Rig Retreat Continues; Shale Production Declines Noted

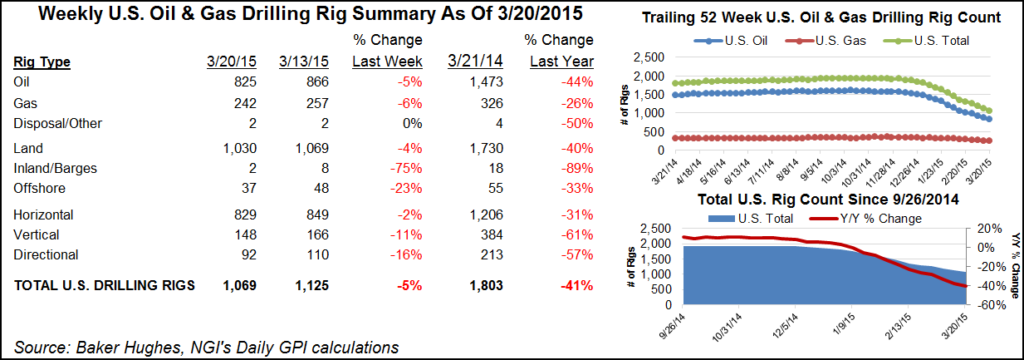

The United States experienced a net decline of nine operating drilling rigs in the latest Baker Hughes Inc. count released Friday (June 12). Land-based, horizontal and oil-directed units led the retreat. Meanwhile, Canada added 11 rigs as drilling season returns to the frozen north.

After losing 12 rigs, the land-based North America count stands at 825 rigs running. One rig was added in the inland waters category for a total of five running, and two rigs were added in the offshore, bringing that count to 29. Seven oil-directed rigs were lost in the United states, and one natural gas-directed rig gave it up, leaving 635 oil- and 221 gas-directed rigs.

Most of the returning rigs in Canada were coming back for oil: nine added for a total of 68. Gas-directed rigs gained two to land at 59. With Canada’s 11 returning rigs, the North American count landed at 986 for the week.

Across the states, declines were spread out, with one rig leaving each of Alaska, Colorado, Kansas, Ohio, Texas, Utah and West Virginia. Louisiana and Oklahoma added one rig each. Across major basins, the Eagle Ford Shale picked up one rig to end at 104, while the Marcellus, Permian and Utica each lost a rig to end at 63, 232 and 23, respectively. The Haynesville held steady at 26 rigs, and the Fayetteville and Barnett didn’t change either, with five and six rigs running, respectively.

In its latest Drilling Productivity Report, the Energy Information Administration said that except for the Utica Shale, natural gas production is seen declining month/month in the other six plays it tracks, down overall by about 221 MMcf/d, or 0.5%, to 45,646 MMcf/d (see Shale Daily,June 9).

In a note to clients BNP Paribas’ Teri Viswanath, director of natural gas commodity strategy, said the news was encouraging. “While associated gas declines in the oilier plays account for nearly all of the monthly losses, the dry gas plays are now no longer offsetting these losses,” she said. “Indeed, both the Marcellus and Haynesville are now, surprisingly, contributing to the production downturn. So while the year-over-year shale production gains at 4.6 Bcf/d are still hefty, the likelihood that producers will not contribute further to the surplus is encouraging.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |