NatGas Value as Transportation Fuel to Grow, IHS Report Says

The value of natural gas — compressed (CNG) and liquefied (LNG) — as a transportation fuel is likely to grow, displacing future oil demand, according to a study released Wednesday by consultancy IHS Inc.

In “LNG in Transportation: Challenging Oil’s Grip,” IHS researchers conclude that natural gas as a transportation fuel could displace more than 1.5 million b/d of oil demand by 2030. A multi-client study, IHS did not release the report to the general public, but its chief strategist for global gas, Michael Stoppard, presented a summary of its findings at the World Gas Conference (June 1-5) in Paris.

While acknowledging that the global oil price crash has lessened the “overly optimistic” market expectations for natural gas in transportation, Stoppard said that “nonetheless, the shift to greater use of natural gas in trucks is set to continue.”

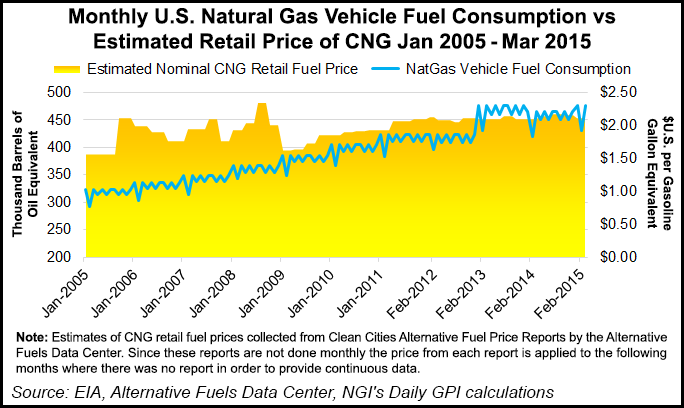

“Even with consistently lower costs of natural gas when compared to gasoline and diesel, NGV consumption has been a relatively small and slow-growing source of demand for natural gas in the United States,” said NGI Markets analyst Nathan Harrison. “While fueling station buildout is continuing, we likely won’t see any significant displacement of crude demand for transportation for quite a while.”

Although it is widely believed that power generation is the primary growth market for natural gas demand, Stoppard said natural gas as a transportation fuel “offers a new market with potentially more value.”

The study cited a combination of drivers for the expected surge in natural gas use in transportation: environmental, technological and commercial considerations. “The highest level of adoption will be in high fuel-consuming applications, such as trucks and ships,” IHS said.

IHS’s report makes the point that worldwide oil consumption in trucks is almost as high as in cars, and it is often more economic for truck fleets to switch to alternative fuel sources, emphasizing that truck fleets have a “relatively quick” turnover that could lead to faster adoption of new technology in that sector.

The IHS forecasts estimated that annual truck natural gas demand globally by 2030 will reach 81 billion cubic meters (Bcm) [2.86 Tcf] collectively for CNG and LNG with an added 17 Bcm (500 Bcf) of LNG coming from ships. LNG demand for trucks and the marine sector is expected to account for 10% of all global LNG traded in 2030.

Regional differences will persist as the study found that “big differences” exist among drivers and outcomes in key regions of the world.

In Canada, a unit of General Electric (GE) and Shell Canada Products are partnering to make it easier for private-sector fleets to switch to LNG trucks, seeking to reduce monthly payments for NGV truck fleets that are leasing NGVs.

The joint venture would provide natural gas fueling contracts from Shell while fleet operators obtain LNG trucks from GE Capital. The initial thrust of the program will be in western Canada where Shell has established LNG fueling stations in both Calgary and Edmonton.

Francois Nantel, head of GE Capital, said the agreement is giving over-the-road trucking “the financial incentive to make the shift from diesel to natural gas. This approach is designed to eliminate the LNG truck re-sale value question that troubles [some fleet] operators.”

Back in the United States, Ryder Systems Inc., a provider of natural gas vehicles (NGV) as part of its effort to use more alternative fueled vehicles in its rental and leasing fleets, inked an agreement to lease three CNG trucks to M&B Products in Florida.

Described by Ryder as a “state-of-the-art, eco-friendly dairy farm,” M&B is getting three Freightliner Cascadia tractor trucks to make five 500-mile roundtrips daily between Tampa and Miami, with maintenance, service and fueling coming from Ryder’s Tampa service facility.

M&B is a participant in Florida’s statewide Natural Gas Fuel Fleet Vehicle Rebate Program from the state Department of Agriculture and Consumer Services.

In New York, the state has another program for doling out up to $3 million from the New York State Energy Research and Development Authority (NYSERDA) for projects that reduce greenhouse gas (GHG) emissions. NYSERDA is looking for applications for awards up to $500,000 in several categories, including “active transportation” and “freight transportation management/logistics.”

In California WorldNGV Technologies, formerly World CNG, was slated to deliver up to 50 dedicated CNG Dodge Promaster vans to Southern California-based Fastech, a petroleum fueling station/convenience store service company. With 3.6-liter CNG engines, the Chrysler platform NGVs are expected to be the first vans from Chrysler certified by the California Air Resources Board.

Elsewhere, WorldNGV is supplying Washington state-based Potelco with a fleet of LNG utility trucks, first-of-a-kind LNG Ford F-550s, and Las Vegas-based MGM Resorts International with a fleet of dedicated CNG stretch Cadillac XTS limousines.

Also in California, Landi Renzo said it is sponsoring an alternative fuels gallery in the Petersen Automotive Museum in Los Angeles, which is undergoing a major renovation and is set to reopen in December. Natural gas will be among the past, present and future examples of alternative fuel technologies that will be on display at the museum.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |