M&A | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Enterprise Selling Offshore GOM Assets to Focus on Land

Genesis Energy LP has agreed to pay $1.5 billion in cash for the offshore pipeline and services business of Enterprise Products Partners LP and its affiliates. The deal includes ownership interest in 2,350 miles of offshore crude oil and natural gas pipelines and six offshore hub platforms.

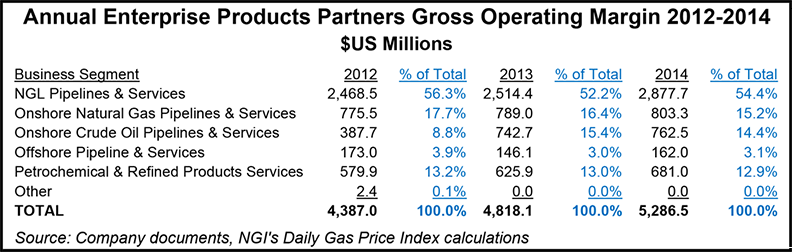

With the advent of onshore shale plays, the offshore assets have become a minor component of the overall Enterprise portfolio.

“In recent years, earnings from our offshore business represented only 3% of Enterprise’s gross operating margin, and our offshore assets do not effectively integrate with our downstream crude oil and natural gas pipeline systems,” said Enterprise general partner CEO Michael Creel. “We plan to redeploy proceeds from this sale into attractive growth opportunities…such as acquisitions and organic projects in the Eagle Ford and Permian shale plays.”

Creel added that the sale proceeds will finance the first installment payment for its acquisition of EFS Midstream LLC in the Eagle Ford (see Shale Daily,June 1). The sale also eliminates the need for equity capital for the remainder of the year, he said.

Closing is expected during the third quarter, according to Enterprise.

The offshore assets include Enterprise’s ownership interest in nine crude oil pipeline systems with more than 1,100 miles of pipeline; nine natural gas pipeline systems totaling about 1,200 miles; and its ownership interest in six offshore hub platforms.

Genesis said the Enterprise offshore business serves some of the most active drilling and development regions in the United States, including deepwater production fields in the Gulf of Mexico (GOM) offshore Texas, Louisiana, Mississippi and Alabama. The assets include 2,350 miles of offshore crude oil and natural gas pipelines and six offshore hub platforms, including a 36% interest in the Poseidon Oil Pipeline System (Poseidon), a 50% interest in the Southeast Keathley Canyon Oil Pipeline System (SEKCO) and a 50% interest in the Cameron Highway Oil Pipeline System (CHOPS).

The Enterprise offshore business assets will complement and expand Genesis’ existing offshore pipelines, which are primarily composed of interests in three oil pipelines: Poseidon (28%), SEKCO (50%), and CHOPS (50%). Contracts supporting the Enterprise assets are mainly long-term and fee-based, Genesis said.

“These offshore assets will substantially enlarge our portfolio of strategic infrastructure in the Gulf of Mexico, which is one of the most prolific producing regions in the United States,” said Genesis CEO Grant Sims. “We believe the acquisition will be immediately accretive to our cash available for distribution per common unit and will improve our credit metrics over time, which should accelerate an increase in our credit ratings in the future.”

Genesis said it expects the GOM to continue to be fertile for exploration and development “even in the current lower commodity price environment.”

Enterprise said it expects to record noncash asset impairment and related charges of about $100 million, 5 cents/unit on a fully diluted basis for the sale.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |