Vanguard Builds Heft Onshore, Snatching Gassy Eagle Rock For $614M

Houston’s Vanguard Natural Resources LLC is adding to its arsenal of onshore prospects after agreeing to buy cross-town producer Eagle Rock Energy Partners LP, whose natural gas-weighted operations are concentrated in the Midcontinent, Permian and East Texas basins.

Eagle Rock has a reserves mix that is 53% tilted to gas, 21% to oil and 26% to liquids. Production between January and March totaled 79.7 MMcfe/d. For Vanguard, the transaction would increase pro forma output by 20%, adding 1,778 producing wells and 202,632 net acres. Proved reserves would jump 16%, or 318 Bcfe.

“The transaction…is another great opportunity for the company and our unitholders,” Vanguard CEO Scott W. Smith said of combining the two master limited partnerships (MLP). “The assets being acquired are attractive bolt-ons to our Midcontinent, Permian and Gulf Coast basin operations.” He specifically cited Eagle Rock’s “meaningful position” in the emerging South Central Oklahoma Oil Province, or SCOOP, “which will provide attractive drilling opportunities for the next several years.”

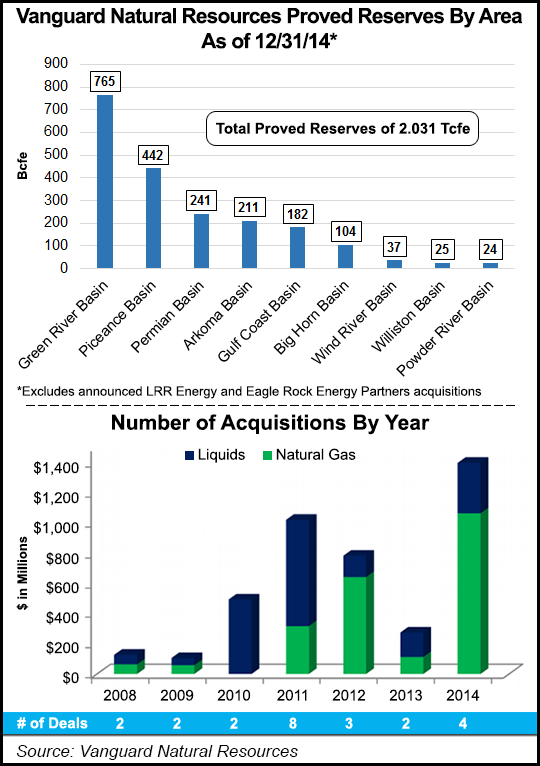

Vanguard already has a healthy body of assets, many acquired in less than two years, that are concentrated across the West, through the Midcontinent and along the Gulf Coast, primarily in the Green River, Arkoma, Permian, Big Horn, Piceance, Gulf Coast, Williston, Wind River and Powder River basins.

Eagle Rock is to become a subsidiary under the terms of the transaction, worth around $614 million total. Vanguard agreed to exchange $474 million in common units and assume about $140 million in debt. The tax-free transaction, representing a 24% premium to Eagle Rock’s closing price on Thursday ($3.05/unit), is to close by the end of September, pending unitholder approval.

The deal comes less than a month after Vanguard agreed to pay $539 million to buy another MLP, LRR Energy LP, also an onshore prospector with about 203 Bcfe of proved reserves, 1,290 gross producing wells and 1,58,000 net acres in the Permian and Arkoma basins.

“Considering the previously announced merger agreement with LRR, we believe that all three companies’ unitholders will benefit from a larger, more diversified entity with lower financial leverage and strong positions in several key U.S. basins,” Smith said. “The all-unit nature of the transaction will allow Vanguard, LRR Energy and Eagle Rock unitholders to jointly reap the value growth in an improving commodity price cycle.”

Vanguard has been on a tear in buying up mature and emerging assets in the U.S. onshore. Last September it paid $525 million to buy Piceance prospects from Bill Barrett Corp. (see Shale Daily, Sept. 16, 2014). Also last summer it paid $278 million for a package of North Louisiana/East Texas properties from Hunt Oil Co. (see Shale Daily, Aug. 4, 2014). In late 2013, $581 million was paid to Anadarko Petroleum Corp. for gassy properties in southwestern Wyoming’s Pinedale Anticline and Jonah fields (see Shale Daily, Jan. 2, 2014; Dec. 30, 2013).

Eagle Rock CEO Joseph A. Mills said the pending merger offered a “compelling…opportunity to deliver significant value for our combined unitholders in the future.” Vanguard plans to retain some personnel to expand its workforce.

Eagle Rock has about 70% of its oil and natural gas hedged through 2015, with 80% hedged through 2016. Additional hedges are in place through 2019.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |