Northeast NatGas Values Ease on Moderating Temps; Futures Lower Ahead of Fresh Storage Data

Physical natural gas prices on Wednesday for gas to be delivered Thursday continued to march higher across the country except in the Northeast, where individual points softened as the heatwave that has been racking the region dissipated into more seasonable temperatures. Over in the futures arena, the July contract traded within a $2.839 to $2.955 range before closing out the regular session at $2.855, down 3.9 cents from Wednesday’s close.

A tropical storm at landfall in Texas, Bill had weakened to a disturbance Wednesday as it moves further north over land, leaving some flooding in Texas cities and tornado warnings in and around Houston. While the storm brought quite a bit of rain, the amount of water looked to be well below most forecaster expectations.

NGI‘s National Spot Gas Average on Wednesday for Thursday delivery moved 2 cents higher to $2.71 as most actively traded points outside of the Northeast tacked on anywhere from a penny to a nickel.

The real story for market watchers was unfolding in the Northeast, where a bit of cooling appeared to go a long way. Transco Zone 6 NY for Thursday delivery declined by 12 cents to average $2.91, while Texas Eastern M-3 Delivery came off 17 cents to average $1.70. Further north, Algonquin Citygate made a modest move in comparison, dropping 3 cents to average $2.04.

Transco also offered another update on its Leidy Southeast Expansion Project outage. As previously announced, the pipeline said that as part of the Leidy Southeast Expansion project, it plans to loop a segment of its pipeline between Station 505 and Princeton Junction (Station 210 pool). “Due to this necessity to make modifications to Transco’s system, and in order to accomplish construction of this pipeline loop in accordance with the authorizations relating to this construction, an existing single line segment of pipeline will be temporarily removed from service during this Operating Condition,” Transco said. The existing pipeline segment is expected to be out of service until next week, possibly June 25.

On Wednesday, Transco-Leidy Line dropped 6 cents to average $1.62.

“After two weeks of some serious heat with temperatures in the 90s, Mother Nature took her foot off of the pedal on Wednesday, which brought much of the Northeast and Mid-Atlantic readings down into the upper 70s to low 80s,” a Northeast trader told NGI. “I think that’s a big reason why we saw most eastern gas prices for Thursday receipt dip a bit on Wednesday. Now, the next question is, when will we see another heatwave arrive?”

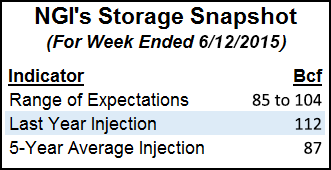

Heatwave or not, traders and analysts on Wednesday afternoon were turning their attention to Thursday morning’s natural gas storage report for the week ending June 12, where many market watchers are expecting a build in the low 90 Bcf area.

A Reuters survey of 25 market experts produced a range of expectations from 85-104 Bcf, with the average expectation coming in at 93 Bcf. A 93 Bcf build would be above the five-year average build for the week of 87 Bcf, but well below the 112 Bcf addition for the same week last year.

Citi Futures’ Tim Evans, who expects the Energy Information Administration to report a 101 Bcf build at 10:30 a.m. EDT on Thursday, noted that natural gas futures were probing the highest level since May 22 as expected storage injections “are running at 94-95 Bcf, a further step down from the 132 Bcf surge from the week ended May 29.” He noted that this is primarily a seasonal trend toward smaller builds as air-conditioning demand picks up, and he noted that the expected build would still exceed the five-year average rate.

“The above-average refill rate suggests that while the data could be considered constructive, it’s not fully bullish,” he said. “As our model projects a somewhat higher 101 Bcf net injection for last week, we see some risk of a bearish surprise for those expecting 95 Bcf or less. In addition, with the current forecast we see storage refills continuing to run at least somewhat above the five-year average rate over the next few weeks.”

Under Evans’ storage scenario, the year-on-five-year average surplus expands at a modest rate from 44 Bcf on June 5 to 74 Bcf as of July 3. “Although not a rapid enough increase to put strong downward fundamental pressure on prices, the rising surplus does confirm that the market is becoming better supplied on a seasonally adjusted basis,” he said. “In the absence of strong guidance from the storage data, we think natural gas prices have some latitude to either test lower levels or move higher if an intermediate-term cycle of short covering takes hold. In general, we expect the downside to prove limited, with the April spot low of $2.443 looking more and more like a price bottom.”

Analysts at NatGasWeather.com said the July futures contract was acting a bit squirrely on Wednesday morning. “July natural gas futures have been quite volatile today, spiking higher 5 cents on the open, and then selling off 10 cents quickly after,” the firm said in an afternoon note. “Fizzling tropical system Bill continues to bring heavy rains and localized flooding to northern Texas and the southern Plains, although rainfall amounts have failed to impress compared to national forecasts hyping 6-12 inches.”

They noted that the system would phase with a cool front associated with a weather system tracking across the Great Lakes and Northeast over the next few days resulting in continued rains across the southern Great Lakes and Ohio Valley. “Due to these weather systems, demand for cooling will be the lightest seen through the rest of the month as high pressure will build strongly in their wake, resulting in temperatures warming into the 90s over all of the southern U.S., with the heat index pushing well over 100 F over the Southeast for much of next week.”

Industry research and analytics firm Genscape Inc. said Wednesday gas demand is finally showing some strength this week with widespread and prolonged warmth.

“While temperatures in most regions are easing in coming days, Genscape’s Meteorologic team’s Lower 48 forecast is predicting weighted CDDs [cooling degree days] will run roughly 30 CDDs above normal by early next week,” the firm said. “California, Desert Southwest, and the Southeast/Mid-Atlantic (SEMA) regions all show the greatest deviations above seasonal norms, while only the Rockies and Pacific Northwest are expected to have temperatures at or below normal. Midwest demand has been running in excess of 8 Bcf/d the past several days, and is forecast to reach season-to-date highs [Thursday] at 10.1 Bcf/d, and remain above 10 Bcf/d into next week. SEMA demand has reached a season-to-date high of 17 Bcf/d. Demand there will ease headed into the weekend, but should rebound to around 15 Bcf/d by Monday.”

Genscape added that a similar trend is expected for Appalachia and New England.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |