Energy Transfer Not Taking ‘No’ From Williams

Energy Transfer Equity LP (ETE) is pushing forward with its effort to buy out Williams (WMB) — in spite of turbulent energy markets and the company’s resistance to a deal, ETE said late Tuesday.

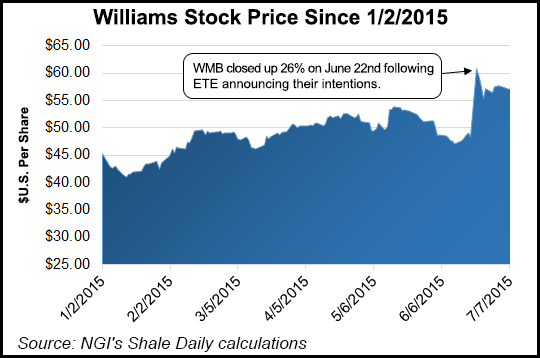

ETE wants to acquire all of the outstanding common shares of Williams at a fixed exchange ratio of 0.9358 ETE Corp. shares for each Williams share, representing a 32.4% premium. Williams has spurned the offer from ETE, which has been pursuing the company for six months (see Daily GPI, June 22). ETE is turning up the pressure.

“Despite comments made by Williams management to research analysts and WMB stockholders, ETE continues to be open to engaging in the strategic alternatives process announced by Williams, but only if it is fair and evenhanded and is not designed to disadvantage ETE (and ultimately WMB shareholders) or unduly restrict ETE’s ability to pursue the proposed transaction,” ETE said.

ETE’s offer is couched as an alternative to the proposed merger of WMB and partnership Williams Partners LP (WPZ) (see Daily GPI, May 13).

To move the offer forward, ETE said it is ready to hand over “confidential information to WMB without material restrictions” so the company’s board “can understand what ETE believes to be the truly unique and compelling investment and return characteristics available to the Williams stockholder from this combination.

“In the event that ETE is unable to participate in the Williams process, ETE remains fully committed to taking the necessary steps to implement the proposed transaction with Williams (including soliciting against the Williams and Williams Partners LP merger).”

Williams said late Tuesday the “board of directors and management team are committed to acting in the best interests of shareholders, and believe a robust, competitive process is the best way to maximize shareholder value.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |