Low Loads, Mild Temps, Westbound NatGas Swamp California Points; Futures Add 4 Cents

Spot gas prices for Friday delivery lost ground across a broad front in Thursday’s trading as weather systems across the country were dominated by a stationary cool front, creating showers and thunderstorms rather than any episodes of heat and humidity likely to prompt much in the way of cooling load.

Losses of a few pennies were common from the East to the Midwest, but the day’s greatest declines were saved for the West, where prices slumped 10 cents to near 20 cents. Overall the market fell 5 cents to $2.38.

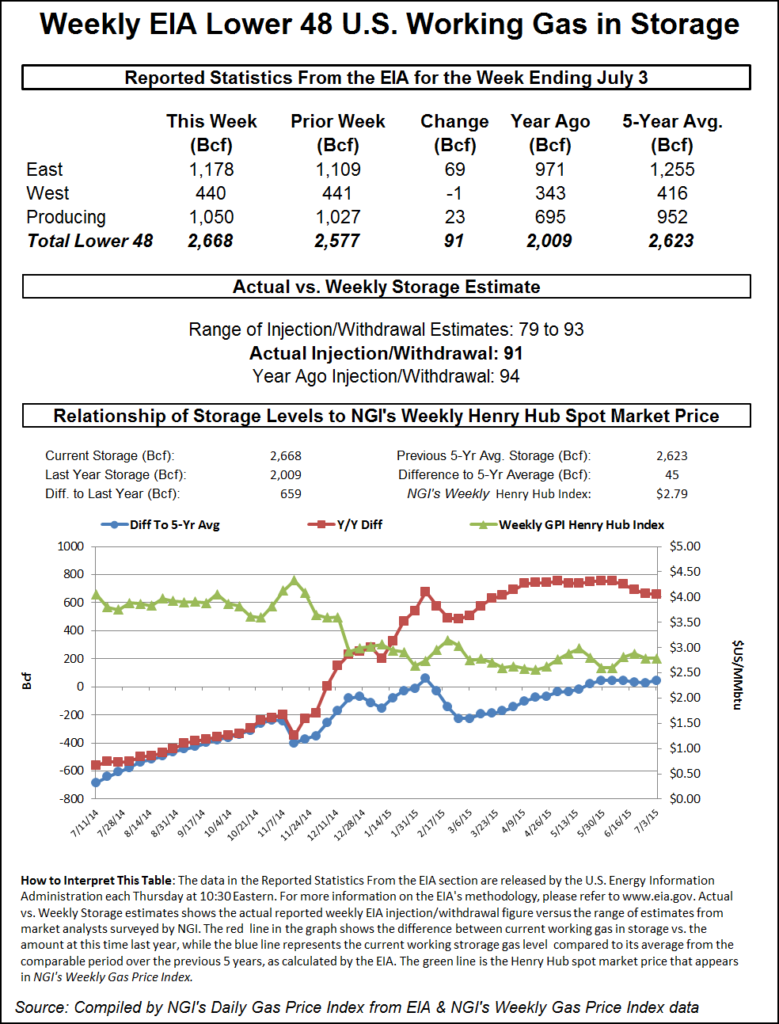

Futures bears were treated to an outsized storage report well above expectations, but price results were counterintuitive. The Energy Information Administration (EIA) in its Thursday morning storage report said inventories increased by 91 Bcf for the week ended July 3, greater than what the market expected by about 5 Bcf. Prices initially eased, but at the closing bell August had gained 4.1 cents to $2.726 and September was higher by 4.1 cents as well to $2.738. August crude oil rebounded $1.13 to $52.78/bbl.

The day’s greatest declines were seen on the West Coast where traders cited low power loads, moderating weather and less movement of gas eastward out of traditional Rockies basins and now trying to find a home in California markets.

Gas at Malin fell 12 cents to $2.50, and deliveries to PG&E Citygate shed 7 cents to $3.04. Gas at the SoCal Border traded a dime less than the Henry Hub at $2.59, down 18 cents, and SoCal Citygate quotes tumbled 14 cents to $2.82. Parcels on El Paso S Mainline changed hands 17 cents lower at $2.61.

“California is at a pretty low load level right now. Burbank is only 73 degrees,” said Jeff Richter, principal at Energy GPS, a Pacific Northwest consulting and risk management firm. “The CAISO peak has been at 32,000 MW, pretty low the last couple of days, and this weekend the Pacific Northwest cools off so there will be a lot more imports.

“We’re under the Henry Hub and I think this is where we will stay. It’s a pretty powerful thing when Rockies gas needs to find a home and when renewable energy comes into play when load is not there. Once REX (Rockies Express Pipeline) starts backhauling more come Aug. 1, and you get more pressure from the Tetco expansion hitting, there will be this swath of molecules, and California is the last resort.”

Temperatures in Southern California are seen struggling to make seasonal norms. AccuWeather.com said Thursday’s high of 74 degrees in Los Angeles was expected to hold Friday and reach 78 on Saturday. The normal high in Los Angeles is 83. San Francisco’s Thursday high of 66 was seen rising to 68 Friday before reaching 69 on Saturday. The seasonal high in San Francisco is 67.

CAISO reported Wednesday’s peak load at a thin 32,627 MW; Thursday’s peak load was estimated at 30,949 MW and Friday’s peak was forecast at 31,052 MW.

Prices softened at major market hubs. Gas at the Henry Hub was quoted at $2.69, down 2 cents, and deliveries to the Chicago Citygate shed a nickel to $2.67. Gas at Opal gave up 9 cents to $2.47.

August futures fell to a low of $2.644 after EIA’s 10:30 a.m. EDT storage data number was released and by 10:45 a.m. August was trading at $2.659, down 2.6 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase in the mid-80 Bcf range. Bentek Energy’s flow model calculated a build of 88 Bcf, and IAF Advisors was counting on a 84 Bcf increase. A Reuters poll of 23 traders and analysts showed an average 86 Bcf with a range of a 79 Bcf to a 93 Bcf injection.

Traders were unimpressed with the move lower. “There’s not a lot of conviction in the market’s move. It’s just drifting within its [established] trading range,” said a New York floor trader.

When queried whether Thursday’s apparent lack of downside follow through to an otherwise bearish number offered a buying opportunity, the trader said, “I think a little lower from here. The upper $2.50s to lower $2.60s. The problem is there is nothing fundamental on the horizon to change people’s opinions.”

Tim Evans of Citi Futures Perspective saw the “91 Bcf build for last week was above the consensus estimate and also more than the 76 Bcf five-year average refill, and so moderately bearish in terms of its immediate price impact. This will be a test for the market, but we still expect prices to hold above the June and April lows, which may set up an eventual intermediate-term price recovery.”

Inventories now stand at 2,668 Bcf and are 658 Bcf greater than last year and 45 Bcf more than the five-year average. In the East Region 69 Bcf was injected, and the West Region saw inventories decline by 1 Bcf. Stocks in the Producing Region rose by 23 Bcf.

Longer-term analysis suggests, however, that demand will have to increase substantially to rebalance the market. In a Thursday morning report RBN Energy said, “With about 127 days between June 26 and the end of the theoretical injection season on Oct. 31, gas demand would need to continue exceeding 2014 demand by 5 Bcf/d or more for the entire period to drop inventories back down to last year’s level.

“But while the hottest months are still ahead, air conditioning use is likely to decline during the fall ‘shoulder’ months. That could bloat storage injections again and leave a surplus going into the gas winter season at the end of October, especially if there are no further production slowdowns.”

Despite recent weakness, long-term market technicians are undeterred in their longer-term bullish outlook. Analysts at United ICAP cite numerous wave count and retracement support levels. “Given the widespread support, our strategy remains unchanged, we prefer to be scale-down buyers (in Q4 2015 and Q1 2016 only) with a protective sell stop beneath $2.406,” said Brian LaRose, a market technician with the firm.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |