BP: Shales Lift U.S. to No. 1 Global NatGas, Oil Producer

Even with turbulent and unsettled conditions in the global energy markets last year, the U.S. shale industry scaled new heights, lifting the country to No. 1 among global natural gas and oil producers, BP plc reported Wednesday.

The oil major’s 64th annual Statistical Review of World Energy, one of the most respected energy forecasts by private or public economists, found that the unconventional growth in North America is surpassing all expectations. Chief economist Spencer Dale discussed the findings during a webcast and highlighted events expected to shape the global energy landscape over the next few decades.

In a word, it’s shale — oil and gas.

No. 1 is the continuing “shale revolution” in the United States, Dale said. The revised data in this year’s review suggest that the United States overtook Russia in 2013 to become the world’s largest producer of gas and oil.

“We are truly witnessing a changing of the guard of global energy suppliers,” said Dale. “The implications of the shale revolution for the U.S. are profound. In China, 2014 was the year of the horse. In energy, 2014 was the year of the American eagle, as the U.S. shale industry went from strength to strength.”

At its height in 2014, more than 1,800 rigs were operating in the major U.S. onshore plays, drilling around 40,000 new wells, he noted. Capital spending in the shale industry alone was estimated to have reached around $120 billion in 2014, more than double its value five years earlier.

Even more striking is the increase in productivity, with tight oil production increasing seven-fold since 2007.

“U.S. oil production rose by 1.6 million b/d in 2014, by far the largest growth in the world, and the first time any country has increased its production by more than 1 million b/d for three consecutive years,” Dale noted. “As a result, oil production in 2014 exceeded the previous peak level of U.S. output set in 1970. Peak oil indeed!”

Production outside OPEC grew by 2.1 million b/d, the largest increase in BP’s dataset. The United States recorded the largest growth in the world and has taken the mantle as the No. 1 oil producer. Along with the United States, Canada, with 310,000 b/d, and Brazil with 230,000 b/d, also hit record levels in 2014.

Most significant of all is that the United States topped Saudi Arabia and Russia to become the world’s largest oil producer for the first time since 1975.

The supply side news definitely is all about the U.S. shale, said Group CEO Bob Dudley, who shared the stage with Dale. Replacing Saudi Arabia as the world’s largest oil producer is “a prospect unthinkable a decade ago,” with the country becoming the first ever to increase annual production by at least 1 million b/d for three consecutive years.

“The growth in U.S. shale gas in recent years has been just as startling,” Dudley said.

The production from U.S. unconventional gas plays accounted for almost 80% of the total increase in global gas supplies in 2014, said Dale.

“Over the past 10 years, U.S. shale gas has accounted for roughly half of the increase in global supplies of natural gas.”

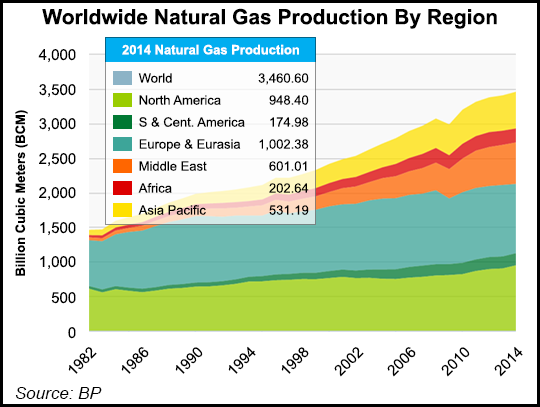

According to BP, total North American gas production in 2014 reached 948.1 billion cubic meters (bcm), a 5.3% increase from 2013. U.S. gas production jumped to 728.3 bcm from 689.1 bcm, 21.4% of the global total. Canada gas output from 2013 climbed nearly 4% to 162 bcm from 156.1, while Mexico’s declined by 0.2% to 58.1 bcm.

North American gas reserves at the end of 2014 were estimated at 429 Tcf, with the United States holding 345 Tcf, or 5.2% of the globe’s gas. Canada had an estimated 71.7 Tcf, with Mexico at around 12.3 Tcf.

U.S. net imports of oil last year were less than half their 2005 peak, all attributed to the onshore surge.

“The U.S. is no longer the world’s largest oil importer; that dubious honor now belongs to China,” Dale said.

In 2007, prior to the financial crisis, the United States was running an account deficit of 5% of gross domestic product (GDP), and U.S. energy imports accounted for almost half of the deficit.

“Just seven years later, in 2014, U.S. energy imports comprised just 1% of GDP, and U.S. production accounted for almost 90% of its energy needs — a level not reached since the mid-80s,” Dale noted.

Overall, BP’s analysis found that the world’s total proved reserves of fossil fuels were unchanged from 2013.

“The big picture remains one of abundant reserves, with new sources of energy being discovered more quickly than they are consumed,” Dale said. “Total proved reserves of oil and gas in 2014 were more than double their level in 1980, when our data begin.”

Oil output, up 0.8%, was the fastest growing fossil fuel for the first time since 1997, elevated by U.S. output. However, oil still lost share within primary energy for the 15th consecutive year.

Worldwide, natural gas and coal, both 0.4% higher, also lost ground, with the share of nonfossil fuels reaching an all-time high of almost 14% with hydro $96.8%), nuclear (4.4%) and renewables (2.5%) increasing.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |