Algonquin June Natural Gas Tanks on Low Holiday Demand, Mild Forecast

Natural gas forward basis markets spent most of the last week slowly chugging along, much like every other shoulder-season week of late, but Thursday (May 21) trading brought about a sharp downturn for one Northeast market hub that’s no stranger to volatility.

New England’s Algonquin Gas Transmission citygates June basis plunged 42.4 cents between Monday and Thursday to reach minus 36 cents/MMBtu, according to NGI’s Forward Look.

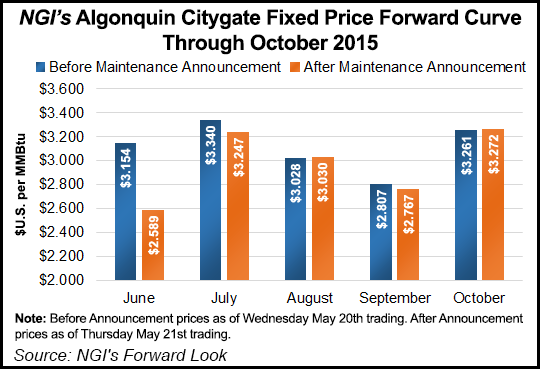

Interestingly, the prompt-month package at Algonquin had surged by nearly 16 cents just one day prior but then tumbled some 60 cents Thursday after the pipeline said it was postponing scheduled maintenance, according to a Northeast trader.

While no such announcement was posted on Algonquin’s website, a separate notice to shippers alerted all delivery point operators to keep actual daily takes out of the system equal to or greater than scheduled quantities regardless of their cumulative imbalance position.

All receipt point operators are required to keep actual daily receipts into the system equal to or less than scheduled quantities regardless of their cumulative imbalance position, the notice said.

The restrictions were to remain in effect from Saturday until 9 a.m. Wednesday in light of the expected low demand due to the Memorial Day holiday weekend.

Indeed, demand across major eastern regions will taper off headed into the Memorial Day weekend, but a warming trend should cause a rapid bounce back to normal, according to industry consultant Genscape.

Genscape’s meteorologic team’s national degree day forecast showed above-normal population-weighted cooling degree days on the national level for the coming week.

“Nearly the entirety of those increases are a result of forecast warmer temperatures in the Northeast, where regional demand forecasts have demand peaking Tuesday in Appalachia at 8.43 Bcf/d,” said Genscape’s Rick Margolin, senior natural gas analyst.

Overall, this spring has brought about higher-than-normal gas burn numbers in the power sector, Margolin said.

“By and large, this is in line with our expectations headed into the summer due to coal retirements and increased utilization of existing gas capacity with competitive gas versus coal prices,” Margolin said.

Just in the last week alone, cash prices at Algonquin have hovered from a low of $1.62/MMBtu to a high of $2.14/MMBtu, according to NGI price data.

With June prices hovering in the low $3.00s/MMBtu for most of this week, the sharp drop in prices did not come as a complete surprise.

“Look how it’s been in cash. And the June forecast isn’t warm, even with the late heat for a few days,” the trader said. “Amazing flush.”

Forecasters at NatGasWeather maintain the most important period to watch is early June as hotter temperatures in the upper 80s and 90s spread across many regions of the central, southern, and eastern U.S., while highs in the 80s gain ground over the Great Lakes and Northeast.

Meanwhile, basis prices further out the curve were not nearly as pronounced, with Algonquin’s July and balance of summer (July-October) packages shifting no more than a few cents.

Elsewhere in the Northeast, Transco zone 6-New York June basis fell 6.6 cents between Monday and Thursday to reach minus 33.2 cents/MMBtu, while July dropped 6.9 cents to minus 40.5 cents/MMBtu. The balance of summer was down 6.3 cents to minus 59.4 cents/MMBtu.

Western markets were down less than five across the curve as generally mild temperatures linger over the region. Highs in the 60s and 70s were forecast for much of Washington and California heading into June, according to AccuWeather.com.

Northwest Pipeline-Sumas posted the most significant declines across the West, with June basis shedding 4 cents from Monday to Thursday to reach minus 33 cents/MMBtu. July slipped 2.5 cents to minus 30.6 cents, and the balance of summer fell 1.7 cents to minus 30.4 cents/MMBtu.

Meanwhile, prices along the Gulf Coast barely budged as ongoing storms have kept temperatures below seasonal averages thus far this spring. Longer-term forecasts, however, showed a return to hotter weather beginning the first week of June, with highs moving into the mid-90s by June 6, according to AccuWeather.

At the Houston Ship Channel, June basis slipped 1.6 cents from Monday to Thursday to reach minus 2.5 cents/MMBtu. July and the balance of summer held steady at plus 2.2 cents/MMBtu and minus 0.005/MMBtu.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |