Weekly Natgas Bears Stirring; Futures And Physical Prices Weaken

Ahead of the holiday-shortened July 4 trading week, traders found physical natural gas prices slip-slidin’ away as cash prices could get little help from the screen and weather forecasts proved stubbornly uncooperative.

For the week ending June 26, theNGI Weekly National Spot Gas Average fell 11 cents to $2.53. The market was awash in red ink with only 8 points followed by NGI making it into the black. The good news is that declines were limited to about a nickel to a dime at most points.

The market point showing the week’s greatest gain was FGT Citygate with a rise of 8 cents to $4.00 and gas delivered to New York on Transco Zone 6 took home the dubious distinction of dropping the most with a loss of 44 cents to average $2.45 as temperatures cooled. Regionally California pulled off the week’s only gain with a rise of a penny to average $2.96, and the Northeast endured the week’s greatest setback with a loss of 23 cents to average $1.84.

South Louisiana was down 9 cents at $2.75, and both South Texas and East Texas shed 8 cents to $2.71 and $2.73, respectively.

The Midwest fell 7 cents to $2.79, the Midcontinent was seen 6 cents lower to average $2.65, and Rocky Mountain points skidded a nickel to $2.60.

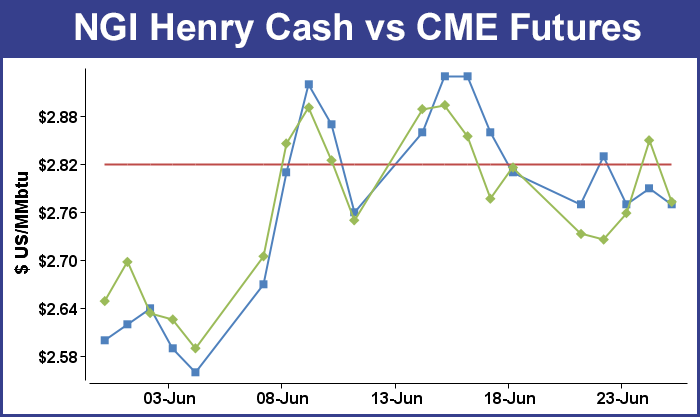

July Futures expired Friday and for the week fell 4.3 cents to $2.773. It could have been a significantly softer week for the July contract had futures bulls not been waiting in the wings Thursday with both barrels loaded once the Energy Information Administration (EIA) reported a mildly bullish storage build of 75 Bcf, about 2 Bcf less than expectations. Futures started on a 9-cent trek higher which saw prices finish at the top end of the day’s range, a short term bullish indicator. At the close Thursday the July contract had risen 9.1 cents to $2.850 and August was up 8.4 cents to $2.866.

Ahead of the 10:30 a.m. EDT release of storage figures on Thursday traders were expecting that some clarity might be shed on production, coal-to-gas switching, power loads, and surging exports to Mexico. If their estimates were correct, the week would be different from previous weeks. Last year 110 Bcf was injected, and the five-year pace stood at 87 Bcf.

Analysts’ estimates were coming in well shy of the five-year average. IAF Advisors was looking for a 76 Bcf injection, and Citi Futures Perspective checked in with a stout 83 Bcf build. A Reuters survey of 25 traders and analysts revealed an average 77 Bcf with a range of 72 Bcf to 88 Bcf.

Once the number hit trading screens at 10:30 a.m. EDT July futures rose to a high of $2.829 and by 10:45 EDT July was trading at $2.784, up 2.5 cents from Wednesday’s settlement.

“Guys were looking for a 76 Bcf to 78 Bcf build, and prices burst higher but are now settling in,” said a New York floor trader once the report was released. He noted that Thursday was also options expiration and for those who had sold $2.75 July calls, they were now sporting a loss of 3.4 cents.

Tim Evans of Citi Futures Perspective said ” The 75 Bcf in net injections was below the median expectation and tends to reinforce the idea of a modest tightening in the background supply/demand balance. Anecdotally, maintenance work may be limiting supply while power sector demand is on the rise with the closure of some coal-fired power plants.”

Inventories now stand at 2,508 Bcf and are 695 Bcf greater than last year and 35 Bcf more than the 5-year average. In the East Region 53 Bcf were injected and the West Region saw inventories increase by 7 Bcf. Stocks in the Producing Region rose by 15 Bcf.

The idea that the closure of coal-fired plants is leading to current increased demand for natural gas is on less than firm footing, according to analysts who dissect the data. Rick Margolin, senior analyst at Genscape in Boulder, CO told NGI that “we are seeing stronger year-over-year power demands even in the absence of extreme heat, but this was anticipated. It’s not just coal plant retirements, and I wonder if people are getting duped by the idea of the retirements. There is a significant amount of nameplate capacity on the coal side that will be retired this summer, but you shouldn’t read too much into that because those units that are slated for retirement have already been scaled back. They were being scaled back in 2014 and the summer of 2013.

“That said, because the replacements have already taken place, we see a structural shift upwards in gas burn per degree the last several summers. We extrapolated that and do expect to see some incremental burn per degree this summer. To us this is what is accounting for the higher power-burn numbers in the absence of extreme heat.

“I wonder if people have been expecting those coal retirements to have a much bigger impact on the market and this has been lending undue support to the market. I think the coal plant retirement card is getting overplayed,” Margolin said.

Friday traders viewing the market landscape for weekend and Monday delivery decided committing to three-day deals could wait and elected to hold off purchases.

Weather forecasts in key Midwest and eastern population centers called for temperatures in many cases to reside below seasonal norms. Losses were widespread, with Northeast and East locations sporting double-digit losses, but declines of a few pennies were common across the market.

Overall, the market for weekend and Monday deliveries fell 7 cents to $2.44. Futures trading was no more inspiring with the July contract limping off the board with a nearly 8-cent loss. At the close, July had dropped 7.7 cents to expire at $2.773 and August was off 9.6 cents to $2.770. August crude oil shed 7 cents to $59.63/bbl.

The outlook for the Midwest was for temperatures well below seasonal norms. AccuWeather.com forecast that Chicago’s high of 67 degrees Friday would increase to 76 by Monday. The normal high in the Windy City is 83. Detroit’s Friday high of 76 was expected to drop to 64 Saturday but rebound to 74 by Monday. The normal late-June high in Detroit is 79.

Gas on Alliance for the three-day period fell 6 cents to $2.72, and deliveries to the Chicago Citygate skidded 6 cents also to $2.73. Gas on Consumers came in at $2.84, down 2 cents, and packages on Michcon were seen at $2.85, down a penny as well. Gas at Demarcation was quoted at $2.65, down 5 cents.

Eastern points followed a similar pattern, with temperature forecasts unable to reach seasonal norms. AccuWeather.com predicted that the high in New York City Friday of 80 degrees would fall to 72 Saturday but recover to 81 Monday. The normal high in New York is 82. Washington, DC, was expected to see its Friday high of 81 ease to 80 Saturday and rise to 84 Monday, three degrees below normal.

Deliveries to New York City on Transco Zone 6 tumbled 87 cents to $1.48, and gas on Tetco M-3 managed a 4-cent gain to $1.28.

Packages at the Algonquin Citygates for the three-day period fell 11 cents to $1.35, and gas on Iroquois Waddington dropped 63 cents to $1.62. Gas on Tennessee Zone 6 200 L changed hands at $1.37, down 12 cents.

Futures traders see a combination of returning production and mild weather leading to a return of triple-digit additions to storage for July. Analysts burrowing into the data, however, see a somewhat more benign pace of storage builds.

“We are not quite into triple digits in our estimates for the out weeks,” Margolin told NGI. “We are expecting more gas to return to the market primarily from conclusion of the Leidy maintenance, and we expect to see full flows on Leidy get back to pre-construction levels sometime by the end of next week, but you will see incremental increases in the meantime.

“We haven’t seen any of the big weather events to drive bullish demand, and we are setting up for 4 Tcf at the end of the year, no question about that. I don’t know why the reality of that hasn’t hit the market, and I haven’t understood why there is such bullish price support.”

In the near term, New York floor traders admitted that the “weather outlook is not focusing traders attention. It’s open window weather.” The shortened trading week coming up was likely to lessen trading interest, and “traders will take a look at conditions Monday and decide which way they want to push the market.”

Other analysts, however, see conditions ripe for the return of triple-digit storage builds and resulting price pressure. “This market is currently relinquishing about half of [Thursday’s] strong gains as negligible support is emanating from updates to the short-term temperature outlooks,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning note to clients.

“Forecasts that we monitor are suggesting mild temperatures with broad coverage with views now extending through about the first third of July. As a result, some triple-digit injections could be seen next month that would resume expansion of the supply surplus following yesterday’s contraction of 11 Bcf against five-year averages.

“We expect this dynamic of an increase in surplus to be accentuated by a long-awaited lift in production following recent maintenance that has covered a wider region and has been extended further than widely anticipated. So unless the temperature views show a shift back to the hot side during the coming weekend, we will look for some renewed selling pressures next week. While our long-term downside possibility of $2.50 may prove out of reach, we do see support violation at about the 2.73 level per the newly prompt August contract.”

Gas buyers for the weekend across the PJM footprint might have had to step up the pace a bit as only modest wind generation was expected. WSI Corp. in its Friday morning report said, “A residual frontal boundary will suppress the best chance of additional rain and thunderstorms across the southern tier of the power pool today. High temps will range in the 70s, 80s to near 90; a vigorous storm system is expected to spin across the power pool tonight into Saturday before it spins up the East Coast by Sunday.

“This late-season storm system will lead to periods of rain and thunderstorms, which may be severe across the lower Mid Atlantic. It will also be breezy and seasonably cool, though temperatures will be highly variable. Weak wind generation is expected during the bulk of [Friday]. However, the expected storm system will likely provide a boost to wind generation during tonight into the weekend with output upward of 2-3 GW. Wind generation will subside from this peak and become variable early next week.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |