In Midyear Review, U.S. E&P Spending Still Seen Down 30% From 2014

U.S. oil and gas exploration and production (E&P) companies have slashed capital spending to control costs, as well as conserve cash flow and liquidity, but it’s unlikely lower spending will translate into lower production this year, a review by Standard & Poor’s Ratings Services (S&P) has found.

For the companies S&P rates, a decline in domestic oil production is unlikely mostly because of the production from wells that came online early this year, said primary credit analyst Thomas A. Watters. He and his team reviewed capital expenditures (capex) and production budgets for 2015 for rated exploration and production (E&P) companies using their midyear spending estimates.

“Following our review, we estimate that overall capital spending for the sector will decline about $72 billion to $167 billion, or 30%, from actual spending of $239 billion in 2014,” Watters said. Investment-grade companies, “BBB-” and above, which represent only about 21% of S&P’s rated E&P entities, account for 78% of the sector’s total budgeted spending for 2015.

“It’s not surprising that the companies in the lower rating categories recorded the largest reductions in capex budgets, with a 45% reduction for ‘BB’ category companies, and a 42% decline in spending for companies rated in the ‘B’ category and below. Lower-rated E&P companies tend to be less diverse and have more limited liquidity, so they’re generally the ones to take more severe actions during industry downturns,” Watters said.

“Moreover, almost all the companies we rate in these categories are concentrated in U.S. shale. Because it tends to be more expensive to drill and extract oil and gas from these plays, companies operating there feel a bigger impact when prices drop than those operating elsewhere or that have more diverse operating portfolios.”

On the other hand, higher-rated producers, including ExxonMobil Corp., rated “AAA,” and Chevron Corp., “AA,” experienced the lowest percentage of capex cuts “because they have healthy geographic diversification and liquidity positions.” Companies rated “A” are expected to cut their capex by an average 33%, and those rated in the “BBB’ category are forecast to reduce their budgets by 35%.

Still, the production gains will be strong, Watters said.

“After reviewing the midyear capital spending guidance from each E&P company we rate, we estimate that production will increase 4% to 6.9 billion boe this year from 6.6 billion boe in 2014,” he said. “We believe that companies rated in the ‘B’ category and below will likely have the largest absolute and percentage production increases, of roughly 81 million bbl and 16%, respectively.”

The uptick in production this year isn’t a new call; many market observers expect the same, Watters noted. “Despite the decline in oil and natural gas prices, companies drilled numerous wells at the end of last year, and rig counts were at record highs before prices collapsed. Many of those wells began producing in the first quarter of this year. We expect production to fall in the second half of the year given the steep declines in capex and the steep decline curves that are characteristics of shale.”

Morningstar.com equity analyst David Meats also issued his insights for the energy sector as the second quarter ended. Bottom line: he also sees no rapid rebound in prices and the pain continuing for E&Ps.

“In the current market environment of high costs and low oil prices, upstream firms face extremely challenged economics where new investment is not value-creative,” Meats wrote. “Such conditions are not sustainable over the long term, however, and we expect the combination of rising oil prices and falling costs to provide significant relief in the coming years.”

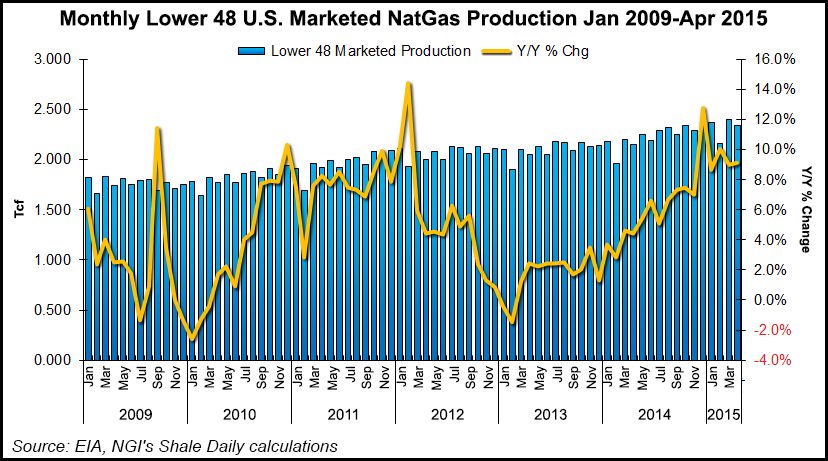

U.S. natural gas production “is likely to slow in the near term as oil-directed drilling hits the brakes,” but “the wealth of low-cost inventory in areas like the Marcellus points to continued growth through the end of this decade and beyond. Abundant supply is holding current prices low, but in the long run we anticipate relief from incremental demand” from liquefied natural gas exports as well as industry. Morningstar.com’s midcycle U.S. natural gas price estimate is $4.00/Mcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |