Demand, Pipeline Work Spark Unusual Northeastern Natural Gas Price Flip

Seemingly low demand and various pipeline issues in the Northeast have sent daily natural gas prices at the typically premium-priced New England market hub to an unusual discount to its New York counterpart since the beginning of May. But market sources say the traditional pricing relationship between these two hubs could quickly reemerge with a swing in demand or the conclusion of pipeline work.

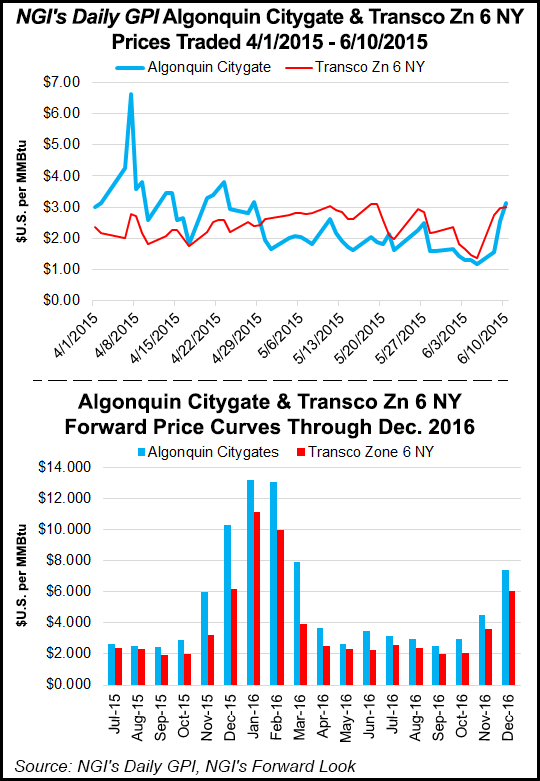

The flip occurred during late spring. Daily gas at the Algonquin Gas Transmission Citygate (AGT) traded below Transco Zone 6-New York prices on April 30, starting a streak that saw AGT falling to as much as a $1.24 discount on May 19, according to NGI historical data.

“A flip is a good way to describe it,” said NGI markets analyst Nathan Harrison. “Going from an Algonquin premium of 8 cents to negative 67 cents in one day certainly stands out. In fact, since April 30 trading, Algonquin Citygate has trailed Transco Zone 6 NY by an average of 64 cents in the daily market. Such trading is not infrequent during winter months, where weather differences and lack of supply can make for huge swings at individual points, but it’s very interesting to see this take place in the middle of the summer strip.”

Algonquin prices continued to come in below New York prices throughout May and on all but two days so far in June, NGI natural gas indexes show.

“It is highly inelastic on both the supply side and the demand side, so if we get a heat wave, a 200 line outage or random compressor work on AGT, it will be strong as heck,” a Northeast trader said of Algonquin prices. “Once demand comes, they will pay quite a bit for it. There’s no real substitute when it’s super hot.”

Indeed, that sentiment rang true on June 10, when Algonquin daily prices jumped 57 cents on the day to move some 12 cents above New York as forecasts called for Thursday’s daytime temperatures in Boston to reach the upper 80s, more than 10 degrees above normal.

Highs in Hartford, CT, were expected to hit the low 90s, about 15 degrees above the seasonal average.

Until this week, however, temperatures and demand in the Northeast have been mostly brushed off by both pipeline operators and market players in the region.

In fact, on most weekends in May and through the first weekend in June, Algonquin operators have issued notices to shippers asking them to keep receipts and deliveries in check because of expected low demand on the system.

But Genscape’s Rick Margolin, senior natural gas analyst, said that despite the pipeline’s warnings of low demand and the generally mild weather in the region, New England set a record for gas demand in May, when it averaged 1,971 MMcf/d. June is also averaging a record 1,937 MMcf/d so far, he said.

“I think the talk about weak demand in New England is a head fake,” Margolin said. The demand is there and fairly sustained, but not quite noticeable for two reasons, he said.

“First, the increase in demand has been gradual and sustained. It’s a product of structural shifts,” Margolin said. “Second, the peak days this summer have been substantially lower than previous summers, so no blowouts.”

Meanwhile, the market is not really constrained, he said, adding that while there have been some maintenance capacity reductions, most have occurred on weekends and getting alternative supply into market hasn’t been much of an issue.

“July is the big power demand month for Algonquin, so it’s possible that’s when we see the traditional pricing relationship restored,” Margolin said.

But aside from another brief heatwave forecast for the fourth week of June, temperatures in the Northeast look to average near or slightly below normal for the remainder of the month and throughout July.

Instead, the trader said Algonquin prices could strengthen once Tallgrass Energy’s Rockies Express Zone 3 East-to-West project comes online, since the cheap supplies currently coming from southwest Pennsylvania will then be rerouted to the Midwest.

“We’ll see a big difference once that comes online,” the trader said.

Tallgrass has said the REX Zone 3 East-to-West project will be completed in the third quarter of this year (see Daily GPI, June 3).

The project is set to provide an additional 1,200 MMcf/d of firm transportation service — which has been fully contracted — and will allow Appalachian gas to reach Midwestern markets via interconnects with NGPL, ANR, Midwestern GT, Panhandle and Trunkline.

Meanwhile, the weakness at Algonquin has been exacerbated by ongoing work on another pipeline in the region, which has helped bolster prices in New York.

Transco in late May began looping a segment of its pipeline between Station 505 and Princeton Junction as part of its Leidy Southeast Expansion Project. The work, which Transco has indicated would conclude around June 19, has restricted flows at various points along the line.

The Leidy Southeast Expansion project involves the construction of about 30 miles of additional pipeline segments in Pennsylvania and New Jersey, as well as the modification of some existing pipeline facilities. It is designed to increase Transco pipeline’s capacity by 525,000 Dth/d.

“The Leidy work is really the key,” another Northeast trader said. “A large chunk of the gas off the Leidy line normally flows to New York, so this really exasperates the problem. You have less cheap gas going to a premium market, so it makes it [Algonquin’s weakness] appear worse.”

The work on the Leidy line is also occurring at a time when gas prices are nearing their seasonal lows, allowing some of the large better-capitalized producers to take some gas off the market, the trader added.

“That’s why we have been unable to make new production highs since before the work began,” the trader said. “Once the work is done, we think things will return to a more normal state.”

The trader cautioned, though, that with a mild summer on tap for the Northeast, the spreads between the two market hubs could be fairly muted.

Meanwhile, NGI’s Forward Look data for June 10 shows Algonquin fixed prices for July at around $2.65/MMBtu, a 25-cent premium over New York prices. Algonquin’s premium for the balance of summer (August-October) sat at 51 cents that day.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |