Advisors expect an increase of 67 Bcf and United ICAP came up with a 78 Bcf build. A Reuters survey of 25 traders and analysts revealed an average 70 Bcf with a range of 64 Bcf to 79 Bcf.

Forecasters continue to call for hot temperatures over the southern United States in the near term. Natgasweather.com said in the next seven days it expects moderate demand for natural gas in days one to two but high demand in days three through seven. Further out in its morning eight- to 15-day outlook it predicted that “strong high pressure with hot temperatures will continue over the central and southern U.S., including Texas, where highs will consistently reach the mid-90s to lower 100s. Although the hot ridge will shift over the West during the first few days of August, including over much of California to bring above normal temperatures, during this time cooler air will briefly spill across the northern U.S.

“It will be important to watch to see if the hot ridge shifts back over the eastern U.S. during the second half of the outlook.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |