Bulls Attempting to Scale $3 Following NatGas Storage Report

Natural gas futures scooted higher following the release of government inventory figures showing an increase in working gas storage that was less than what the market was expecting.

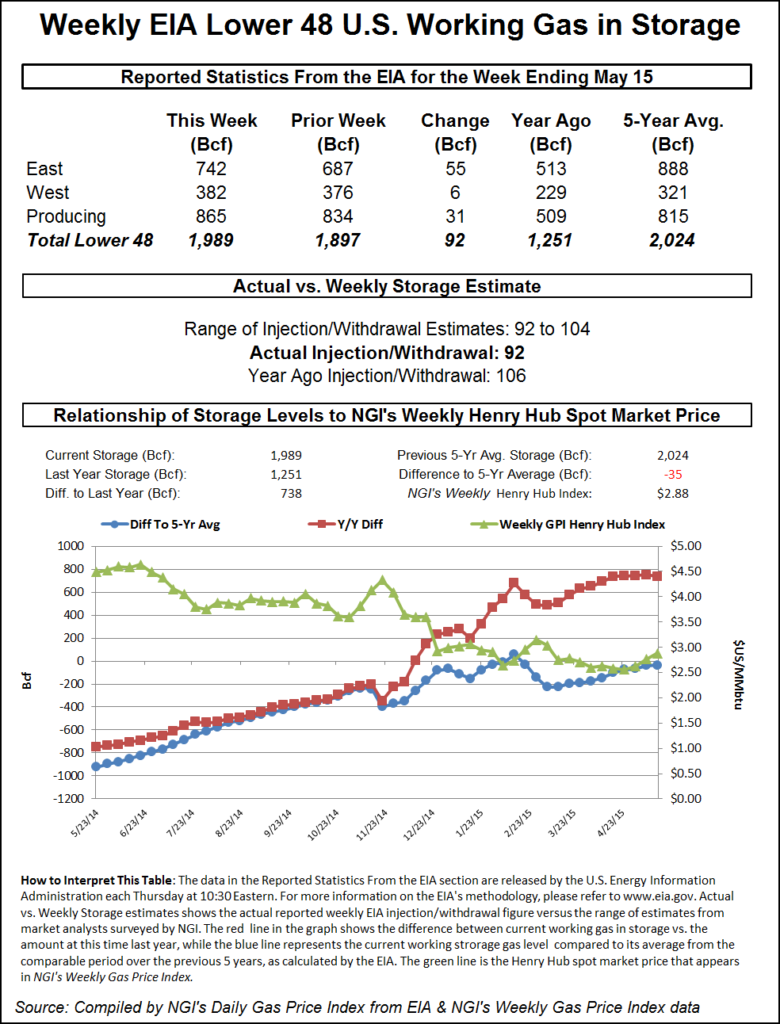

For the week ended May 15, the Energy Information Administration (EIA) reported an injection of 92 Bcf in its 10:30 a.m. EDT release. June futures rose to a high of $3.038 after the number was released and by 10:45 a.m. June was trading at $2.981, up 6.6 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase closer to the upper-90 Bcf area. IAF Advisors calculated a 98 Bcf increase, and industry consultant Genscape was looking for a build of 99 Bcf. A Reuters poll of 22 traders and analysts showed an average 97 Bcf with a range of a 90-107 Bcf injection.

Analyst Tim Evans of Citi Futures Perspective said the number “suggests that the background supply-demand balance continues to firm relative to where it was two to four weeks ago. We’ll need to see monthly data to confirm the source of the shift, but fading production growth and rising power sector demand remain at the top of our watch list.”

“$3 is still a pivotal area,” said a New York floor trader. “$3 is a number we need to stay above if we want to see any momentum to the upside, and we are not seeing that, basically.”

Inventories now stand at 1,989 Bcf and are 738 Bcf greater than last year and 35 Bcf less than the five-year average. In the East Region 55 Bcf was injected, and the West Region saw inventories increase by 6 Bcf. Stocks in the Producing Region rose by 31 Bcf.

The Producing Region salt cavern storage figure was up by 8 Bcf to 251 Bcf, while the non-salt cavern figure increased 23 Bcf to 614 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |