Fixed Forward Natural Gas Prices Tumble With Nymex Futures; Northeast Leads Pack

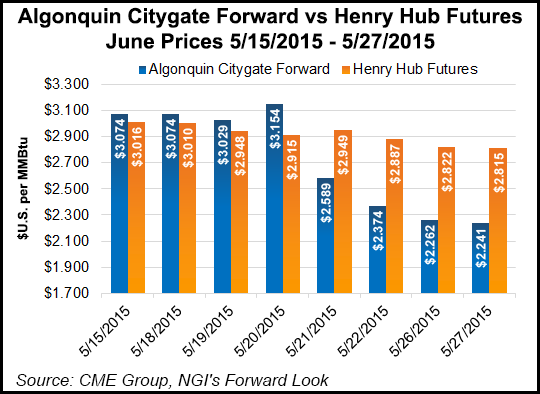

Natural gas fixed forward prices all followed Nymex futures lower this week, but a couple of points posted even sharper declines as mild forecasts and the earlier-than-normal return of nuclear generation added pressure to those markets.

Both New England and New York markets posted comparably sharp declines at the front of the curve during the short holiday week as a weather system forecast for the weekend is expected to keep temperatures on the cool side.

There was no trading on Monday in observance of the Memorial Day holiday.

The largest declines occurred at New England’s Algonquin Gas Transmission Citygates, where July basis dropped 16.7 cents from Friday to Thursday to reach plus 4.4 cents/MMBtu, according to NGI’s Forward Look.

The nosedive for the prompt month followed a 90-cent decline in Algonquin cash prices, which occurred Thursday as part of a broad selloff across the country.

Further out on the curve, Algonquin August basis plunged an even steeper 24.4 cents to minus 27.3 cents/MMBtu, while the balance of summer (August-October) dropped 15.1 cents to minus 19.1 cents/MMBtu.

Fixed prices for those packages were down close to 20 cents on Thursday alone and down as much as 38 cents for the week, NGI price data shows.

At Transco Zone 6-New York, July basis was down 9.8 cents to minus 48.1 cents/MMBtu, and August was down 7.7 cents to minus 60.3 cents/MMBtu. The balance of summer dropped 5.1 cents to minus 69.4 cents/MMBtu.

Fixed prices for those packages were down by between 10 and 20 cents on Thursday and down between 25 and 31 cents for the week, according to NGI data.

The weakness in the Northeast comes as four nuclear power plants were returned to service during the week following scheduled maintenance and refueling, displacing upwards of 250,000 Mcf/d of gas-fueled generation.

Typically, such outages remain in place until late June or early July.

Meanwhile, early indications show temperatures across the Northeast remaining rather mild throughout the next month at least, with daytime temperatures mostly in the 70s and low 80s, according to AccuWeather.

But forecasters with NatGasWeather cautioned it’s important to watch weather developments after June 7, as high pressure will try to hold strong over the northern U.S. to keep a very warm pattern intact.

If it holds strong, bearish weather sentiment will trend to neutral or even potentially slightly bullish as very warm to locally hot temperatures dominate, the weather agency said.

“However, if it gives up ground to weather systems and allows very comfortable spring temperatures to spill back across the northern U.S., bearish weather sentiment will persist,” NatGasWeather said.

Forecasters said the latest suite of data remains quite warm, almost what they would consider relatively hot.

“But do keep in mind, prices have just dropped nearly 45 cents over a short period of time, and the markets will be coming back to increasing demand for cooling,” they said. “If it looks like warmer temperatures could last during the second week of June, it could give reason to support spot and futures prices, especially over Texas and surrounding regions where cooling demand will be getting much stronger.”

Despite the bullish sentiment for Texas, however, forwards prices there — and across the Gulf Coast, for that matter — were down by the double-digits for the week, a direct response to the more than 20-cent drop in Nymex futures.

Houston Ship Channel prices for both July and August are hovering at around a 1.5-cent premium to the Henry Hub, with fixed prices in the low to mid-$2.70s/MMBtu.

Even the premium-priced Florida Zone 3 market has fixed prices sitting comfortably in the low $2.80s/MMBtu for the duration of summer.

It was the same story over in the West, where ongoing mild weather has limited demand in California and pushed fixed prices in the southern part of the state down as much as 20 cents for the week.

At Southern California Gas, prices are hovering in the upper $2.60s/MMBtu to mid-$2.70s/MMBtu throughout the summer, NGI’s Forward Look shows.

According to industry consultant Genscape, May composite weighted-average temperatures are hovering at 60.09 degrees, with May to date demand on SoCal averaging just 2.17 Bcf/d, the lowest since at least 2007.

Comparatively, the previous three-year average temperature stands at 67.30 degrees, and demand averaged 12% higher at 2.49 Bcf/d.

“The California Independent System Operator has also gone through many iterations of extending the Path 15 derate, ostensibly flooding the SoCal market with solar and wind, and possibly knocking out gas-fired generation,” said Genscape’s Rick Margolin, senior natural gas analyst. “The derate is expected to expire on June 2nd, during which temperatures are forecast to stay near current trends. Through the end of next week, gas demand in SoCal should pick up slightly to 2.28 Bcf/d with a slight upside risk.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |