NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

ConocoPhillips Pulls Plug on GOM Deepwater Spending

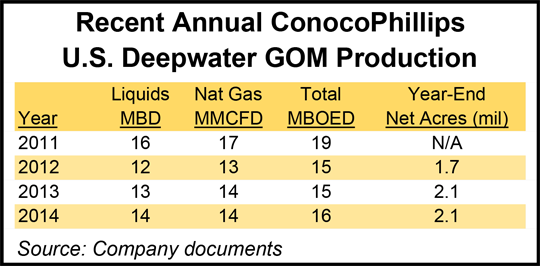

ConocoPhillips’ deepwater exploration spending is being scuttled this year, with the most significant cuts to impact the Gulf of Mexico (GOM) program, the Houston super independent said Thursday.

The producer also has canceled a contract for a drillship that was scheduled to begin a three-year exploration program in the GOM later this year.

“Since the start of the oil and gas price downturn last year, we have moved decisively to position ConocoPhillips for lower, more volatile prices by exercising capital flexibility and reducing operating costs across our business,” said CEO Ryan Lance. “Our decision to reduce spending in deepwater will further increase our capital flexibility and reduce expenses without impacting our growth targets. This strengthens our ability to achieve cash flow neutrality in 2017 even if lower commodity prices persist.”

No financial details were provided, nor was any information provided on how the cutbacks may impact production. The company said more information would be available during the second quarter conference call, which is scheduled for July 30.

The cutbacks to the deepwater capital expenditures (capex) “reflect a decision to reduce exposure to programs with greater resource risk and longer cycle times,” Lance said. “However, we will continue to pursue organic growth through more focused exploration programs.

“Furthermore, with increased capital flexibility, we can direct more investment to our captured resource base of 44 billion boe, which includes significant identified inventory in the highest value areas” including unconventional drilling in the Eagle Ford and Bakken shales, Permian Basin and Western Canada. “We believe this will accelerate value for shareholders by shortening the cycle time on our overall investment program.”

ConocoPhillips has achieved “notable success in our deepwater program, particularly in the Gulf of Mexico Lower Tertiary play and offshore Senegal. We are committed to delivering the value we have created from these discoveries, while reducing the number of deepwater exploratory prospects we drill in the future.” The operator also explores offshore Nova Scotia and Angola.

To help alleviate deepwater capex costs, in January ConocoPhillips allied with BP plc and Chevron Corp. in two key GOM discoveries in Keathley Canyon, one of the most sought-after lease areas of the Lower Tertiary Trend (see Daily GPI, Jan. 28).

The reduced offshore capex plan has led ConocoPhillips to terminate a contract with the Ensco DS-0 drillship, which was scheduled for delivery to the GOM later this year. The Ensco drillship was to begin drilling the producer’s operated deepwater inventory on a three-year contract. Ensco said separately that under the terms of the contract, ConocoPhillips is obligated to pay termination fees monthly for two years equal to the operating dayrate of $550,000, which could be partially defrayed if the rig is re-contracted within the next two years.

ConocoPhillips has increased its quarterly dividend to 74 cents/share, up one cent. “A compelling dividend is a key aspect of our value proposition to shareholders,” Lance said. “While this increase is more modest than in previous years, we believe it is appropriate given the lower commodity price environment.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |