Natural Gas Onshore Output Rises Year/Year, But Edging Down in August, EIA Says

U.S. natural gas production is expected to be higher in August from a year ago in six of seven major onshore basins, but output has begun to weaken as associated production slumps from the pullback in oil drilling, according to data compiled by the Energy Information Administration (EIA).

New-well gas and oil production per rig also is rising substantially across the board, according to the Drilling Productivity Report (DPR), which was issued Monday.

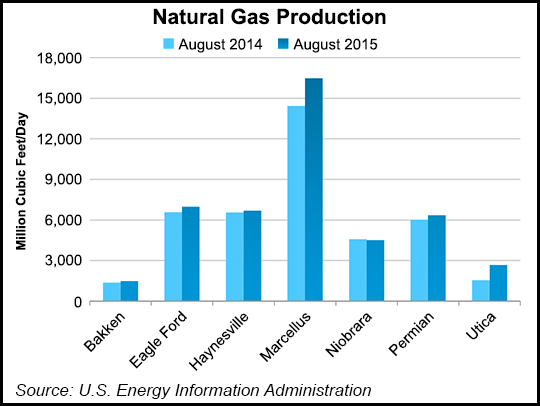

Gas production year/year is led by the Marcellus Shale, with shale gas from the Eagle Ford slightly edging out the Haynesville and the Permian Basin’s tight gas supplies. Gas from the Niobrara formation is about even from a year ago, while Utica Shale gas has nearly doubled. Bakken Shale gas supplies are seen slightly higher year/year.

However, as oil drilling has declined and associated gas with it, EIA is forecasting onshore gas production to fall in August from July by 0.6% (260 MMcf/d) to 45.146 Bcf/d, the biggest decline since March 2014. The declines are led by the Eagle Ford, where data indicate production should decline month/month by 1.7%, or 122 MMcf/d, to 6.971 Bcf/d in August. Only in the Utica is gas expected to continue to increase, with output up 0.8%, or 22 MMcf/d, to 2.664 Bcf/d.

The Marcellus, where gas production has moving at a blistering pace, should see a decline from July to August of 41 MMcf/d to 16.487 Bcf/d, EIA said. Haynesville gas output is forecast to fall by 29 MMcf/d to 6,688 MMcf/d, while in the Permian, the production decline is forecast at 14 MMcf/d to 6,351 MMcf/d.

The Niobrara’s gas production also is seen declining from July to August by 51 MMcf/d to 4.507 Bcf/d, while Bakken gas output should fall 24 MMcf/d to 1.478 Bcf/d.

Marketed gas production now is set to expand at a slower rate this year, EIA reported, up 5.7% to a record 78.97 Bcf/d, versus a 6.2% increase in 2014.

Overall, U.S. oil output is set to be down from July to August by 91,000 b/d to 5.357 million b/d, the DPR noted. However, some basins will see gains.

U.S. oil production in the Permian is seen up by 5,000 b/d in August from July to 2.05 million b/d, according to the DPR. Marcellus oil output also should rise month/month by 1,000 b/d to 72,000 b/d. In the Haynesville and the Utica, oil output is seen remaining flat month/month, with Haynesville oil output at 59,000 b/d and Utica production of 65,000 b/d.

However, oil production is set to decline from July to August in the Eagle Ford by 55,000 b/d to 1.538 million b/d, EIA estimated. In the Bakken, oil output is seen falling by 22,000 b/d to 1.182 million b/d, while in the Niobrara, production should decline by 20,000 b/d to 395 b/d.

The DPR uses recent data on the total number of drilling rigs in operation with estimates of drilling productivity and estimated changes in production from existing wells to provide estimated changes in production for the seven key regions. The seven regions accounted for 95% of domestic oil production growth and all domestic gas production growth during 2011-2013. The data, EIA noted, does not distinguish between oil-directed rigs and gas-directed rigs because once a well is completed it may produce both oil and gas; more than half of the wells produce both.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |