MarkWest Energy Agrees to $15.8 Billion Merger with Marathon Petroleum Affiliate

Marathon Petroleum Corp.’s (MPC) midstream master limited partnership, MPLX LP, has agreed to acquire MarkWest Energy Partners LP for roughly $15.8 billion in a deal that could double MarkWest’s growth profile over the next five years.

The merger, which is subject to approval by MarkWest unitholders, regulators and other closing conditions, would tie up the nation’s fourth-largest crude oil refiner and one of the Appalachian Basin’s largest natural gas processors. MPLX said the deal would create the fourth-largest MLP in the country based on a market capitalization of $21 billion. It is one of the largest deals announced since the slide in oil and natural gas prices last summer.

“MPC’s strong balance sheet and liquidity position will enable MarkWest to accelerate organic growth in some of the nation’s most economic and prolific natural gas resource plays that it may have been limited in pursuing otherwise,” said MPLX and MPC CEO Gary Heminger. “…This combination creates a unique new competitor in the midstream sector.”

The merger would mostly be a tax-free, unit-for-unit transaction that values MarkWest at $20 billion, including $4.2 billion in debt that MLPX would assume. MarkWest common unitholders would receive $78.64/unit — a 32% premium to Friday’s closing price on the New York Stock Exchange (NYSE). MPC would also contribute a one-time cash payment of $675 million to help fund the acquisition. It is expected to close in the fourth quarter.

The deal would provide MPC with further vertical integration and a direct supply of natural gas liquids (NGL) for its refining business, one source close to the deal said. It’s also attractive for producers in the Northeast, too as NGLs have declined on the spot market with demand in the region met.

“MarkWest as a marketer has all those products,” the source said. “There’s a lot of NGLs in the Northeast that are owned by marketers trying to get better realized prices for producers. If you continue to be in an environment where propane is selling for 80 cents, that ultimately creates a constraint on wet gas drilling in the Marcellus and Utica. By combining with Marathon, they allow producers to support drilling down to a lower price deck, which supports [MarkWest’s] volumes and economics.”

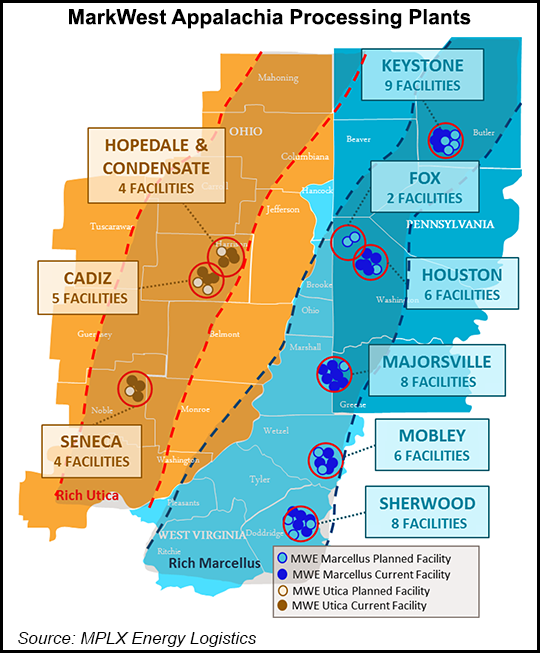

Findlay, OH-based MPC, which has a crude oil refining capacity of 1.7 million b/d and sells its gasoline at more than 5,000 independent gasoline stations in 19 states, created MPLX in 2012 to operate and acquire crude oil and refined products pipelines and other assets. MarkWest has already set forth a $1.5 billion annual capital investment program over the next five years and operates cryogenic processing, fractionation and other midstream assets in Ohio, West Virginia, Pennsylvania, Kentucky, Texas and Oklahoma.

MarkWest is the nation’s second-largest natural gas processor and fourth-largest fractionator. Its largest position is in the Marcellus and Utica shales, where it operates 34 processing facilities and has another 18 under construction. It’s also the largest sub-investment grade MLP in the U.S.

A merger with MPC is a “category changing event” that allows the company better flexibility with a lower cost of capital. MLPX has an investment-grade profile and combined with MPC’s ability to incubate growth projects through significant drop-down capabilities, MarkWest would no longer “be losing money, they could keep up,” the source said.

Both companies had been partnering on several projects in the Northeast. MarkWest has had other suitors in the past, but the idea of a merger with MPC was floated in March, with serious discussions getting under way in April, those close to the deal said.

“We have been business partners with MarkWest for many years,” Heminger said during a conference call with financial analysts on Monday. “As our teams continued to work more closely on a wide variety of projects in the Utica and Marcellus, it became evident that our companies have a strong confluence of desires and capabilities and some very natural synergies.”

MarkWest’s footprint in the Northeast overlays MPC’s operations, Heminger said. Its business also ties into MPC’s recent work to develop solutions to move NGLs and refined products to the East Coast for fuels blending and exports.

“The volume of NGL production in the Utica/Marcellus is expected to increase significantly over the next decade, creating an opportunity to convert NGLs to higher value blending components,” Heminger said.

Semple added that strong cash flow at MLPX and dropdown capabilities from MPC would allow the combined entity to grow at a 25% compound annual rate through 2017.

Semple would become executive vice chairman of MPLX and the company’s remaining executives would join MPLX and continue to work from the company’s headquarters in Denver, CO.

MarkWest’s Class B Units are held by an affiliate of the private equity firm The Energy & Minerals Group (EMG). If the merger is completed, EMG would become the second-largest equity holder in MPC.

MarkWest units gained more than 13% on Monday from their previous close to finish at $68.01, while MPC shares jumped more than 7% to close at $58.78 on NYSE. MPLX, however, fell about 15% to $59.03/unit.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |