Physical NatGas Prices Left Behind by Exuberant Futures; August Up Another 8 Cents

Next-day natural gas prices were generally lower across a broad front in Wednesday’s trading with losses of a few pennies at numerous points offsetting outsized gains at some East and Northeast points. Overall, NGI’s National Spot Gas Average lost 3 cents to $2.61.

Futures bulls continued to romp higher, adding another 8 cents to the week’s cumulative gains, which were already at 7 cents going into Wednesday’s trading. At the closing bell, August had added 7.8 cents to $2.918, and September was higher by 7.0 cents to $2.909. August crude oil fell $1.63 to $51.42/bbl.

Softer next-day power pricing and forecast lower loads in the Mid-Atlantic helped keep next-day gas from advancing. Intercontinental Exchange reported that on-peak power Thursday at the PJM West Hub fell $4.27 to $32.18/MWh, and PJM forecast peak load Wednesday of 42,430 MW would ease to 41,159 MW Thursday. Friday’s loads were expected to be 41,595 MW.

Gas for delivery to Tetco M-3 was flat at $1.30, but gas headed for New York City on Transco Zone 6 fell 35 cents to $1.59.

Other eastern prices were mixed, and major hubs softened. Gas at the Algonquin Citygates rose 20 cents to $1.98, and gas on Iroquois Waddington fell 26 cents to $2.78. Gas on Tennessee Zone 6 200 L climbed by 18 cents to $2.16.

Gas at the Chicago Citygate fell a nickel to $2.91, and gas at the Henry Hub shed 3 cents to $2.92. Deliveries to the NGPL Mid-Continent Pool were seen 1 cent lower at $2.85, and deliveries to Opal came in 4 cents lower at $2.86.

Futures traders see the market continuing to buy into the forecasts of hot weather next week and implied leaner storage builds.

“I think the market is looking at these forecasts and buying into it,” a New York floor trader told NGI. “They are buying the market, but you have great, great, great resistance at $2.98 to $3.00. If you could put a boulder in front of it, that’s the resistance you have, but traders will try to push that area. I say there is great resistance there, but I wouldn’t be surprised if it went right through, either.

“If I had to put my own money on it, I would say there’s a 90% chance it holds, but traders will test $3.00.”

An industry veteran said, “It could be short covering. The market starts going up and it’s ‘Oops. Time to buy those contracts back.'”

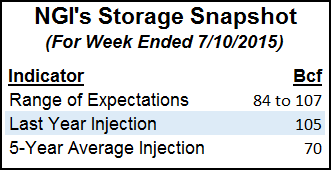

That test may come at 10:30 a.m. EDT Thursday when the Energy Information Administration (EIA) releases its report on natural gas inventories. Expectations are that the storage increase will easily surpass long term averages but fall short of last year’s triple-digit build. Last year a stout 105 Bcf was injected and the five-year average stands at 71 Bcf.

Analysts at IAF Advisors in Houston expect a 96 Bcf increase, and ICAP Energy calculated a 90 Bcf addition. A Reuters survey of 27 industry cognoscenti revealed an average 95 Bcf with a range of 84 Bcf to 107 Bcf. Preliminary data for next week shows an average 67 Bcf increase with a range of 59 Bcf to 72 Bcf, said Reuters.

Weather forecasters in their updates Wednesday continued to call for elevated heat as next week high pressure is expected to sit over the central United States, prompting high air conditioning loads. They admitted, however, to model uncertainty regarding the handling of a weather system expected to impact the northern United States.

“The latest overnight weather data retains a very warm to hot U.S. pattern over the next two weeks, although there are still some weather model struggles trying resolve if cooler temperatures will find a sneaky way to spill across the northeastern U.S. late next week,” said Natgasweather.com forecasters.

“This scenario isn’t preferred but is still in need of close watching. The feature causing the greatest model uncertainty is how a weather system during the middle of next week spins up over the northern U.S. Some scenarios try to cut the system off from the main flow and stall it over the East Coast with showers and thunderstorms, which would keep temperatures more seasonal.

“However, we believe it’s more likely to track right around the periphery of the hot dome of high pressure in a fairly progressive fashion where it fails to push very far into the U.S. only brings only slight cooling, while also exiting off the Atlantic Coast relatively quickly.”

Others see the forecast heat more at the end of the month. Tim Evans of Citi Futures Perspective expects the heat to shave off a portion of an increased year-on-five-year storage surplus. He calculated the year-on-five-year storage surplus as reaching 84 Bcf by July 24 but then slipping back to 74 Bcf by the end of the month.

“Overall, we see the net increase in the surplus over the month of July as slightly bearish, but that may no longer be the compelling story,” Evans said. “Instead, stronger seasonal power sector demand to meet air conditioning loads will be limiting storage injection rates, with weekly refills dropping from a projected 92 Bcf build for the week ended July 10 to a 42 Bcf gain in the week ending July 31.

“Coupled with what we continue to see as a relatively conservative current valuation and the potential for a further round of short covering, we think [that] could lift the market above the $3.00 mark in the months ahead.”

Evans recommended holding on to a long August position opened at $2.68 on July 8 with a protective sell stop resting at $2.63 to limit exposure on the trade.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |