Unconventional Rig Count Reverses, Inches Higher

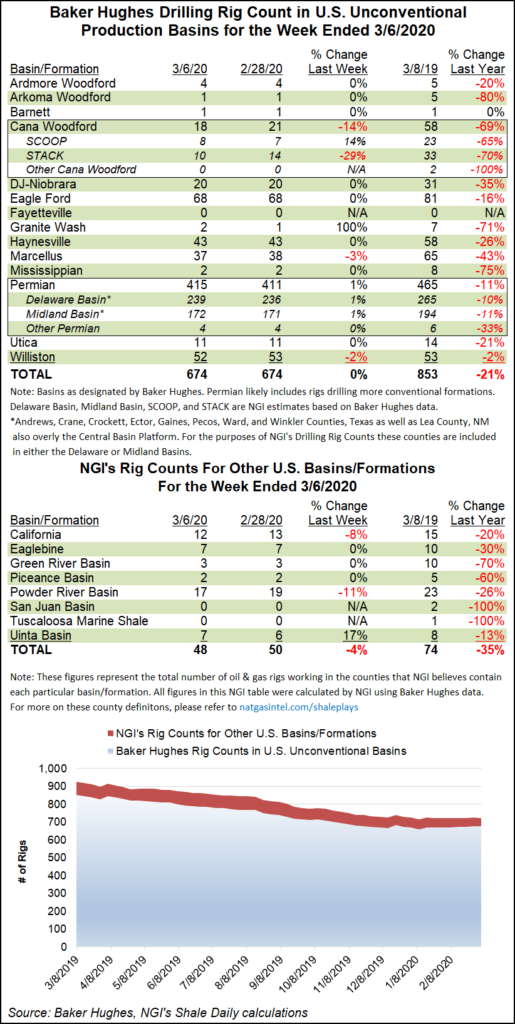

Rig count data for the 14 unconventional oil and natural gas basins tracked by Baker Hughes Inc. showed that rig movement for the week ending June 19 was flat at 650, while NGI‘s assessment of eight additional basins from Baker Hughes data showed a week-over-week increase of four rigs to 60.

While experts say it is far too early to say this is the beginning of a rebound, each additional report will be picked over for signs of whether the downward trend has hit a bottom.

For the week, the Uinta Basin was the only play to add two rigs over the previous week, while the Ardmore Woodford, Arkoma Woodford, Marcellus Shale, Permian Basin, Eaglebine (upper Eagle Ford), Green River Basin, Piceance Basin, Tuscaloosa Marine Shale and Williston Basin all added one rig apiece from the week ending June 12.

There were six plays that lost rigs for the week. The Cana Woodford, Denver Julesburg/Niobrara, Granite Wash, Mississippian Lime and Utica shales, and Green River Basin each dropped one rig.

Much has been made of the cutbacks made by the exploration and production sector due to low oil and natural gas commodity prices. While steep job cuts in the oilfields of Texas and North Dakota have been hard to miss in recent months, the Appalachian Basin has not been immune, but the downturn’s effects have been harder to gauge due to the region’s prolific production and low finding and development costs (see related story).

However, there have also been recent, albeit few, signs of investment and rigs returning to specific plays. Just this week, Clayton Williams Energy Inc. announced it is raising it capital expenditure plans this year and resuming drilling in Texas in the Permian Basin and the Upper Eagle Ford Shale during the third quarter (see Shale Daily, June 18). Energen Corp. also announced this week it is ramping up activity in the Permian during the third quarter.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |