Record Rainfall, Less Drilling Gut Basic Energy’s 2Q Revenue Forecast

Basic Energy Services Inc., which provides well site services in more than 100 service points across Texas, the Midcontinent, Rockies and Appalachia, expects second quarter revenues to drop sequentially by as much as 24%, which it is blaming on stormy weather and continuing declines in the onshore drilling market.

The Fort Worth, TX-based provider reported Friday that its well servicing rig count remained unchanged month/month in May at 421, but drilling rig days dropped from April by 8% and the utilization rate was flat. Drilling rig days totaled 96 in May, producing a rig utilization of 26%, versus 34% in April and 89% in May 2014.

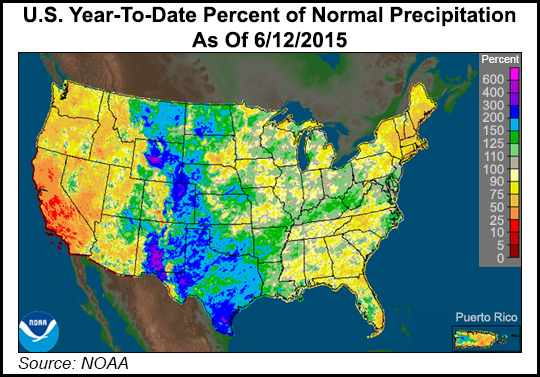

“Our May activity levels, excluding weather interruptions, were generally consistent with what we experienced in April,” CEO Roe Patterson said. “A record amount of rainfall across our primary operating footprints substantially hampered each of our primary service lines during May. We estimate heavy rains reduced well servicing utilization by 500 basis points [bp] and fluid service truck hours by 5%, and also significantly impacted both our stimulation and rental tool service lines. “

As well, the Memorial Day holiday reduced well servicing utilization by 200 bp and fluid service truck hours by 2%.

“Completion-oriented business lines, such as stimulation services, continue to experience fierce competition given the declining drilling rig count,” Patterson said. “However, price concessions are starting to stabilize in most of our operating markets.

“Well servicing and fluid services utilization appears to have reached steady levels with potential for slight improvement as we experience longer daylight hours and anticipate better weather through the summer months. The first part of June has reflected this initial stabilization.”

During the first quarter conference call in April Basic projected second quarter revenues would be 10-15% lower sequentially (see Shale Daily, April 24). It’s going to be well below that forecasted decline.

“With drilling rig count decreases and pricing competition being greater than anticipated, combined with unprecedented adverse weather conditions, we now expect our second quarter revenue to be approximately 22-24% lower sequentially,” Patterson said. About 40% of the revenue projection changes are from the “weather impact that occurred subsequent to our first quarter earnings call.”

Cost cutting measures and right-sizing in each geographic area “have been successful and remain ongoing.”Well servicing rig hours last month totaled 48,200, with a rig utilization rate of 50%, the same as it was in April but down from the year-ago rate of 70%. The fluid service truck count also declined by two from April to 1,006. Fluid service truck hours were 189,900, compared to 190,600 in April and 213,400 a year earlier.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |