Shell, Asian Partners Seek Canadian ‘Super-Permit’ For LNG Exports

An international liquefied natural gas (LNG) scheme led by Shell has stepped forward as the first candidate for newly available extended Canadian export licenses with a lifespan of 40 years.

The super-permit “would increase the regulatory certainty associated with the project as well as the economic value,” says LNG Canada Development Inc., 50% owned by Shell, 20% by PetroChina Investment Ltd., and 15% each by Mitsubishi Corp. and Korea Gas Corp.

Canada’s pro-industry Conservative federal government enacted the availability of the extended license term as of June. Only the duration — and not the size — of the plan for an export terminal at Kitimat on the northern Pacific coast of British Columbia would change, LNG Canada says in its application for an extended license to the National Energy Board (NEB).

The project already has a permit to load overseas tankers with up to 3.7 Bcf/d for the previous maximum 25 years. Canada has more than enough gas to cover the increased total allowance — 49.7 Tcf, up 51% from 32.9 Tcf — that would result from the 15-year extension, the group says.

Supporting studies by Navigant Consulting Inc. recite astronomical — and still growing — estimates of gas supplies generated by “the shale revolution” of horizontal drilling and hydraulic fracturing across the United States and Canada.

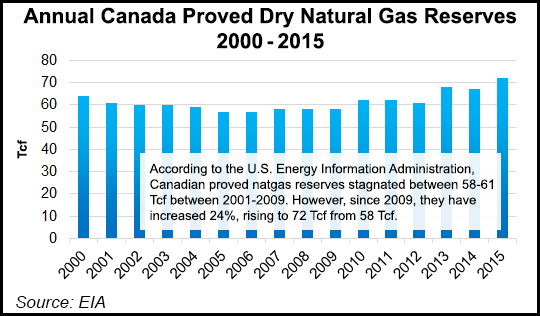

The U.S. Energy Information Administration (EIA) estimates Canada’s proved natural gas reserves at 72 Tcf.

As portrayed by the NEB, the EIA and earth sciences agencies, the “continental market” has enough gas to hold prices down to a reasonable range of US$3.00-$7.00/MMBtu for four decades, says the California consulting firm.

“Even under the most conservative assumptions, where all approved and applied-for Canadian LNG projects totaling over 45 Bcf/d are assumed to go forward and current net pipeline exports [to the U.S.] of 4.9 Bcf/d are also added to the Canadian demand total, the Canadian natural gas resource would still have a life of over 60 years,” says the application for an extended overseas sales license.

The Canada LNG group continues to keep its development pace options open in the new filing with the NEB, saying the schedule would be driven by market conditions and the availability of labor and supplies on the northern Pacific coast.

The development plan calls for construction of the proposed Kitimat export terminal in four equal “trains” or stages. “Operations are tentatively scheduled to start in 2021 but Train #1 may start up as early as 2019, with Train #2 following six months later,” says the NEB application.

Options for procuring gas supplies are also being kept open. Northern BC shale fields where the LNG Canada participants own drilling rights are prime targets. But the partners reserve rights to tap “the most efficient options at any given point in time.”

The alternatives include Alberta production or output from other producers’ fields that could be drawn off TransCanada Corp.’s western supply collection network, Nova Gas Transmission Ltd. (NGTL).

LNG Canada is the anchor customer for a jumbo TransCanada project: Coastal GasLink Pipeline, a 670-kilometer (400-mile) conduit of 48-inch diameter pipe capable of delivering two to three Bcf/d initially and much more in future across BC to Kitimat from inland connections with NGTL and other supply sources.

Total costs of the mammoth LNG Canada scheme, including terminal and pipeline construction plus shale supply development by the partners, have been estimated at C$40 billion (US$32 billion).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |