Cash NatGas Weakens, But Futures Vault Higher on Storage Report

Physical natural gas and futures continued on their different ways in Thursday’s trading, with losses at eastern points failing to offset broader gains in the Gulf, Midcontinent, Midwest, Rockies and California.

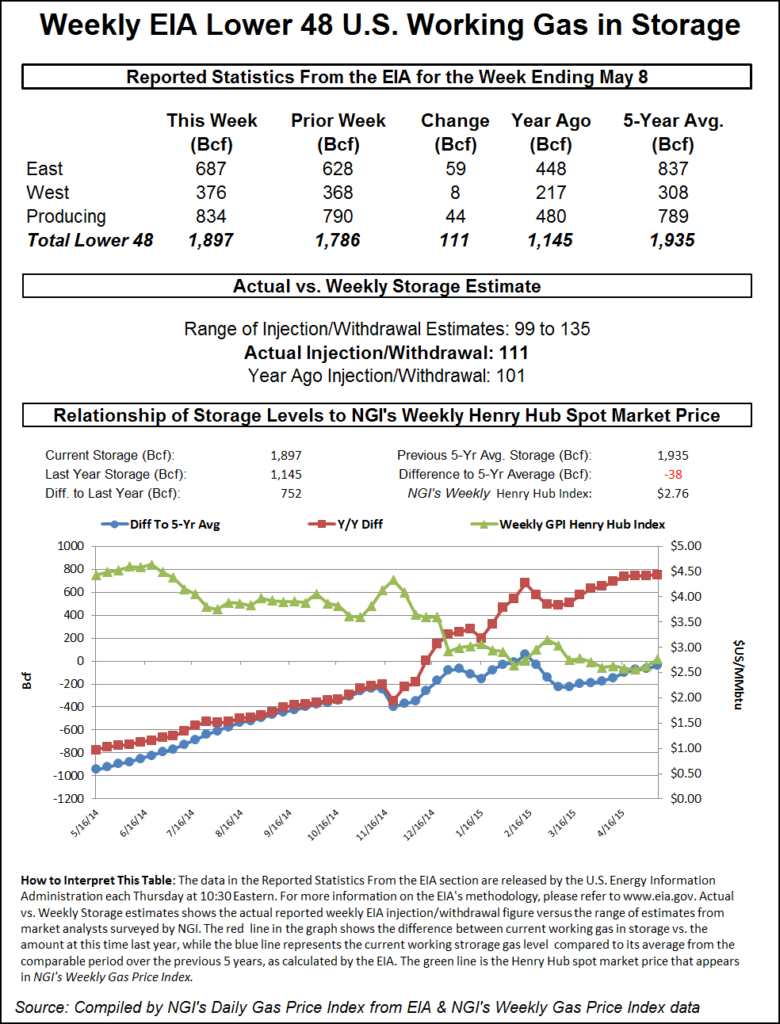

The overall market decline was 3 cents and stood in stark contrast to exuberant futures, which posted a stout gain following a supportive Energy Information Administration (EIA) storage report. The EIA said working gas inventories increased by 111 Bcf, and futures immediately responded by reaching the high of the day at $3.020. At the close the June contract had managed to hold on and posted a 7.3-cent advance to $3.008. July settled 7.9 cents higher at $3.063. June crude oil slipped 62 cents to $59.88/bbl.

Most traders and analysts were not expecting the 111 Bcf build and were looking more toward an increase of about 5 Bcf higher.

Last year, 101 Bcf was injected during the same week, and the five-year average is for an 82 Bcf increase. Estimates for this week’s figure were closely bunched just below 120 Bcf. Ritterbusch and Associates was looking for a build of 109 Bcf, but analysts at ICAP Energy calculated a 116 Bcf increase. A Reuters poll of 26 traders and analysts indicated a sample mean of 116 Bcf with a range of 99 Bcf to 135 Bcf.

Industry consultant Genscape combined the output from both its supply-demand model and pipeline model and came up with a 119 Bcf injection. “For this week, our pipeline model has a 118 Bcf injection, while the supply-demand model is at 121 Bcf. The S-D model is based on production estimated to have run at 72.8 Bcf/d,” the company said in a report.

“Production peaked early in the week at 73.4 Bcf/d then fell to a low of 72.1Bcf/d on gas day May 5 before rebounding towards the tail end of the week. Production for this storage week is more than 4.5 Bcf/d greater than last year’s same storage week. Demand is estimated to have averaged 58.1 Bcf/d with power now accounting for more than 50% of demand. Last week’s power demand (non-weather adjusted) averaged 22.33 Bcf/d, the highest power demand has run in gas week 19 since 2012.”

The relatively lean injection caught a few by surprise and June futures rose to a high of $3.020 after the number was released and by 10:45 a.m. EDT June was trading at $2.983, up 4.8 cents from Wednesday’s settlement.

Analysts see a somewhat tighter supply-demand balance. “The 111 Bcf net injection for last week was still above the 82-Bcf five-year average rate, but it was below the consensus expectation and bullish relative to our weather-driven model,” said Tim Evans of Citi Futures Perspective. “The data implies a tightening of the background supply/demand balance which is at least more constructive than prior data suggested. It’s a bullish report, at least in terms of short-term price impact.”

“The market would have to close above $3 if we are going to see anything significant on the upside,” said a New York floor trader. “Given the actual number, I wouldn’t have expected a market reaction much different.”

Analysts see the market over the remainder of the injection season having difficulty finding a home for all the produced gas. “Despite the forecast miss, today’s record build could hardly be categorized as bullish as it establishes a new record for the reference week,” said Teri Viswanath, director of natural gas strategy at BNP Paribas.

“After putting in a calendar low two weeks ago, natural gas futures prices gained 50 cents, or roughly 20%, with the early arrival of summer. It would appear that the above-normal temperatures in the eastern half of the U.S. prematurely raised expectations that cooling demand will soon temper the robust stock build under way.

“To be sure, while last week’s stock build well exceeded last year’s injection, the decline in daily storage receipts so far this week suggests that cooling demand has tightened supply-demand balances. The problem is, with milder weather ahead and prices moving above $3, electric power demand will likely falter. With supplies remaining reasonably supported and a containment problem looming ahead, we expect that the market will need to keep prices discounted for an extended period.”

Going forward, weather-driven demand is going to be hard to come by. The National Weather Service for the week ended May 16 forecasts fewer degree days for both heating and cooling in major U.S. markets. New England is forecast to see a combined 46 HDD (heating degree days) and CDD (cooling degree days) or 23 fewer than normal. New York, New Jersey and Pennsylvania are expected to experience 44 degree days, or 13 fewer than normal, and the greater Midwest from Ohio to Wisconsin is seen enduring 43 degree-days or 25 fewer than its seasonal norm.

For the following week a Reuters poll shows an average 105 Bcf with a range of 90 Bcf to 116 Bcf. That would compare to a build last year of 106 Bcf and a five-year average of 89 Bcf.

Physical players buying gas based on May index have some healthy gains as cash prices have posted solid advances relative to the May index. Chicago Citygate and Henry Hub gas are both currently quoted at $2.87, well above the NGI Bidweek indices of $2.53 and $2.52, respectively.

In a competitive environment such as natural gas marketing where every penny of margin counts, the temptation might be to sell bidweek volumes on the spot market. “Typically you have a plan that matches your bid week volumes with actual volumes,” said a Houston pipeline veteran.

“If power burns or demand comes in less than expected, you might take the difference and book some profit, but there are other alternatives such as storage. You would have to see if your pipeline would let you store the gas or park it.”

He noted that LDCs “are not typically sellers of gas. They would likely take the unused volumes and place it in storage.”

In the day’s physical trading, gas at the Algonquin Citygate fell 17 cents to $1.74, and deliveries to Iroquois Waddington eased 6 cents to $3.02. Gas on Tennessee Zone 6 200 L fell 24 cents to $1.81.

Gas bound for New York City on Transco Zn 6 fell 25 cents to $2.61, and gas on Tetco M-3 came in 10 cents lower at $1.49.

In the West, gas at the Cheyenne Hub fell a penny to $2.67, and Kern River added a penny to $2.66. Gas on Northwest Pipeline Wyoming was flat at $2.61, and parcels at the Opal Plant Tailgate added 2 cents to $2.67.

On the West Coast packages at the PG&E Citygate added 4 cents to $3.24, and gas at the SoCal Citygate was quoted a penny higher at $2.96. Deliveries to the SoCal Border changed hands 3 cents higher at $2.80, and gas on El Paso S Mainline was seen a penny higher at $2.79.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |