West Coast Rail Crude Oil Shipments Increasing, Says EIA

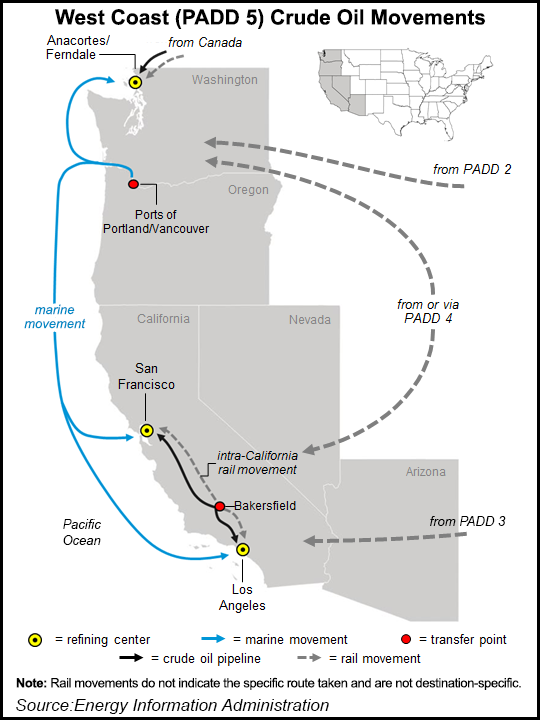

In response to declining in-region production, crude oil shipments by rail to the West Coast have increased during the past five years, the U.S. Energy Information Administration (EIA) said Tuesday.

Shipments of domestic crude by rail to the West Coast increased to an average of 157,000 b/d in 2014 from 23,000 b/d in 2012, EIA stated. In the first quarter, the rail shipments have averaged 191,000 b/d. Others also have noted the increasing shipments this year (see Shale Daily, April 30).

EIA noted that Bakken crude oil from North Dakota is the major source of the West Coast rail shipments, accounting for nearly 90% of the West Coast crude-by-rail receipts last year. EIA noted that “relatively small shipments” from other U.S. regions have also increased to the West.

“Shipments from the Gulf of Mexico coast tripled from 2013 to 2014, and Rocky Mountain shipments quintupled,” according to EIA. “These increases in crude-by-rail movements occurred only after West Coast crude-by-rail unloading infrastructure was significantly expanded.”

While regional oil production dropped by about 100,000 b/d from 2010 through 2014, foreign crude oil imports reached 1.1 million b/d during the past five years. The national statistics showed an increase in U.S. oil production of 3.2 million b/d during the same five-year period.

Logistically, rail shipments of U.S. crude go to unloading terminals at refineries in Washington and to terminals in California, Oregon and Washington. Along the Pacific Coast, compliant vessels and pipelines are then used to transport the domestic crude supplies to refineries without rail unloading facilities.

“In California, regulatory and permitting problems have delayed construction of some crude oil unloading facilities and forced the closure of operations at others,” EIA’s Arup Mallik, a co-author said.

Despite permitting delays, refiners in California get some U.S. crude oil by rail from other regions. California Energy Commission data indicated that the state receives crude by rail from Utah and Wyoming, for example.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |