Summer NatGas Supply, Demand to Soar; Prices Will Wilt, NGSA Says

The combined impact of weather, economic growth, customer demand, storage inventories and production activity will put downward pressure on natural gas prices this summer, but both production and demand are likely to set records, according to the Natural Gas Supply Association (NGSA).

“When NGSA weighed all the different factors, the picture that emerged for the upcoming summer is one of remarkable growth, both in supply and in demand,” said NGSA Chairman Bill Green, who also is vice president of downstream marketing for Devon Energy Corp. “Even with record-setting demand expected, production is also projected to set summer records. With more than enough supply to meet demand, we anticipate downward pressure on prices compared to last summer.” NGSA does not forecast actual prices.

“Our expectation for downward price pressure is based on a forecast for record production that exceeds even the record level of demand expected to occur this summer,” NGSA said.

Henry Hub natural gas spot prices averaged $4.19/MMBtu last summer. Henry Hub prices are likely to average $2.93/MMBtu this year and $3.32/MMBtu next year, according to the Energy Information Administration (EIA) (see Daily GPI, May 12).

EIA’s price forecasts have been on a general downward trend for some time (see Daily GPI, March 10; Feb. 10;Jan. 13; Dec. 9, 2014). The Federal Energy Regulatory Commission recently said it expects natural gas to be competitive with coal when prices are adjusted for the relative efficiency of gas- versus coal-fired electric generation units (see Daily GPI, May 14).

Based on data from Energy Ventures Analysis, NGSA said combined demand for natural gas from the electric, industrial, residential and commercial sectors will reach a record high 65 Bcf/d this summer.

“Most notably, the electric sector is forecasted to increase its summer demand by 8% compared to last summer,” NGSA said.

“Much of the increase can be attributed to fuel switching, when utilities temporarily switch to using gas-fired power plants due to lower fuel costs. Some of the increase is attributable to a more permanent shift to natural gas-fired generation caused by the retirement of many coal-fired power plants with the implementation of the Mercury and Air Toxics Standards rule in April 2015.” A total of 126 coal-fired plants are set to be retired, the association said.

While demand from the residential and commercial sectors is expected to be about the same, demand from the industrial sector is expected to increase 4.5% compared with last summer, and 94 major gas-intensive industrial projects have been or will be completed between 2012 and 2020, NGSA said.

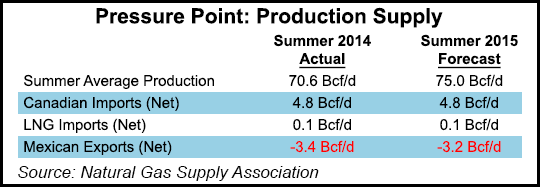

At the same time, NGSA also expects a summer of record natural gas production, an estimated 75 Bcf/d. Net imports from Canada (4.8 Bcf/d) and liquefied natural gas imports (0.1 Bcf/d) are forecast to be the same as last summer. Exports to Mexico (3.2 Bcf/d) are expected to be slightly less than in 2014.

“The shale revolution has ushered in a remarkable era, as evidenced by dramatic growth in production over the last eight years,” Green said. “This summer’s supply is expected to be even more robust than last year because of drilling efficiencies and new infrastructure coming online to move natural gas out of producing shale areas.

“The important takeaway is the strength and responsiveness of natural gas supply. Since the onset of shale production on a large scale, we’ve had year after year of stability for consumers.”

Other factors included in NGSA’s supply and demand calculation are forecasts of a slightly warmer summer this year than in 2014, projected average growth in gross domestic product and larger natural gas inventory compared with last summer.

Natural gas working inventories totaled 2,101 Bcf as of May 22, which was 737 Bcf more than at the same time in 2014 and 18 Bcf lower than the previous five-year (2010-2014) average, according to EIA. EIA has projected that end-of-October inventories will total 3,890 Bcf, which would be 92 Bcf above the five-year average.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |