Weekly Prices Muster Only Nominal Gains Following Record Power Burn

You would never have known that trading for the week ended June 19 followed the earliest point ever in the cooling season when power burn exceeded 31 Bcf/d. Prices made only modest gains and the NGI Average Weekly Spot Natural Gas Price rose a tepid 7 cents to $2.64.

Most points gained between a nickel and a dime, and all regions of the country with the exception of the Northeast posted gains. The Rocky Mountains led the pack with a 9-cent advance to $2.65 and the Northeast endured a modest 2-cent setback to $2.07.

FGT Citygate was the market point with the greatest gain, 77 cents to $3.92, and Tennessee Zone 5 200 L found itself at the bottom of the pile with a 40-cent loss to $1.83.

Regionally, California and the Midcontinent both enjoyed 8-cent gains to $2.95 and $2.71, respectively, and South Louisiana and South Texas came in with 7-cent advances to $2.84 and $2.79, respectively.

East Texas and the Midwest both rose 6 cents to $2.81 and $2.86, respectively.

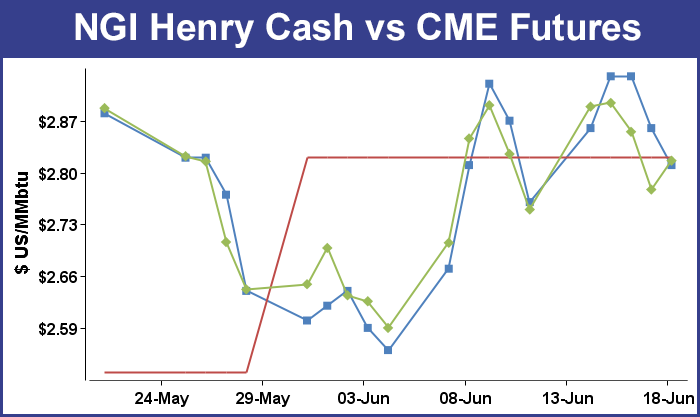

July futures traded in step with the widespread though nominal gains in the physical market. For the week July futures added 6.6 cents to $2.816 and what should have been a positive response to Thursday’s Energy Information Administration (EIA) weekly storage report came off as a dud. The EIA said inventories increased 89 Bcf, somewhat less than what traders were thinking, but prices fell anyway. At the close July had floundered 7.8 cents to $2.777 and August was off 8.4 cents to $2.799.

Traders greeted the release of the data with a thundering yawn. For the week ended June 12, the EIA reported an injection of 89 Bcf in its 10:30 a.m. EDT release. July futures rose to a high of $2.882 after the number was released and by 10:45 a.m. July was trading at $2.834, down a counterintuitive 2.1 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase closer to the 93 Bcf area. Bentek Energy had calculated an 89 Bcf increase, but IAF Advisors was looking for a build of 93 Bcf. A Reuters poll of 25 traders and analysts showed an average 93 Bcf with a range of a 85 Bcf to a 104 Bcf injection.

“It looks like the market doesn’t have much incentive to the upside,” a New York floor trader told NGI. “I think there are a lot of cautious bulls in here and as long as the market holds $2.81, those bulls will remain in the market.’

Tim Evans of Citi Futures Perspective saw the report imparting a bullish tone to the market going forward. “The 89 Bcf in net injections for last week was less than the consensus expectation and only marginally above the 86-Bcf five-year average for the week ended June 12. This implies a somewhat larger jump in summer air-conditioning demand than the week-to-week change in temperatures suggested. This tightening of the background supply/demand balance suggests smaller injections going forward as well.”

Industry consultant Bentek Energy hit the nail on the head and calculated that “Total demand picked up considerably compared to the previous week, gaining more than 3 Bcf/d, which was driven entirely by higher power burn demand. During the week, power burn hit a 2015 high of 31.4 Bcf/d, and this now sets the record for the earliest time of year where power burn has hit above 31 Bcf/d.”

Inventories now stand at 2,433 Bcf and are 730 Bcf greater than last year and 46 Bcf greater than the five-year average. In the East Region 59 Bcf was injected, and the West Region saw inventories increase by 8 Bcf. Stocks in the Producing Region grew by 22 Bcf.

Although the futures market did not initially respond favorably Thursday to the lower than expected 89 Bcf storage build, analysts at Tudor Pickering Holt & Co. said one has “to like the slight beat at 89 Bcf versus 93 Bcf injection expectations. [$2.82] indicates a market very close to balanced, given that weather was a touch mild last week. It’s still early in summer cooling season so no real insight into this year’s gas generation fleet’s full responsiveness to low gas prices, but demand looks to have returned a solid performance this week. Absolute storage levels continue 2%, or 50 Bcf above the norm and recent hotter weather should help bring that down a bit this week for next week’s print.”

Market technicians said Thursday’s post storage report weakness indicated short-term softness, but longer term they are looking to buy the dips.

There’s “still see room for a deeper pull back near term,” said United ICAP’s Brian LaRose, a technical analyst. “However, we are only anticipating a retracement of the move up from $2.556 at this time. As such, we are counting this retreat as corrective and looking for a entry point to buy the dip once again. To force us to reevaluate the downside risk the bears would need to push natural gas beneath the $2.641-2.616 zone.”

In Friday’s trading not only did physical traders balk at committing to three-day weekend purchases, but in key eastern and Mid-Atlantic markets, the load-killing effects of Tropical Storm Bill made any sense of urgency to buy gas diminish further.

Losses were widespread, with only a couple of eastern points trading in positive territory. Overall the market dropped 9 cents to $2.53. Futures were having none of the cash market weakness and managed nominal gains. At the close, July had added 3.9 cents to $2.816 and August was higher by 4.1 cents to $2.840.

Temperatures over the weekend in major markets were forecast to struggle to make it to seasonal norms, as widespread showers and thunderstorms and their cooling effect lessened the likelihood for any substantive temperature-driven power loads.

AccuWeather.com predicted that Boston’s high Friday of 83 degrees would drop to 71 Saturday before climbing to 81 Monday. The normal high in Boston is 78. New York City’s Friday high of 84 was anticipated to give way to 73 on Saturday before reaching 88 on Monday. The normal high in the Big Apple this time of year is 81. New York City was expected to see rain showers Saturday and Sunday. Boston was predicted to endure rain on Sunday. Chicago’s 67 high on Friday was seen rising to 85 Saturday before sliding to 82 Monday, one degree above normal.

Gas for delivery to New York City on Transco Zone 6 added a penny to $2.75, but packages on Tetco M-3 fell 9 cents to $1.41.

Marcellus points were mostly lower. Weekend and Monday packages on Millennium fell 11 cents to $1.22, and deliveries to Transco Leidy skidded 29 cents to $1.16. Gas on Tennessee Zone 4 Marcellus added 4 cents to $1.16, but gas on Dominion South dropped 8 cents to $1.34.

Gas at the Algonquin City gates was quoted 17 cents lower at $1.53, and packages on Iroquois Waddington retreated 12 cents to $2.70. Gas on Tennessee Zone 6 200 L changed hands 15 cents lower at $1.59.

“Areas of heavy rain and thunderstorms will extend from parts of the Midwest to the Northeast, while more searing heat and blazing sunshine are forecast for the South on Father’s Day,” said AccuWeather.com meteorologist Alex Sosnowski. “A combination of Bill and an approaching front will squeeze moisture out of the atmosphere from the central Plains to the Ohio Valley, central Appalachians, mid-Atlantic and New England on Father’s Day.

“An exception to the warmth will be the northern Plains to the upper Great Lakes, where a push of Canadian air will occur. There will be a pocket of showers and storms frpart of North Dakota to northern Minnesota to around Lake Superior.

Prices at major market hubs slipped. Gas at the Chicago Citygate fell 8 cents to $2.74, and parcels at the Henry Hub eased a nickel to $2.81. Gas delivered to El Paso Permian retreated 12 cents to $2.61, and gas at the SoCal Citygate also gave up a dozen to $2.98.

According to forecasts from the National Weather Service (NWS), higher cooling demand is expected. For the week ended June 20 NWS expects New England to see 19 cooling degree days (CDD), or four more than normal. New York, New Jersey, and Pennsylvania are forecast to endure 45 CDD, or 16 more than its usual tally.

The greater Midwest, from Ohio to Wisconsin, should experience 58 CDD, or 22 more than its seasonal norm, and the South Atlantic should see 112 CDD, or a whopping 35 CDD more than normal.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |