Barclays Seeking Sale of North American NatGas Assets This Month

Barclays Bank plc intends to sell all of its physical natural gas assets in North America and will be accepting bids from potential buyers through July 29, the UK banking giant said in documents filed at FERC.

Barclays has asked the Federal Energy Regulatory Commission to waive for 180 days its capacity release regulations to enable the company “to transfer its various FERC-jurisdictional physical natural gas park and loan transportation or storage service agreements and its firm transportation capacity rights under two asset management agreements,” which Barclays intends to sell, “along with other non-jurisdictional physical natural gas assets, to one or more purchasers in order to effectuate Barclays’ exit from the North American physical natural gas trading business.”

Affected pipelines are Dominion South Pipeline Co., El Paso Natural Gas Co. LLC, ETC Katy Pipeline, Millennium Pipeline Co. LLC, Natural Gas Pipeline Co. of America and Tennessee Gas Pipeline Co. Barclays said it was not requesting a waiver regarding its transportation agreements with Portland Natural Gas Transmission System, which expire Oct. 31.

Barclays intends to sell the assets through a competitive auction process and anticipates closing of any transactions on July 29 with an effective date no later than July 24, according to the filing. The transfer of its physical natural gas portfolio “likely will take several months to complete because of the potential for multiple transactions and multiple purchasers,” Barclays said.

Barclays announced plans to exit the majority of its global commodities business in April 2014, following published reports that it was planning to withdraw from parts of the energy, metals and agricultural commodities markets due to slumping revenues and increased regulatory scrutiny (see Daily GPI, April 23, 2014). Six months later, Barclays sold its electricity trading book to Macquarie.

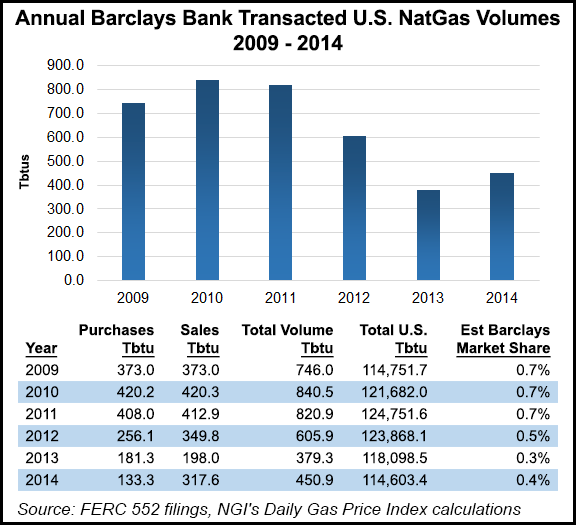

The total volume of Barclays’ U.S. natural gas transactions, which peaked at 840.5 TBtu in 2010, was down to 450.9 TBtu last year, according to an analysis by Natural Gas Intelligence (NGI) of Form 552 buyer and seller filings with FERC (see Daily GPI, May 28). The bank’s market share was 0.4% in 2014, down from 0.7% in 2009-2011. Barclays was No. 43 in combined purchase and sales volumes in 2012; No. 51 in 2012, and no longer ranked by 2013 (see Daily GPI, June 6, 2014; June 4, 2013).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |