Oilfield Services Quarterly Outlook Appears Grim

Houston-based Oil States International Inc. has reduced second quarter guidance for the U.S.-focused well site services segment following a huge fall-off in business, an indication of continued bad news for the North American oilfield services (OFS) sector.

The lower-than-anticipated guidance by Oil States resulted from several factors, management said:

Oil States provides completions services for 60 locations in U.S. onshore basins. Through subsidiary CapStar, it also provides land drilling services in West Texas and the Rockies.

“While we continue to work diligently to address and control our cost structure and spending, we are dealing with a very challenged market,” said CEO Cindy B. Taylor.

Revenues for the well site segment are expected to be $85-90 million in 2Q2015 on margins of 13-14%. In late April, Oil States had pegged well site service revenues to be $110-120 million on margins averaging 19-21%. At that time, for Oil States 22 of 34 land drilling rigs had been stacked.

Oil States isn’t alone in announcing a reduced forecast. Helmerich & Payne Inc. (HP), whose U.S. land drilling segment provides 90% of total operating profits, indicated it too would miss its quarterly projections. In an investor presentation, it said the shortfall is coming because it is not only running a smaller fleet, but it’s receiving less revenue for the rigs — about $500/day — after renegotiating some existing long-term contracts.

Less than a week remains in the second quarter, but the earnings misses aren’t a surprise.

The “magnitude” of Oil States’ volume declines is “emblematic of soft overall second quarter completions activity,” said Tudor, Pickering, Holt & Co. (TPH) analysts on Friday. The outlook also reflects how many exploration and production (E&P) companies have switched to “lower cost product/service substitutions in lieu of otherwise time/efficiency/safer offerings…”

Forecasting for the near-term is difficult. The “more efficient/safer — even more expensive — offerings will ‘win’ as activity recovers,” according to TPH. “We don’t think the longer term margin opportunity for this segment changed dramatically given 2Q2015 results. But the bottom is obviously deeper than we originally thought.”

The game changer in market sentiment “doesn’t come until production declines show up” and there’s “disbelief it will actually occur…”

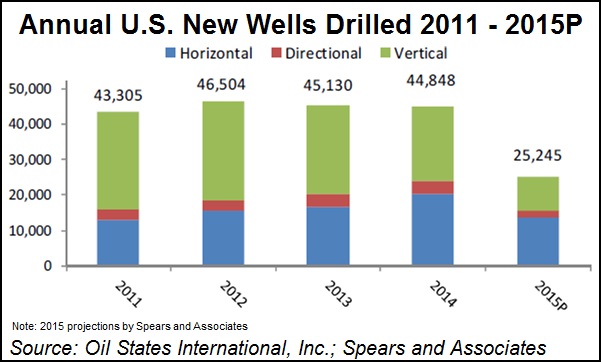

Douglas-Westwood, which covers 20 OFS operators, is estimating a 34% decline in total U.S. spending this year.

“On a basin-by-basin level, the Barnett and the Bakken will be hit hardest,” said Houston-based analyst Jacob Halevy in a recent report. “The Barnett rig count has continued its steep decline from a 2008 peak, now with only four rigs drilling for gas. With the fall in oil price, operators in the Bakken will spend 40% less on services in 2015. The Bakken is one of the more expensive shale plays and the low price environment will lead to fewer wells being completed and intense cost cutting pressure on services companies.

“Conversely, the Marcellus is likely to be hit the least as recently the gas drilling market has not suffered to the same extent as the oil plays.”

Proppant spending is forecast to plunge by 42% from 2014, in part on the pullback in work, as well as the turn to using cheaper sand over ceramic proppants, Halevy said.

“While all drilling and completion-led services will suffer in 2015, those driven more by the active wellstock will suffer less than new drilling activity. Historically, services such as artificial lift and slickline services for example have been less directly correlated to oil price and are less affected by downturns.”

Even though the slump has been dramatic, the “big four” U.S. land drillers — HP Patterson-UTI Energy Inc., Nabors Inc. and Precision Drilling Corp. — are likely to keep building new 1,500 hp alternating current drive rigs over the next 12-plus months even if term contracts aren’t in place, according to TPH.

The bigger names have been able to take away market share from the under capitalized players and better able to stay afloat. In addition, the OFS leaders want to keep the construction continuing “just in case newbuild rig demand surprises to upside in 2016-plus.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |