California Posts July Natural Gas Bidweek Gains Surrounded By Sea of Red

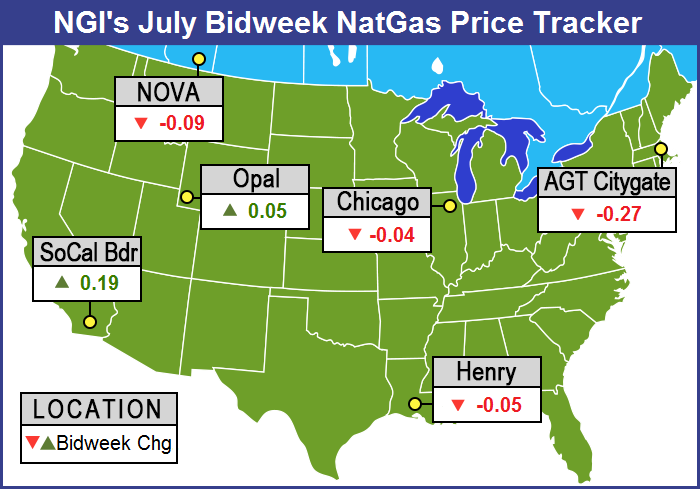

Ample natural gas inventories, strong production and an unimpressive temperature outlook teamed to put downward price pressure on most bidweek locations for July, with a majority of individual points shedding about a nickel from June bidweek values. NGI’s National July Bidweek Average came in at $2.52, down 3 cents from June and a whopping $1.50 discount to July 2014’s $4.02 bidweek average.

Of actively traded points the bidweek location showing the greatest gain was SoCal Citygate with a rise of 21 cents to $3.16, while Transco Zone 6 New York was the greatest U.S. loser dropping 35 cents to $2.12, and Westcoast Station 2 fell 79 cents in Canada to average $1.70.

Thanks to consistent heat and an uptick in electricity demand, California bidweek prices scored the greatest gains, up 16 cents to average $2.99, but regionally all other large territories endured modest declines. The Northeast suffered the worst drubbing, losing 19 cents to average $1.82, as temperatures continued to fluctuate just on either side of “normal” and the Appalachian Basin continued to bolster gas supplies.

The Midwest fell 7 cents to average $2.82, and South Texas was off 5 cents to $2.70. East Texas was down 5 cents to average $2.71 and South Louisiana declined 4 cents to average $2.74. The Rocky Mountains and Midcontinent both came in a penny lower at $2.59 and $2.63, respectively.

The futures market also turned in a lackluster performance for the month, with the July contract expiring at $2.773, down 4.2 cents from the June settlement.

Hefty ongoing power requirements put California bidweek prices squarely in the plus column and lifted the state to the only regional gain. For June 26, the California Independent System Operator (CAISO) recorded peak load of 39,794 MW, but by June 29 peak load was 39,843 MW and on June 30 CAISO peak load reached 41,892 MW. For July 1, CAISO forecast peak load of 42,758 MW.

Great Lakes index buyers were pleased with their purchases. “With a $2.77 market finish and about an 8-cent basis, things are looking pretty good,” said a Michigan buyer. The buyer said they went in “pretty heavy, and we don’t have that much left to buy for July. At this point it doesn’t look as though our daily purchases will be all that much.

“We are hearing that prices could go even lower,” he said.

“We are talking July, so you have to believe temperatures are going to get a little warmer,” said a Houston-based pipeline veteran. “You have to think it’s going to be normal, and I think it’s been a little below normal for June currently. Temperatures will probably correct themselves.

“Generally, bidweek purchases are as light as they get this time of year especially when we are fairly full on storage.”

At the conclusion of bidweek Tuesday, physical gas for Wednesday delivery was mostly lower as benign eastern weather lent a soft touch to the market. A few Northeast points advanced as pipeline restrictions continued, but next-day power forecasts called for moderate increases in load, and next-day peak power rose slightly.

Last Thursday (June 25), the Energy Information Administration (EIA) reported a mildly bullish storage build of 75 Bcf for the week ending June 19. Ahead of the 10:30 a.m. EDT release traders were expecting that some clarity might be shed on production, coal-to-gas switching, power loads, and surging exports to Mexico. If their estimates were correct, this week would be different from previous weeks. Last year 110 Bcf was injected, and the five-year pace stands at 87 Bcf. This week’s numbers were expected to be lower.

Analysts’ estimates came in well shy of the five-year average. IAF Advisors was looking for a 76 Bcf injection, and Citi Futures Perspective checked in with a stout 83 Bcf build. A Reuters survey of 25 traders and analysts revealed an average 77 Bcf with a range of 72 Bcf to 88 Bcf.

Once the number hit trading screens at 10:30 a.m. July futures rose to a high of $2.829.

“Guys were looking for a 76 Bcf to 78 Bcf build, and prices burst higher but are now settling in,” said a New York floor trader once the report was released. He noted that Thursday was also options expiration and for those that had sold $2.75 July calls, they were now sporting a loss of 3.4 cents.

Tim Evans of Citi Futures Perspective said, “The 75 Bcf in net injections was below the median expectation and tends to reinforce the idea of a modest tightening in the background supply-demand balance. Anecdotally, maintenance work may be limiting supply while power sector demand is on the rise with the closure of some coal-fired power plants.”

Inventories now stand at 2,508 Bcf and are 695 Bcf more than last year and 35 Bcf more than the five-year average. In the East Region 53 Bcf was injected and the West Region saw inventories increase by 7 Bcf. Stocks in the Producing Region rose by 15 Bcf.

John Sodergreen, editor of the Energy Metro Desk weekly survey, queried “Is production really dipping? Not even close. Recall that we’ve been burning a bit more gas lately due to coal plant shutdowns, and oh yes, last week was the warmest week of the year.”

Looking ahead at gas demand for the power sector, Genscape Inc. said, June “has seen a large tranche of coal capacity retired from the power market, and the replacement gas burn increase resulting from that has come in almost exactly in line with [their] estimates headed into the summer season. Just over 8 GW of coal nameplate capacity was scheduled for retirement” last month, mostly all in PJM. “Nomination data supplemented with Genscape’s proprietary power market datasets have confirmed most of the scheduled retirements have in fact taken place.”

Genscape added that in its summer outlook it had estimated “weather-normalized incremental gas burn to replace the June retirements would be 338 MMcf/d above last June. This was based on historic utilization rates of those to-be-retired plants and an assumed replacement heat rate on a combined-cycle gas plant of 7.”

Market-wise coal plant replacements may have already made their market impact, and the market may just not have realized it. Genscape’s Rick Margolin, a senior analyst, told NGI, “we are seeing stronger year-over-year power demands even in the absence of extreme heat, but this was anticipated. It’s not just coal plant retirements, and I wonder if people are getting duped by the idea of the retirements. There is a significant amount of nameplate capacity on the coal side that will be retired this summer, but you shouldn’t read too much into that because those units that are slated for retirement have already been scaled back. They were being scaled back in 2014 and the summer of 2013.

“That said, because the replacements have already taken place, we see a structural shift upwards in gas burn per degree the last several summers. We extrapolated that and do expect to see some incremental burn per degree this summer. To us this is what is accounting for the higher power-burn numbers in the absence of extreme heat.

“I wonder if people have been expecting those coal retirements to have a much bigger impact on the market and this has been lending undue support to the market. I think the coal plant retirement card is getting overplayed,” Margolin said.

“When you get three of those markets rallying [crude, heating oil, gasoline], that puts some upward momentum on natural gas. Most of the day we sat around doing nothing,” said a New York floor trader.

Analysts see both bulls and bears becoming frustrated with a market that seems locked in a trading range. “This market could test the patience of both the bulls and the bears for a couple of sessions given near-neutral indications from the temperature factor and lack of significant impetus from the supply side of the equation,” said Jim Ritterbusch of Ritterbusch and Associates in a Tuesday morning note to clients. “Although some warming in weather trends is anticipated next week along much of the eastern seaboard, this factor is being more than offset by cool trends across much of the nation’s Midcontinent.

“As a result, some much above normal supply injections would appear likely across most of the July EIA releases. With the demand side of the equation offering limited impetus, supply side items will likely determine how the market finishes this week. To the extent that Thursday’s reported injection is unlikely to stray far from normal builds, we won’t expect much response as both buyers and sellers will be reluctant to take a sizable position into a holiday weekend that could bring some significant shifts to the temperature forecasts.”

Ritterbusch is maintaining a bearish outlook and said, “we suggest holding any short August holdings. But we will caution against additional shorts until chart support at the 2.73 level is violated.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |