Divergent Natural Gas Cash And Futures Sending Ominous Weekly Signals

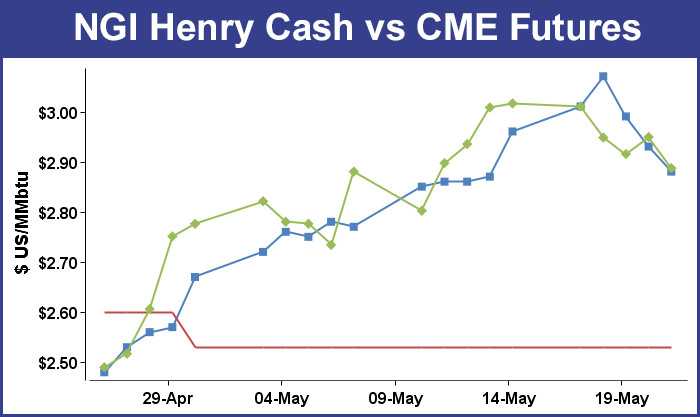

Natural gas cash and futures markets parted ways in weekly trading for the week ended May 22. If the futures are viewed as a leading indicator for the physical market, the outlook does not look good for physical market bulls. The NGI Weekly Spot Gas Average managed a gain of 6 cents to $2.71, but June futures skidded nearly 13 cents to $2.887 and failed to hold key technical objectives.

Most physical points enjoyed a gain of about a dime, with all but one losing point confined to the Northeast. Of the actively traded points the week’s greatest advance was seen on Tennessee Zone 6 200 L with a rise of 17 cents to average $2.33, and the largest setback was a loss of 24 cents on Transco Zone 6 non NY north (southeasternmost Pennsylvania and southern New Jersey) to $2.55. Regionally South Texas and East Texas saw the week’s largest gains at 11 cents to $2.91 and $2.93, respectively, and the Northeast was the only loser dropping 3 cents to average $2.12.

The Rockies rose 6 cents to $2.69 and both California and the Midwest carved out 8-cent gains to $2.98 and $3.04, respectively.

The Midcontinent rose 9 cents to $2.82 and South Louisiana added a dime to $2.95.

June futures for the week retreated 12.9 cents to $2.887, dealing something of a blow to market technicians who had seen the June contract trade as high as $3.105 and suggested prices might hold $3. Thursday’s price action was revealing in that June posted the highs of the session following the Energy Information Administration (EIA) report of a relatively lean 92 Bcf injection, about 6 Bcf below expectations, but failed to settle above the $3 mark. At the close Thursday June had managed a disappointing gain of just 3.4 cents to $2.949.

In spite of the report coming in less than expectations traders were not all that impressed. The June contract posted its high for the day of $3.038 immediately after the figure was released, but at the end of the day prices had skidded about 9 cents. “I think a lot of guys were caught long after the number, and I am not bullish,” said a New York floor trader.

“I think some guys are bullish, and it’s a battle in either direction. There never seems to be any follow-through. The close today [Thursday] was pretty weak, and anything below $2.96ish in June is pretty bearish. There is also some weird stuff going on and traders are rolling into July. I think prices are headed lower, but I’m not sure I’m in the majority.

“I would be a seller on rallies until we get back above July’s high at $3.081.”

The EIA report caught a number of traders by surprise and prior to the release of the data analysts were looking for an increase closer to the upper 90 Bcf range. IAF Advisors calculated a 98 Bcf increase, and industry consultant Genscape was looking for a build of 99 Bcf. A Reuters poll of 22 traders and analysts showed an average 97 Bcf with a range of a 90 Bcf to a 107 Bcf injection.

Analyst Tim Evans of Citi Futures Perspective said the number “suggests that the background supply/demand balance continues to firm relative to where it was 2-4 weeks ago. We’ll need to see monthly data to confirm the source of the shift, but fading production growth and rising power sector demand remain at the top of our watch list.” “

“$3 is still a pivotal area,” said a New York floor trader. $3 is a number we need to stay above if we want to see any momentum to the upside, and we are not seeing that, basically.”

Inventories now stand at 1,989 Bcf and are 738 Bcf greater than last year and 35 Bcf less than the 5-year average. In the East Region 55 Bcf were injected and the West Region saw inventories increase by 6 Bcf. Stocks in the Producing Region rose by 31 Bcf.

Teri Viswanath, director of natural gas strategy at BNP Paribas, calculated an increase of 95 Bcf, “a level that falls far short of last year’s 106 Bcf injection. If verified, last week’s build would mark the first time this season that the storage injections have lagged year-ago levels. Thereafter, this trend (of weekly injections lagging behind last year) will likely continue as significant growth in the electric power demand sector limits restocking. Indeed, we expect that the industry will stock away 105 Bcf for the week ending May 22nd and 115 Bcf for the week ending May 29th, or a pace that falls short of last year’s 113 Bcf and 118 Bcf build, respectively.”

In spite of recent price weakness, market technicians Thursday weren’t willing to call the recent high of $3.105 a market top. “Once again, $2.949-2.908 was tested. And once again the bears failed to produce a close beneath this zone,” said Brian LaRose, market technician at United ICAP. “As a result, we are still unable to label $3.105 as a short-term top. Bears need to take out Wednesday’s low [$2.902] to trigger a deeper correction of the $2.443 to 3.105 advance. Bulls need to push through $3.105 to signal the trend is still up.

In Friday’s trading for the extended weekend, spot natural gas for the holiday weekend skidded as traders decided to make any necessary spot purchases over the weekend instead of commit to a four-day deal. This happened in spite of power load forecasts calling for huge increases Tuesday in eastern markets.

Declines of a nickel to a dime or more were widespread. Futures fared no better. At the close, June was down 6.2 cents to $2.887 and July had fallen 7.5 cents to $2.919.

Power loads and prices soared, yet there was no impact on weekend and Monday-Tuesday gas. Intercontinental Exchange reported that peak power Tuesday at ISO New England’s Massachusetts Hub jumped $17.26 to $44.74/MWh and peak power for Tuesday delivery to the PJM West Hub vaulted $44.37 to $76.96/MWh.

Power loads were forecast higher as well. The New York ISO forecast that peak load Saturday would reach 15,935 MW and peak load Sunday was expected to climb to 16,361 MW. By Tuesday, however, the ISO forecast peak load at a whopping 23,725 MW.

Traders were not impressed with the higher loads and prices. “Everyone just keeps track of the weather, and if power generators need more gas they will just buy it over the weekend, with a cellphone if necessary,” said a New England marketer. “I’m sure that in Tuesday’s trading we will see prices a lot higher, but right now people are just putting gas in storage. We’ll see much stronger prices next week. They can’t get much weaker.”

The marketer was not optimistic about stronger cash quotes going forward. “There’s a lot more transportation starting up in the next six months. There’s not much more moving east, most of it is moving to Chicago.”

Gas at the Algonquin Citygates fell 52 cents to $1.62, and deliveries to Iroquois Waddington shed 37 cents to $2.69. Gas on Tennessee Zone 6 200 L fell 28 cents to $1.93.

Parcels on Millennium changed hands a penny lower at $1.34, and gas bound for New York City on Transco Zone 6 was off 15 cents to $1.97.

Gas at major hubs fell by double digits. Deliveries to the Chicago Citygate skidded 11 cents to $2.83, and gas at the Henry Hub fell a nickel to $2.88. Packages on El Paso Permian changed hands 11 cents lower at $2.54, and deliveries to the SoCal Citygate plunged 15 cents to $2.85.

Futures traders said the day’s decline was gradual. Likely few stop-loss orders went off, and “we are now in alignment with a $2.75 to $3.00 trading range,” said a New York floor trader. “These lower settlements below $3 signal somewhat of a bearish sentiment. We haven’t been able to settle over $3 except on three occasions, and $3 looks like solid resistance.”

Analysts see the market as having an overall bearish tonality with an eventual test of recent lows in the $2.50 range. “Although this market managed to respond to a supportive storage injection of 92 Bcf, the inability to maintain early gains above the $3.00 mark keeps this market vulnerable to fresh lows during the next couple of sessions, in our opinion,” said Jim Ritterbusch of Ritterbusch and Associates.

“The 92 Bcf supply hike was proximate to our supply expectations and narrowed the deficit against five-year averages only slightly by about 6 Bcf to 35 Bcf. Some renewed price weakening would appear likely tomorrow ahead of a holiday weekend that will be reducing industrial demand. However, short-term one- to two-week forecasts are still maintaining a bullish hue with above-normal temperatures expected along the Eastern Seaboard.

“All in all, we will look for support to hold at the 2.90 level during [Friday’s] trade, while we expect some renewed selling next week into the $2.82-2.90 zone, with the market gradually ratcheting on down to around the $2.50 area. We are maintaining a bearish trading bias for now and would use any price rallies toward today’s highs as fresh selling opportunities.”

Others don’t see the market working that low. Tom Saal, vice president at FC Stone Latin America LLC, in his work with Market Profile expected the market to test Thursday’s value area at $3.003 to $2.949. It “could test the 50% breakdown target at $2.855. Market should stay above the ‘intermediate term’ mode at $2.786. Look to buy on any weakness,” he said in a Friday morning note to clients.

Buyers tasked with purchasing gas for power generation across the PJM footprint over the extended weekend are not likely to have much in the way of wind generation to offset purchases. WSI Corp. in its morning outlook said, “A cold front is expected to sweep across the Mid Atlantic today with just a slight chance of an isolated shower or storm. This will likely usher high pressure into the power pool during the next couple of days. This should lead to seasonably cool temperatures with highs in the 60s and 70s. Lows may dip into the upper 30s, 40s to mid-50s. High pressure will slowly slide off the East Coast during Sunday into early next week.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |