Weak Natural Gas, Oil Prices Expected to Continue to Erode Canadian Job Market

The Canadian economic casualty count from low oil and natural gas prices is on the rise, with continued deterioration expected, industry experts are reporting, even as government data paints a rosier picture.

The potential for employment setbacks has hit 185,000 job losses, or 25% of an estimated 720,000 positions tied directly and indirectly to the fossil fuel sector, a report by Petroleum Labor Market Information (PetroLMI) indicated. PetroLMI is a data arm of Enform, which runs employment training programs for six industry associations.

About two-thirds of the jobs at risk are in Alberta, the chief gas and oil-producing province, the report said.

Engineering and construction are expected to suffer the lion’s share of the damage, but the victims range from architecture and administration to insurance and drilling rig technicians.

Personal bankruptcies, in the worst performance since the 2008-2009 recession, also have risen by 6.5% in Alberta over the past six months, said the Canadian Imperial Bank of Commerce.

“Continued deterioration” is forecast because the number of applications to enter the legal insolvency process has jumped by 24%. Lean times in gas and oil have spilled over into other sectors such as residential real estate, which formerly boomed in Alberta on speculation of continuing population and property value increases.

The forecast scale of employment losses mirrors potential investment cuts projected by the Canadian Association of Petroleum Producers if the price slump persists beyond this year.

However, no industry sources are predicting that Canadian production will decline.

Increases are on the horizon as oilsands and related thermal plant fuel gas pipeline projects continue, many begun before the price declines. Canadian industry adaptations to low energy commodity prices focus on efficiency improvements that include spreading costs thinner by raising output from long-lived installations such as oilsands plants.

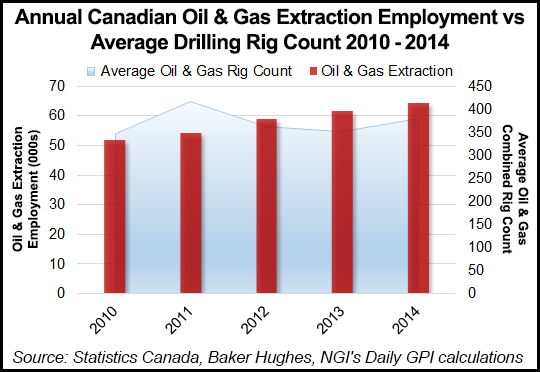

The dour outlook from PetroLMI would appear to stand in contrast with government data on jobs tied to oil and natural gas extraction in the country. According to data compiled by Statistics Canada, a government agency, the number of direct oil and gas extraction jobs in Canada has increased consecutively over at least the last four years through 2014, as have jobs tied to the support of mining and oil and gas extraction.

Direct oil and gas extraction jobs rose from 51,686 in 2010 to 64,306 in 2014. Similarly, the number of support jobs for oil and gas extraction and mining rose from 82,432 in 2010 to 102,008 in 2014.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |