NatGas Cash, Futures Trudge Lower Ahead of EIA Storage Report

Physical natural gas prices for Thursday delivery waffled on Wednesday within a couple of pennies of unchanged for the most part. Modest gains in the Midwest, Midcontinent, and California were unable to offset weak postings in the Northeast and Appalachian Basin.

Overall, NGI’s National Spot Gas Average fell 2 cents to $2.43. Many market points failed to show temperature readings equal to their historical norms, and next-day power weakened as well. The New York Stock Exchange was down for three and a half hours because of what was termed a computer malfunction, but futures trading was unaffected. Natural gas futures trading was as soft as the physical market as traders looked ahead to what is expected to be another plump storage build ahead of long-term averages.

At the close, the August contract had fallen 3.1 cents to $2.685, and September was off 2.9 cents to $2.697. August crude oil shed 68 cents to $51.67/bbl.

Next-day quotes in the Midwest managed modest gains in spite of temperature forecasts hovering well below average. Wunderground.com forecast that Wednesday’s high in Chicago of 67 would make it to 73 Thursday and 78 on Friday. The normal high in early July is 85. Detroit’s high on Wednesday of 67 was expected to climb to 75 Thursday and to 80 on Friday. The seasonal high is 85.

Next-day gas on Alliance added a penny to $2.73, and deliveries to the Chicago Citygate gained 2 cents to $2.72. Gas on Consumers and Michcon both rose by 2 cents to $2.79 and $2.78, respectively, and parcels at Demarcation changed hands 4 cents higher at $2.69.

Eastern points slumped by as much as a dime as a moderate temperature outlook and weak next-day peak power kept buyers on the bench. Wunderground.com predicted that Boston’s high of 87 Wednesday would drop to 71 Thursday before rebounding to 82 Friday. The normal high in Boston is 81. New York City’s 87 high was forecast to fall to 82 Thursday and then climb to 86 Friday, near the normal high in early July is 84.

Next-day packages on Millennium fell 10 cents to $1.05, and gas on Tennessee Zone 4 Marcellus shed 8 cents to 98 cents. Gas on Transco Leidy was quoted 7 cents lower at $1.05, and parcels on Dominion South fell 11 cents to $1.06.

Intercontinental Exchange reported that next-day peak power at the ISO New England’s Massachusetts Hub plunged $8.48 to $23.75/MWh. Peak power at the PJM West Hub gave up $2.37 to $35.76/MWh.

At other eastern points, pipeline reductions in capacity on Algonquin Pipeline were not enough to prompt a price response. According to a Genscape Inc. report, maintenance scheduled for Thursday will reduce capacity through the Cromwell compressor to 900 MMcf/d from its normal 980 MMcf/d.

“Flows through Cromwell during the past 14 days have averaged just 840 MMcf/d but have peaked as high as 960 MMcf/d. A similar capacity reduction at the end of June did not appear to disrupt flows, though it coincided with low market demand due to below-normal temperatures and a weekend.”

Gas at the Algonquin Citygate shed 11 cents to $1.35, and deliveries to Iroquois Waddington eased a penny to $2.83.

Futures traders thought that about an 85 Bcf storage injection was already in the market ahead of Thursday’s release of figures by the Energy Information Administration.

“I think what is helping to keep the natural gas down is the weakness in the other markets, even though one is domestic and the petroleum markets are international,” said a New York floor trader. “You will always see a little reflection of that” in natural gas prices.

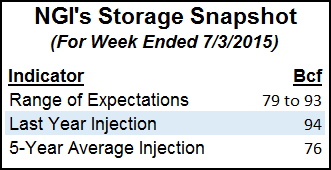

The consensus 85 Bcf lies well ahead of the five-year average of 75 Bcf but behind last year’s 94 Bcf increase. Other estimates include United ICAP at 86 Bcf, IAF Advisors at 84 Bcf, and a Reuters poll of 23 traders and analysts showing an average 86 Bcf with a range of 79 Bcf to 93 Bcf.

Analysts in the near term see the market entering a period of upside potential, but things could get ugly toward the end of the injection season.

“The combination of a return to production above 72 Bcf/d and the relatively mild 15-day weather outlook means that the ledger should see some relative stability over the next couple of weeks,” said Societe Generale analyst Breanne Dougherty in a recent report. “However, given the underlying strength of power loads, there is significantly more risk to tightening than loosening from middle of July through to the end of August. We expect the storage pace to slow consistently relative to last year.

“Our end-of-October storage level continues to tease the 4.1 Tcf mark. This is not only a record level, but a threshold that we think will be critical if breached when it comes to fall and fourth quarter pricing dynamics. While the capacity to inject beyond this level is there, we anticipate some containment pressure-type pricing behavior if the trajectory outside the core summer looks too strong.

“Late in the summer (watch mid-September) the market needs an incentive to inject if storage looks flush. That traditionally materializes as downside front-month pressure,” she said.

Market bears hoping for any great attenuation in cooling requirements may have to bide their time. For the week ended July 11, the National Weather Service (NWS) forecasts above-average cooling requirements in major population centers. New England is expected to endure 61 population-weighted cooling degree days (PWCDD), or 24 more than its average. New York, New Jersey and Pennsylvania are expected to see 65 PWCDD, or 12 above their seasonal norm, and the greater Midwest from Ohio to Wisconsin is forecast to receive 59 PWCDD, or six above its seasonal tally.

MDA Weather Services in its morning six- to 10-day outlook said the models were generating “lower than normal confidence,” but the end result was normal temperatures over a wide section of the country.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |