OneSubsea, Subsea 7 SA Partner on Integrated Offshore Systems

Houston-based OneSubsea is allying with Norway’s Subsea 7 SA to design, develop and deliver integrated options for the offshore, a market that has seen as big a downturn if not more, than the onshore.

OneSubsea, a Schlumberger Ltd. and Cameron International Inc. company, was formed in late 2012 (see Daily GPI, Nov. 16, 2012). Cameron designs, manufactures and installs technology, while Schlumberger’s offshore business concentrates on well completions, subsea processing and platform integration. Subsea 7’s expertise would bring to the table seabed-to-surface engineering, construction and services for the offshore.

The alliance would offer integrated solutions for subsea production systems (SPS), subsea processing systems, subsea umbilicals, risers and flowlines systems (SURF) and life-of-field services. Resources would be combined on selected projects and work collaboratively with clients to design, develop and deliver integrated SPS and SURF solutions to enhance project delivery, improve the recovery and optimize the cost/efficiency of deepwater developments for the life of the field.

“The technology and expertise from Subsea 7 perfectly complements OneSubsea’s ‘pore to process’ business strategy to offer a holistic approach to subsea development solutions,” said OneSubsea CEO Mike Garding. “Our established competencies in subsurface modelling and production systems engineering will be further strengthened by integrating the SURF expertise provided by Subsea 7.”

The combination of “subsurface, SPS, SURF and life-of-field expertise is unique in its breadth of integrated service offering and provides clients with the opportunity to significantly improve subsea field economics over the lifetime of the development,” said Subsea 7 CEO Jean Cahuzac.

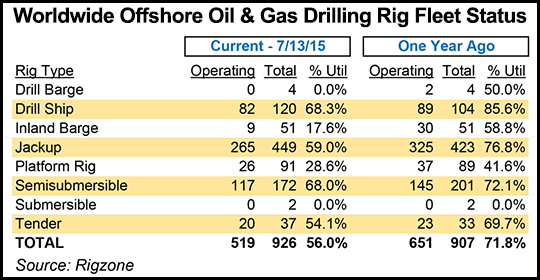

The capital-intense offshore industry, both directly and indirectly, has been hit hard during the downturn, as costly rigs have been pulled, mega-projects delayed and thousands of jobs cut. Allying with other companies to promote technology and efficiencies may prove to be a bold bet. But is the business there? Long-term yes, short-term, probably not, said analysts.

Sanford C. Bernstein & Co. LLC analysts, in their deep dive on the offshore services market, have come to the conclusion that offshore-focused services remained “the principal casualty of the oil price correction.” There are a few exceptions, such as Royal Dutch Shell plc’s recent final investment decision (FID) on Appomattox in the Gulf of Mexico (GOM) (see Daily GPI, July 1). Appomattox would be Shell’s eighth and largest floating platform in the U.S. offshore, and the FID advances construction and installation. It is expected to be delivered over a 55-month construction schedule.

Except for Appomattox and a few other “world-beating projects” overseas, facility engineers and equipment providers “face another wave of falling share prices before they trough,” said Bernstein’s Nicholas J. Green. New offshore activity in the first half of 2015 was at a 25-year low, he said.

Most of the projects being sanctioned now are small-to-medium size, such as the Otis field in the deepwater GOM. Otis is part of the Delta House project in the Mississippi Canyon Block 79. The field, discovered last October, is to be developed as a subsea tieback to LLOG Exploration Offshore LLC’s Delta House platform. Delta House came onstream in April, producing from the Son of Bluto II and Marmalard fields. Otis has an estimated 8 million boe of reserves, with production expected to plateau at 13,000 boe/d.

Subsea facility installation was awarded to McDermott International Inc., which plans to install a 75,000-foot insulated rigid flowline and insulated steel catenary riser with associated pipeline end terminations. Offshore installation is set to be completed early next year.

The market for ancillary work, including for offshore support vessels (OSV), overall doesn’t look too promising at this point, according to Tudor, Pickering, Holt & Co.’s (TPH) George O’Leary and Jeff Tillery.

“Offshore rigs actively engaged in drilling/completing wells drive demand for OSVs, and we believe offshore rig demand continues to move lower through the beginning of 2016 on the floater side, which is what the majority of newbuild OSVs are being built to service,” said the duo. “We believe global floater demand troughs early next year but negligible incremental demand likely results in lower deepwater rig count in 2015,” down 10% year/year (y/y) and off 6% y/y in 2016 before stabilizing in 2017.

“Where does this leave floater demand? It will sit below 2014 and 2013 levels if our predictions are even close to correct,” the analysts said.

“Another factor to sincerely be concerned about is deepwater drilling efficiencies, which should drive operators to utilize fewer rigs to poke the same or an increasing quantity of holes on the seabed floor. Just to hammer that point home as it relates to the boats, it’s not bueno for OSVs. On the jack-up side, we do believe demand should improve 2016 and 2017, but only somewhere in the low-to-mid single digits ballpark. This will not materially clean up the market as this work tends to be less service/OSV intensive (e.g., less mud used per well drilled). Point being, tough for us to see material demand-side help until later than 2017.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |