Mexico’s first-ever auction opening the oil and natural gas industry to private and foreign investment Wednesday awarded two shallow water leaseholds in the Gulf of Mexico (GOM) to a single consortium.

Mexico’s first-ever auction opening the oil and natural gas industry to private and foreign investment Wednesday awarded two shallow water leaseholds in the Gulf of Mexico (GOM) to a single consortium.

Nine companies and consortiums, less than half of the 38 exploration and production companies qualified for the tenders, chose to submit offers for the 14 blocks in the southern GOM, according to Mexico’s National Hydrocarbons Commission (NHC) and Energy Ministry (see Daily GPI, May 26). Several blocks received no offers and other bids failed to meet the minimum threshold for profit sharing with the government.

The auction was the first opportunity for private producers to bid on exploring for oil and gas resources since 1938 (see Daily GPI, May 2, 2014).

A consortium made of up of Mexico’s Sierra Oil & Gas, Houston’s Talos Energy LLC and UK’s Premier Oil plc was high bidder for blocks No. 2 and 7. Block 2 is estimated to hold 341 million boe, light oil and dry natural gas, in 194 square miles off the Veracruz coast. Block 7, which the group outbid four other companies, holds an estimated 263 million boe of oily reserves in 465 square miles off the coast of Tabasco.

The consortium offered to pay the government 55.99% of the operating profit from Block 2. It agreed to pay a 68.99% share for Block 7. In both blocks, the group has agreed to invest 10% above the minimum requirement. The government had set a minimum for a 40% share in operating profit and no required incremental investment.

The formal awards are expected by Friday. NHC had estimated the value of the shallow water blocks at $17 billion total.

Among the producers that passed on the auction was Mexico’s state-owned Petroleos Mexicanos, Pemex. Before the sector was opened to private bidding, Pemex was assigned about 80% of the country’s proven and probable reserves.

Also qualified to bid but not participating were units of U.S.-based ExxonMobil Corp., Chevron Corp. and Hess Corp. Seven consortiums and 18 individual producers total were qualified, including units of Statoil ASA, Eni SpA, Total SA, BHP Billiton Ltd., OAO Lukoil and China’s Nexen.

According to the NHC, nine of the blocks that were up for auction have 20-36% probabilities of commercial success, with resources estimated at 164-384 million boe.

There are two more auctions scheduled this year, one Sept. 30 and the other Dec. 15.

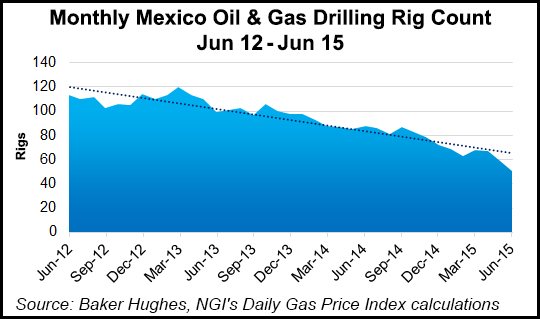

Unlike in the United States where the rig count only began to decline in December 2014, drilling activity in Mexico has seen a much more steady downturn. The drilling rig count in Mexico has fallen at an annualized trend-line rate of 19% per year since June 2012, according to Baker Hughes Inc. data and NGI’s Daily Gas Price Index calculations (see chart).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |