Broad Selling Engulfs NatGas Physical, Futures Markets; July Sheds 14 Cents

It seems as though no corner of either the physical or futures markets was spared from a tsunami of selling Thursday.

In the physical market, trading for Friday through Sunday deliveries saw prices decline at every market point followed by NGI. Double-digit declines were common, and the overall market swooned 15 cents to $2.44.

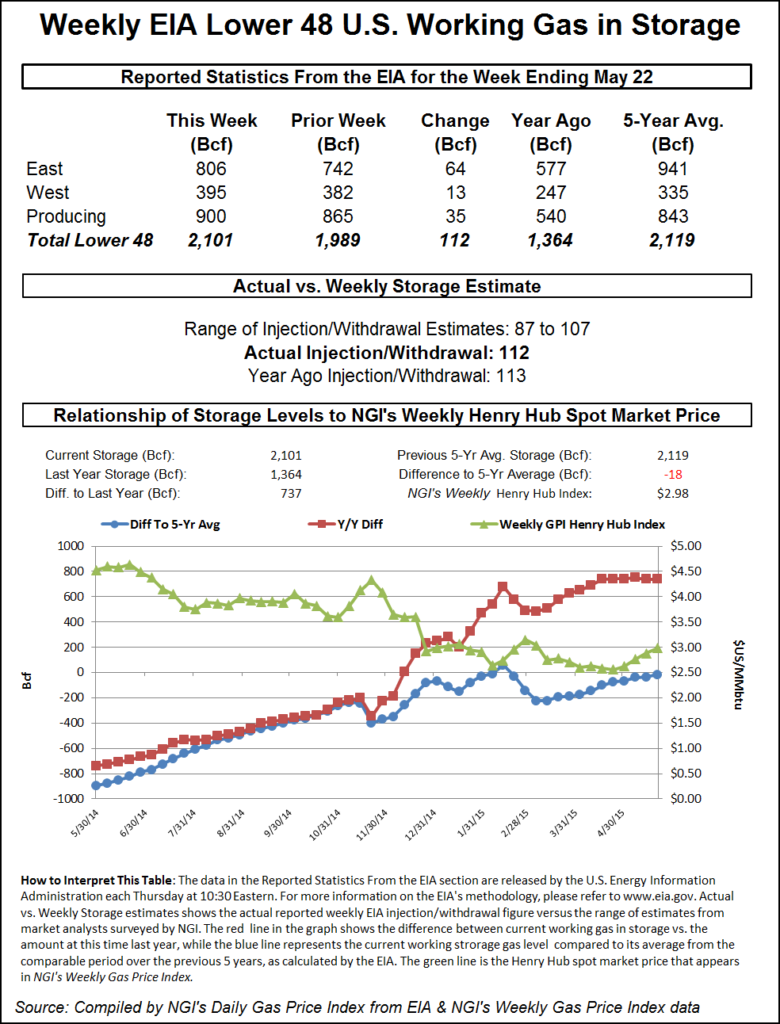

Futures bulls had difficulties of their own as the Energy Information Administration (EIA) reported a plump build of 112 Bcf, a figure well above expectations, and prices sank. At the close, July had fallen 14.1 cents to $2.706 and August had erased 13.5 cents to $2.730. July crude oil added 17 cents to $57.68/bbl.

The day’s plunge by futures had traders thinking of a new trading range of $2.50-2.75. “$2.75 is initial resistance, but not very much,” said a New York floor trader. “It’s not as though we haven’t been there and done that. $2.50 is the most likely support level.”

The 112 Bcf figure caught just about everyone off guard. Prior to the release of the data, analysts were looking for an increase closer to the 100 Bcf area. IAF Advisors calculated a 105 Bcf increase, and Ritterbusch and Associates was looking for a build of 102 Bcf. A Reuters poll of 21 traders and analysts showed an average 99 Bcf with a range of a 87 Bcf to a 107 Bcf injection.

“We had heard a build of anywhere from 99 Bcf to 102 Bcf,” said a New York floor trader. “We just went from a $2.75 to $3 trading range to a $2.50 to $2.75 range.”

That lower trading range itself may be subject to question as analysts see the report suggesting more bearish reports to follow. “The 112 Bcf in net injections was at the very top of the range of market expectations and above the 95 Bcf five-year average, sending a clear bearish message,” said Tim Evans of Citi Futures Perspective. “We don’t know the background details of supply and demand behind the swing, but this suggests that the apparent tightening in the data over the prior two reports was temporary. This will have at least some bearish implications for storage expectations over the next few weeks.”

Inventories now stand at 2,101 Bcf and are 737 Bcf greater than last year and 18 Bcf less than the five-year average. In the East Region 64 Bcf was injected, and the West Region saw inventories increase by 13 Bcf. Stocks in the Producing Region rose by 35 Bcf.

Natgasweather.com’s Andrea Paltrinieri suggested a number of reasons for the lofty build figure. Power burns declined when prices flirted with the $3 level last week and significant demand was switched back to coal. Less demand was likely due to the Memorial Day weekend and early office closures. “Production last week was higher than analyst estimates, [and] my view is that EIA implicitly revised the last couple of weeks that were too low,” she said.

“The framework we get from this number is bearish based on normal weather. I see us loosening both week over week and year over year, with end of season greater 4.1 Tcf. It will be important for summer to bring heat waves, otherwise we need to go lower.” she said.

Some did advance the idea that the number would be higher than what most were thinking, but didn’t quite take it far enough. Energy Metro Desk (EMD) in its weekly survey said, “The spread between the three categories we track [surveys, banks, individuals] is wide at 3.8 Bcf and thus signaling a surprise of 5 Bcf higher or lower than the market. All indications point to a build bigger than this week’s survey index of 99 Bcf. This week, we note that our EMD consensus was 2.5 Bcf higher than the survey index — higher bias is the word.”

John Sodergreen, EMD editor, estimated 100 Bcf for last week’s number and came in way off the 92 Bcf actual figure. Sodergreen called for a 100 Bcf build this week and said, “Last week the 100 forecast was way off; this week, it should be close to spot on.”

Less gas is expected to be flowing out of the Marcellus in the next few days. Genscape reported that “REX [Rockies Express] east-to-west flows through Chandlersville [eastern Ohio] have dropped below 800 MMcf/d for the first time since late March due to apparent operational issues at upstream receipt points.

“REX receipts at the Eureka Hunter/REX Monroe gathering system interconnect have plummeted to just 42 MMcf/d today and yesterday after having run near record highs around 216 MMcf/d during the previous week, and averaging 153 MMcf/d during the previous 30 days. No notices or planned maintenance have been posted per this specific point, so it is not known when volumes will recover.”

Marcellus points took it on the chin, as did most locations. Gas on Millennium for Friday through Sunday gas was quoted 22 cents lower at $1.30, and packages on Transco Leidy shed 20 cents to $1.28. Gas delivered to Tennessee Zone 4 Marcellus changed hands 17 cents lower at $1.18, and gas on Dominion South came in at $1.40, down 15 cents.

Quotes for Friday through Sunday gas at the Algonquin Citygate tumbled 90 cents to $1.60, and gas on Iroquois Waddington shed 25 cents to $2.70.

Major market hubs saw double-digit declines. At the Chicago Citygate gas for the three-day period fell 9 cents to $2.67, and deliveries to El Paso Permian shed 13 cents to $2.46. Gas at Opal was seen 13 cents lower at $2.46, and at the PG&E Citygate Friday-Sunday gas fell 8 cents to $3.11.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |