North Dakota Production Rebounds as Prices Dive

North Dakota energy officials on Friday reported rebounding oil and natural gas production in the midst of declining prices. In May, gas production set an all-time mark, averaging 1.62 Bcf/d, according to the Department of Mineral Resources (DMR).

Another new all-time high was set for producing wells in May, hitting 12,659, and DMR Director Lynn Helms reported that 77% of the producing wells now are located in the unconventional Bakken Shale play. At the same time, efficiency gains and well cost reductions are reaching new levels.

May oil production was 37.2 million bbl (1.22 million b/d on a preliminary basis), compared to 35 million bbl (1.16 million b/d) in April. Gas production in May hit 50.3 Bcf (1.62 Bcf/d), compared with 45.8 Bcf (1.52 Bcf/d) in April.

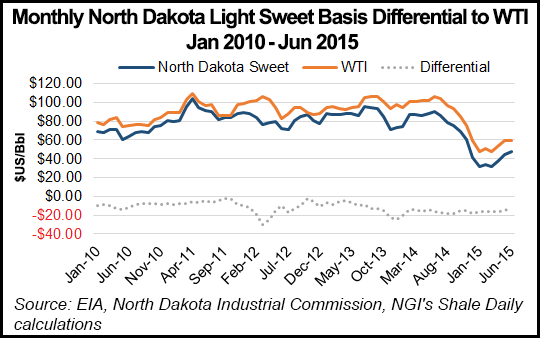

While fearing another oil price correction downward for a “second dip” (Bakken sweet crude rose to nearly $48/bbl in June but was under $41/bbl Friday), Helms expressed surprise at the May production increases and even more amazement at what he called the doubling of rig efficiency in two years, 25% increases in initial well production, well costs dropping to $1 million/well, and gas capture hitting nearly 83%, even with a 5.5% gas production increase.

The overall rig count has dropped to 73, its lowest level in six years, Helms said, following a drop from 91 in April to 78 last month. “The capability of these 73 rigs is pretty astounding in terms of just how good they have gotten and what they do,” he said. “They are drilling wells in batches of six to eight at a time, and that helps with the rig efficiency.”

The reality of rig counts plunging from 197 to 73 in less than a year is that nearly 15,000 jobs have been lost, and a portion will never come back because Helms thinks it is unlikely with all the efficiency gains that the number of rigs will get back to the 190 level again.

Even with the 67% rig count drop, there has only been a 48% drop in permit applications, Helms said, adding that this is a sign that “companies are still really optimistic about Bakken drilling; it is just a matter of when, not if.”

He said companies are positioning themselves for future price increases, which is categorized as a sustainable $65/bbl price, and that could drop to the $60/bbl level with continued drilling efficiencies.

“It seems that at $65, the fracking crews will begin coming out again, and at $70, the drilling rigs will go back to work,” said Helms, noting that there were 114 wells completed in May, a slight increase. Generally, he predicts that 110 to 120 wells/month will need to be completed to sustain the current 1.2 million b/d oil production.

“I anticipate we will exit 2015 pretty much where we are now in terms of production, and maybe even a little bit higher with the number of wells that need to be completed in December [to avoid state-imposed penalties],” Helms said.

“The strategy for producers appears to be that as long as we’re stuck in a $55-60/bbl mindset, they will just sustain production and cash flow with as few a number of rigs as possible.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |