U.S. Natural Gas, Oil Onshore Royalties Policies ‘Frozen in 1920s,’ Says Group

The royalty rate to drill for natural gas and oil on U.S. lands is half the rate charged by most states’ private landowners and much less than the rate charged to drill in the offshore, causing millions to be lost in revenue, a review by a progressive group has found.

The Center for American Progress (CAP), which labels itself a nonpartisan progressives group, issued the report earlier this month, two months after the Department of Interior’s Bureau of Land Management (BLM) launched an advance notice of rulemaking (ANPR) to consider updating royalty rates, rental payments, lease sale minimum bids, civil penalty caps and financial assurances on federal lands (see Shale Daily, April 17).

“The oil and gas industry and its technologies have grown by leaps and bounds in the past century, but the federal government’s royalty policies are frozen in the 1920s,” said CAP’s Nichole Gentile, who directs the Campaigns for the Public Lands Project. “From a business perspective, the shareholders of America’s public lands — U.S. taxpayers — aren’t receiving a fair share from the development of their resources.”

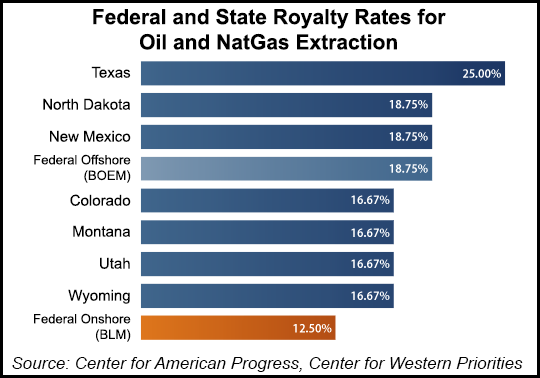

The private gas and oil leases examined by CAP require that a company pay the landowner 25% of the value of the resource extracted. The BLM collects a 12.5% royalty for drilling in national forests and other public lands, while Interior’s Bureau of Ocean Energy Management collects an 18.75% royalty for offshore drilling in the Outer Continental Shelf.

According to the Center for Western Priorities, which issued a separate study this month, if the onshore federal royalty rate were the same as the offshore rate, the U.S. government would collect an additional $730 million every year.

CAP researchers identified other deficiencies in the federal policies. Bonding requirements, insurance to protect taxpayers from the costs of cleaning up abandoned wells, have not been updated in more than 50 years, CAP noted.

“If adjusted for inflation, the bonding requirements would be 800-1,000% higher today,” the report stated. “Further, companies are only required to pay $1.50/acre in rental fees to maintain their right to drill for up to 10 years; this compares unfavorably with the state of Texas, which increases its rental fee to $2,500 per acre in the third year of a lease to incentivize early production.”

Some states have updated their royalty rates, CAP researchers noted. “Texas charges a 25% royalty for leases on the state’s university and school lands — state land set aside to financially support these state institutions — while New Mexico and North Dakota charge 18.75% for oil and gas production on public lands. Many western states, including Wyoming, Utah, Montana, and Colorado, charge a 16.67% royalty rate on state-owned leases.”

Interior Secretary Sally Jewell had said in April that the time had come “to have a candid conversation about whether the American taxpayer is getting the right return for the development of oil and gas resources on public lands.” She noted then that federal rules had not kept pace with technology and market conditions.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |