Natural Gas Futures Dive Following EIA Storage Data

Natural gas futures plunged following the release of government inventory figures showing an increase in working gas storage that was well above what the market was expecting.

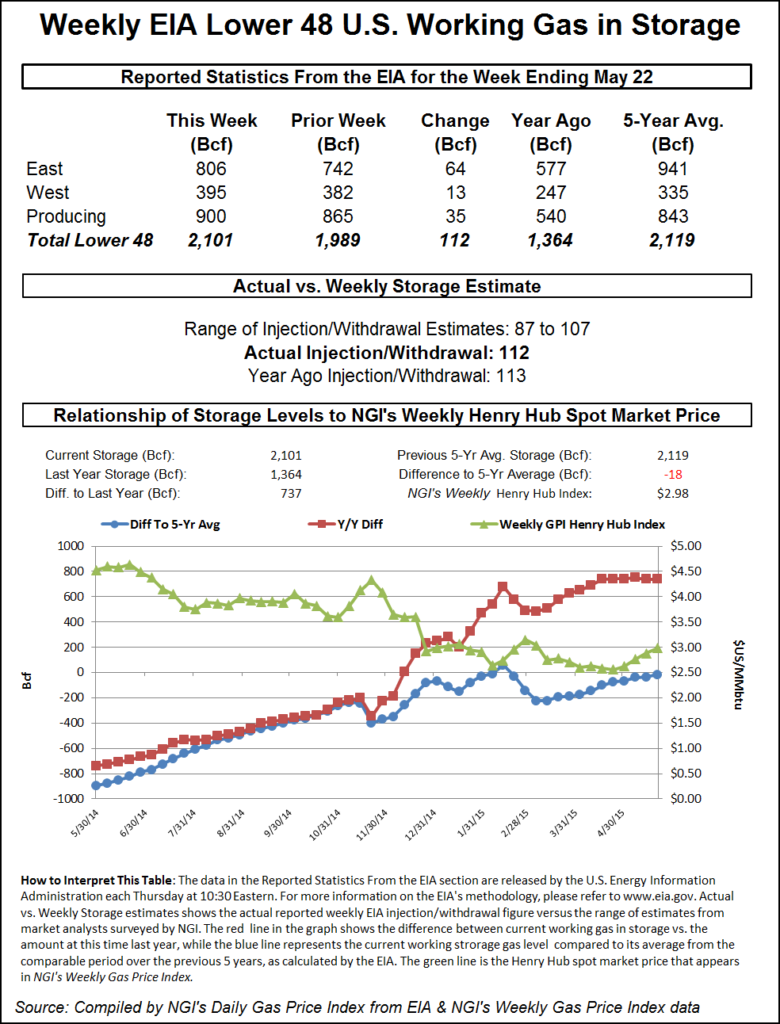

For the week ended May 22, the Energy Information Administration reported an injection of 112 Bcf in its 10:30 a.m. EDT release. July futures fell to a low of $2.708 after the number was released and by 10:45 a.m. July was trading at $2.715, down 13.2 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase closer to the 100 Bcf area. IAF Advisors calculated a 105 Bcf increase, and Ritterbusch and Associates was looking for a build of 102 Bcf. A Reuters poll of 21 traders and analysts showed an average 99 Bcf with a range of an 87-107 Bcf injection.

“We had heard a build of anywhere from 99 Bcf to 102 Bcf,” said a New York floor trader. “We just went from a $2.75 to $3 trading range to a $2.50 to $2.75 range.”

That lower trading range itself may be subject to question as analysts see the report as suggesting more bearish reports to follow.

“The 112 Bcf in net injections was at the very top of the range of market expectations and above the 95 Bcf five-year average, sending a clear bearish message,” said Tim Evans of Citi Futures Perspective. “We don’t know the background details of supply and demand behind the swing, but this suggests that the apparent tightening in the data over the prior two reports was temporary. This will have at least some bearish implications for storage expectations over the next few weeks.”

Inventories now stand at 2,101 Bcf and are 737 Bcf greater than last year and 18 Bcf less than the five-year average. In the East Region, 64 Bcf was injected, and the West Region saw inventories increase by 13 Bcf. Stocks in the Producing Region rose by 35 Bcf.

The Producing Region salt cavern storage figure was up by 10 Bcf to 261 Bcf, while the non-salt cavern figure increased 24 Bcf to 638 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |